With 58,470 homes for lease in 22 states across the country as of Dec. 31, AMH is meeting changing lifestyle demands by providing residents access to updated homes with features they value, such as proximity to jobs and access to good schools. The trust strives toward establishing “American Homes 4 Rent” as a nationally recognized brand that stands for quality, value, and tenant satisfaction.

We think these qualities should help attract and retain tenants and qualified personnel, as well as support higher rental rates. As of Dec. 31, the breakdown of the 58,470 single-family properties is: 55,768 occupied single-family properties, 251 stabilized properties, 398 non-stabilized properties, and 2,053 held for sale and other properties.

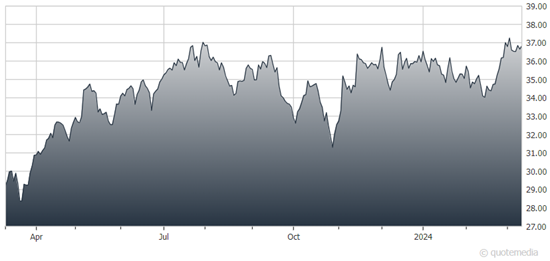

American Homes 4 Rent (AMH)

At year-end 2023, nearly 65% of AMH’s properties in operation were concentrated in five states: Texas, North Carolina, Florida, Georgia, and Tennessee. Management says property values and operating fundamentals for single-family properties in these markets will improve significantly over the next few years.

In 2024, AMH guides for Funds From Operations of $1.70-$1.76 per share. In Q4 2023, rental revenues rose 7.3% and cash net operating income (NOI) was up 6%. While multi-family REITs face flat Y/Y cash NOI in 2024, AMH guides for up to 5% cash NOI growth.

In 2024, the trust intends to acquire $700 million-$800 million in homes and develop $100 million-$150 million in homes, partly funded by disposing of $500 million in noncore homes. In Q4 2023, AMH’s blended rental rates rose 5.7% Y/Y to a record $2,112 monthly, with new lease rates +4.5% Y/Y and renewal rates +6.2%.

As of Dec. 31, AMH’s total debt to total capital ratio was 36.9% compared to 38.7% at the end of 2022 and 36.7% at the end of 2021. On total debt outstanding of $4.52 billion, the trust has debt maturing $949 million in 2024, $10 million in 2025, and $100 million in 2026. The weighted average interest rate is 4.05%.

The trust has $59 million in cash equivalents and $1.25 billion in unused capacity of its credit revolver facilities. Our 12-month target price is $40 using a forward P/FFO of 22.9x our 2024 FFO view, above the peer average of 19.0x given AMH’s premier markets.

Recommended Action: Buy AMH.