This article was written exclusively for Investing.com

- APA: already an investor opportunity in late 2021

- Natural gas volatility is back with a vengeance

- Russia-U.S. tensions over Ukraine could create significant shortages in Europe

- The Biden administration tries to twist arms to divert LNG shipments

- APA continues to have huge upside potential

Aside from cryptocurrencies, few markets exhibit the same wild price volatility as the natural gas arena. On Jan. 27, the expiring February NYMEX natural gas futures contract exploded to a high of $7.3460 per MMBtu, eclipsing the October $6.466 high on the continuous futures contract and rising to the highest price since 2008, the last time natural gas traded above $10 per MMBtu.

Natural gas has become as explosive in the futures market as its raw form is when in the Earth’s crust. The natural gas futures market can also be as implosive as it is explosive. In early October 2021, the energy commodity rose to $6.466 per MMBtu after trading to a 25-year low of $1.432 in June 2020. Then, after moving over 4.5 times higher, the price corrected to a low of $3.536 in late December, before more than doubling on Jan. 27.

The now active March contract declined to $3.416 in late December. In early February, the price reached $5.572, a more-than-63% rise in a little over one month.

Natural gas volatility has caused more than a few market participants to lose their shirts over the years. However, the upward trend since the June 2020 low and shift in U.S. energy policy means that U.S. natural gas producers are sitting pretty with prices north of $4 per MMBtu.

Equity investors can take advantage of this trajectory via APA Corporation (NASDAQ:APA), an oil and gas producer profiting from the bullish trends in the traditional energy markets.

APA: Already An Investor Opportunity In Late 2021

During the last week of 2021, I wrote about APA Corporation. The article outlined five reasons APA was a good bet for 2022. On Dec. 28, APA shares closed at $27.93 per share. Since then the stock has accelerated.

Houston, Texas-based APA explores for and extracts oil and natural gas. On Dec. 28, March NYMEX crude oil futures were at the $75.60-per-barrel level, and March natural gas futures settled at $3.742 per MMBtu. On Feb. 7, March crude oil futures were 21.2% higher at $91.65, and March natural gas at $4.20 had appreciated by 12.2%. At $34.09 per share, APA moved almost 22% higher.

Natural Gas Volatility Returned With A Vengeance

Natural gas prices can be as combustible as the fuel in its raw form. As the February NYMEX futures contract was expiring in late January, the price soared to the highest level since 2008.

Source: CQG

As the chart highlights, nearby NYMEX natural gas futures recently exploded to a high of $7.346 per MMBtu. The high in the March contract was at $5.572 on Feb. 2 of this year.

