- Amazon will unveil its Q4 2023 earnings report tomorrow.

- All eyes will be on revenue generated from Amazon Web Services.

- Technically, the stock is approaching a key resistance zone and will need an earnings beat to break above it.

- Navigate this earnings season at a glance with ProTips - now on sale for up to 50% off!

Amazon's (NASDAQ:AMZN) quarterly earnings have traditionally captured investors' attention, given the company's status among the magnificent seven.

If the forecasts materialize this time around, the upward trend in revenues will continue alongside a potential slowdown in earnings per share compared to Q3.

Aside from the overall figures, scrutiny will be on Amazon's key recent business segment, Amazon Web Services (AWS), a global leader in cloud computing and artificial intelligence.

However, it's crucial to note that the stock, which has experienced a significant surge in recent months, might be particularly susceptible to a correction in the event of any disappointment.

Amazon Web Services Keeps Growing at an Impressive Pace

Amazon Web Services is experiencing impressive growth. It represents Amazon's division dedicated to expanding its cloud business, with a specific focus on AI solutions.

AWS has shown substantial growth over the past three years as the revenue has doubled.

Key products include Amazon Q, an AI assistant offering support with broad business tools, and the Graviton4 and Trainium2 chips designed to enhance the efficiency of cloud operations, making them faster, more secure, cost-effective, and energy-efficient.

Analysts' consensus indicates an expected net sales increase of just over 13%, reaching $24.17 billion, serving as the benchmark for tomorrow.

In the context of providing a solid foundation for consistent growth, eyes will also be on the results from the introduction of advertising on the Amazon Prime Video streaming service.

With approximately 200 million subscribers globally, this platform presents significant potential for generating additional profits, projected to reach up to $2 billion by 2025.

Reflecting on Amazon's performance last year, the market consensus suggests further revenue growth, with the following outlook for earnings per share.

Source: InvestingPro

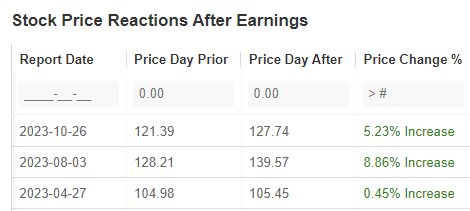

Analyzing the market's response to the publication of results over the last three quarters, we observed the stock consistently rising in the same session following better-than-expected results.

This trend leads us to believe that if the final data surpasses the consensus, we might witness another surge in stock price.

Source: InvestingPro

It's crucial to note that, along with the fundamentals, the market will also scrutinize forecasts for the upcoming quarters.

Intel (NASDAQ:INTC) is a great example. Despite posting better-than-expected results in key indicators last week, the stock fell more than 10% due to bleak forecasts.

Amazon Technical View: $160 Resistance Poses a Challenge for Bulls

Amazon's stock price has continued its northward movement and is looking to mount an attack on a strong supply zone located in the $160 per share price area.

This approach could be similar to what happened when the stock closed in on $145 area, where buyers encountered resistance, leading to a significant correction.

To overcome this barrier, a substantial boost in the form of quarterly results surpassing expectations is crucial.

A successful breakout by the demand side would pave the way for an assault on the historical highs just below $190 per share.

Conversely, if there's a rebound, sellers are likely to face initial challenges at the aforementioned $145 level.

***

InvestingPro: Empowering Your Financial Decisions, Every Step of the Way

Take advantage of InvestingPro ProTips and many other services, including AI ProPicks strategies on the InvestingPro platform with a discount of up to -50%.

For an extra 10% discount, use Coupon: Canada2024. Don’t miss the New Year’s sale. Only until Jan 31.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.