Having tracked AMD's (NASDAQ:AMD) journey quite closely, the recent fall of its stock price does not tell the whole story because, behind the scenes, AMD is working hard to redefine its role in AI, gaming, and mobile computing. Of course, at CES 2025, all of this was a powerful reminder of its potential, and innovations like the MI300X GPUs and Ryzen AI Max processors prove this company is very far from slowing down. This undervaluation and relentless innovation make AMD one of the most exciting long-term opportunities in the tech space.

AMD at CES 2025: Creating a New Vision of AI, Gaming, and Mobile Computing toward the Future

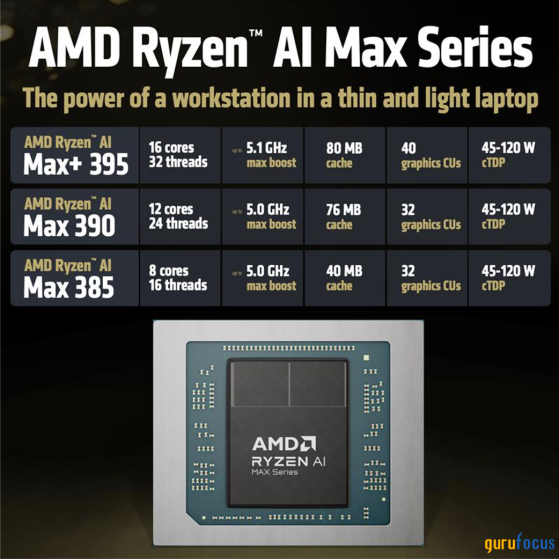

CES 2025 has been the day when AMD showed these capabilities, innovating and leading across domains-from AI to gaming and down to mobile computing. Ryzen AI Max Series processors establish a new performance score for AI-powered laptops, introducing much more advanced technologies such as Copilot+ to an even larger population. Ryzen Z2 Series changed the guard in terms of what is possible with handheld gaming, it is Ryzen 9000 HX-Series that writes the new rulebook in terms of what's been possible from both mobile gaming and productivity. The Ryzen 200 Series showed that even with mainstream processors, AMD was quite serious about bringing more advanced features into everyday computing.From AMD, without a doubt, one of the brilliant leaps that stole the show and blew everybody away in this realm would have to be at the official CES 2025 unveil, where, with no hint of doubt in one's mind, their Ryzen AI Max Series mobile processor truly came forward to mark serious next levels in integrating a host of powerful AI into everyday consumer laptops right out the box. The goal of enabling intelligent portable systems for high-level computation in professional-grade use and conventional situations.

Ryzen AI Max processors bring desktop-class performance with up to 16 "Zen 5" CPU cores, while AMD Radeon 8000S Series graphics complement it, providing high-fidelity visuals for both gaming and creation workloads. It also leverages a discrete AI engine, capable of driving an industry-leading peak of up to 50+ Tera Operations Per Second of AI processing for emerging AI workloads, such as Language Modeling, Image Generation, and Productivity applications powered by Copilot+, among others. Besides this, it also has fitted in up to 128 GB of unified system memory to seamlessly allow multitasking and productivity without burning the battery. Equipped with state-of-the-art AI performance and next-generation power efficiency, the processors establish new parameters of competition among thin and light laptops.

Announcements of Ryzen AI Max processors detail the strategic efforts by AMD to push AI into the mainstream of consumer devices, while bridging high-end computing with daily convenience. More specifically, collaboration from leading OEMs such as Dell Technologies, which intends to fit and embed the AMD CPU into Dell's commercial desktop offerings and PCs, adequately demonstrates AMD's broad-market appeal in this next wave of innovation in computing. With the inclusion of AI, these are only embedded core technologies for mobile computing, executed to meet the expectations grown toward smarter or speedy gadgets, and also to take advances in AMD technology through AI-powered gadget leadership into consumer product realization. With this in mind, the development further cements AMD's commitment to delivering industry-leading solutions that push the envelope on efficiency and performance while setting Ryzen AI Max Series as the centerpiece for CES 2025.

AMD's AI Revolution: How to Cash In on a $990 Billion Inference Opportunity (SO:FTCE11B)

In fact, this represents an unmatched opportunity for AMD-inside the global trend from training to inference-accelerating demand to deploy pre-trained AI models into real-world applications. AI inference is basically the running of AI models to make predictions or derive insights. Efficiency, scalability, and cost-effectiveness are expected in this respect. It would further lead to a high-octane explosion from $780 billion to $990 billion in 2027, driven by large-scale and small-scale computing innovations. Growth is due to hyperscalers, enterprises, and independent software vendors making continued investments into differentiated technologies such as GAI, inference, and vertically optimized systems. With demands for both growing, AI workloads are anticipated to grow at a 25-35% CAGR through 2027, which is great news for AMD.With AMD's focused effort on AI inference-a high-growth market that's in desperate need of customized silicon and high-bandwidth memory-AMD is well positioned, says finance expert Sami Andreani, as it meets its MI300X GPUs. Capturing even a small portion of this-5% to 10%-could drive $5 billion to $10 billion annually and likely double its data center revenue today, placing AMD solidly as a formidable competitor in the evolving AI landscape.

Undervalued and Positioned for Explosive Growth

At today's price of $118, the 12-month consensus price target of $174.63, representing a 47% upside, but robust bull cases project this target upwards to as high as $250. Cheerily, underpinning a business of AMD's newer MI300X GPUs meant for AI inference workloads-25-35% CAGR into 2027-enabled by its next-generation chiplet architecture with advantaged cost and scalable options-an associatedly robust ROCm software stack in tow-perhaps there's nothing quite so poised in one bid at attempting the taking of space lead titles as uniquely AMD is positioned. Valuation metrics also support the growth story of AMD.Meanwhile, the forward P/E of 23.79 and a PEG ratio of 0.85 suggest that the stock actually is undervalued against its growth prospect-and most specifically, the rich valuation afforded to NVIDIA (NASDAQ:NVDA). Strong analyst sentiment points toward 16 Buy and 27 Outperform ratings out of a total 52 working towards reflecting confidence that AMD will continue delivering on that growth potential. Although the Price-to-Free-Cash-Flow and Price-to-Tangible-Book ratios do show some further room for operational efficiencies, these challenges are set to normalize in due course when AMD ramps up its production of the latest MI300X GPU and cements its position in the AI market.

Takeaway

With the AI market bound to reach $990 billion by 2027, while AMD's next-generation MI300X GPU aims at fast-growing inference workloads, it may be in for surprise revenue uptick. Currently, AMD is undervalued to such an extent that long-term investors will have an excellent opportunity to participate in its growth.This content was originally published on Gurufocus.com