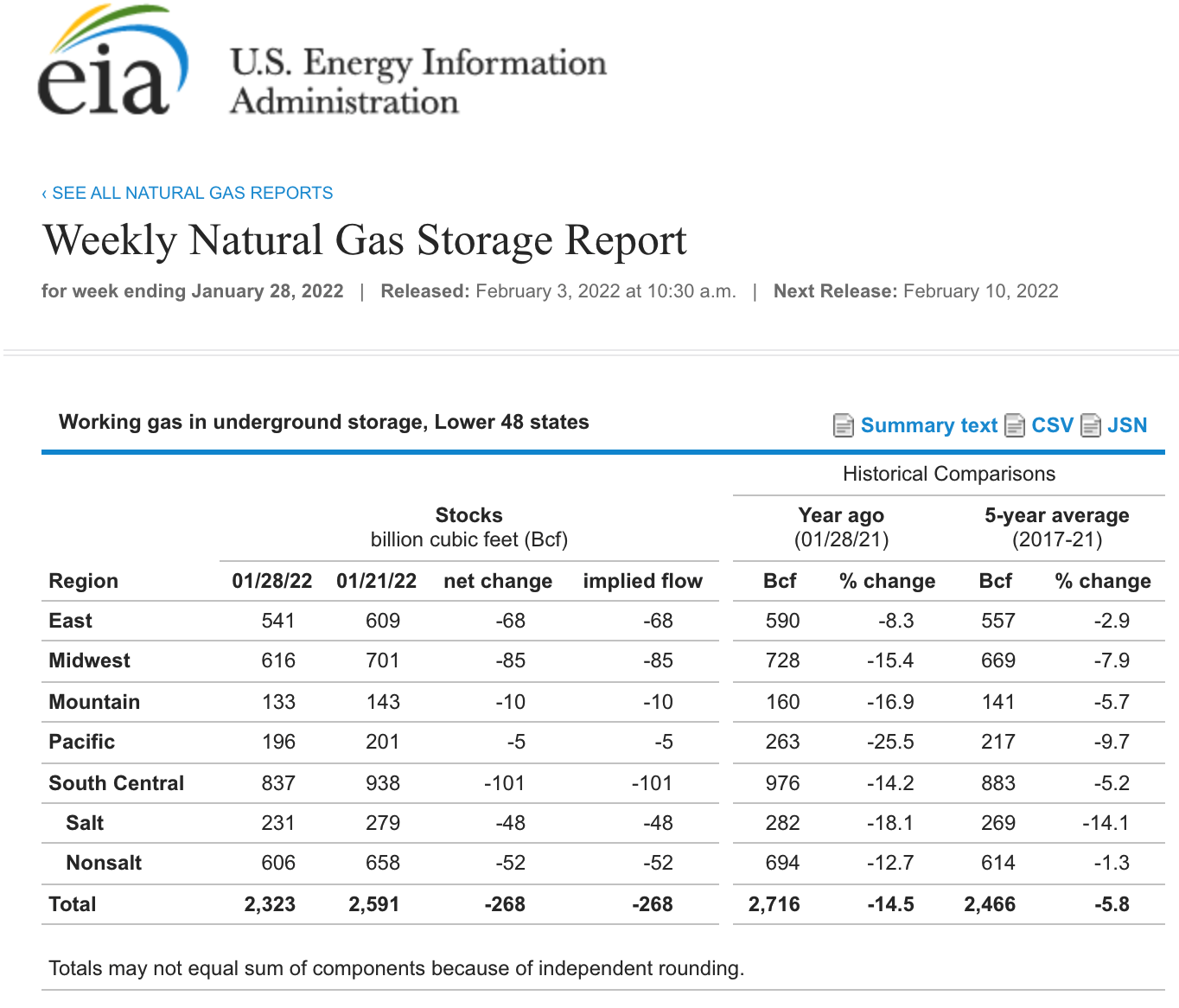

Natural gas trading sees both explosive and implosive price moves. Recently, a pair of winter storms in the U.S. increased heating demand over the past weeks. U.S. inventories were below last year’s level and the five-year average for the week ending on Jan. 28.

Source: EIA

The chart illustrates 2.323 trillion cubic feet in storage across the U.S. was 14.5% below last year’s level and 5.8% under the five-year average for the end of January. On the release, natural gas price volatility returned with a vengeance, but it was more than the weather that pushed the energy commodity’s price higher.

Russia-U.S. Tensions Over Ukraine Could Create Significant Shortages In Europe

Russia supplies much of Europe with natural gas and prices have soared. The tensions between the U.S. and Russia, and NATO and Russia have been mounting as more than 100,000 Russian troops sit on Ukraine’s border. Russia does not want Ukraine to become part of NATO and has demanded assurances from the U.S. and Europe. The standoff increases the potential for an incursion into the country the West considers a free state in Eastern Europe and Russia considers western Russia.

The tensions could interrupt natural gas flows from Russia into Europe, causing severe fuel shortages. The U.S. natural gas futures market has always been a domestic market as the delivery point for the NYMEX futures is at the Henry Hub in Erath, Louisiana.

However, technological advances in processing natural gas from pipelines into LNG have made the energy market more international. Natural gas now travels by ocean vessels to points well beyond the North American pipeline network.

Biden Administration Tries To Twist Arms To Divert LNG Shipments

Companies that process natural gas into LNG have seen rising demand from Europe and Asia. Over the past years, Asian consumers entered into long-term supply contracts for liquefied natural gas. Companies like Cheniere Energy (NYSE:LNG), a leading LNG processor, are sold out of supplies for the coming years and are struggling to increase production.

Meanwhile, the tensions with Russia have caused the U.S. government to ask U.S. producers to divert LNG shipments from Asia to Europe. Hostilities in Ukraine would create supply shortages in Europe, while shifting LNG from Asian consumers would create shortages in Asia. While NYMEX natural gas has a long history as a domestic market, LNG has allowed the business to go global.

APA Continues To Have Huge Upside Potential

As the U.S. addresses climate change, a far stricter regulatory environment becomes a deterrent for new companies entering the hydrocarbon markets. Moreover, existing companies face rising production costs and labor shortages as inflationary pressures rise.

The current environment eliminates competition for existing producers as rising prices cause profits to soar. APA shares remain in a bullish trend as of early February, with lots of room for additional gains.

Source: Barchart

While APA shares have gained 22.4% since Dec. 28 and are at the $34 level currently, there is plenty of upside room. The chart shows the next technical resistance level stands at $50.03, the October 2018 high. Above there it looks even more promising:

- APA traded at $69 in December 2016

- The stock rose to a high of $104.57 in July 2014, the last time crude oil prices were at over $100 per barrel.

- APA reached a high of $134.13 in April 2011 during the height of the post-financial crisis commodity rally.

- APA traded to its all-time peak of $149.23 in May 2008 as crude oil prices reached their all-time high and natural gas traded at more than the $10-per-MMBtu level.

The path of least resistance for APA shares, crude oil and natural gas remains higher right now. However, the higher prices rise, the greater the odds of corrections increase.

Bull market corrections can be quick and nasty so be careful. I favor buying APA on price dips as the company has plenty of room for share appreciation.

A break above the October 2018 high of $50.03 could launch the stock. APA ended its bearish trend of lower highs and lower lows in January, when the shares rose above the first resistance level at the January 2020 high of $33.77. I continue to rate APA a buy on any price weakness.