While some tech companies are suffering a sell-off, such as Microsoft (NASDAQ:MSFT), which has fallen by 11% in the last 30 days, and Amazon (NASDAQ:AMZN), which has fallen by an even greater 16%, Apple Inc. (NASDAQ:AAPL) has continued to advance and reached the $224 mark in the post-earnings period.

This new valuation level for Apple is justified by its responsibility for spreading artificial intelligence (or Apple Intelligence) technology through its strong user base and possible monetization from this, such as a better cycle for its hardware and maintaining the momentum of service revenue.

Apple maintaining this very premium valuation level is explained by its excellent earnings, which have highlighted a clearer scenario for the company.

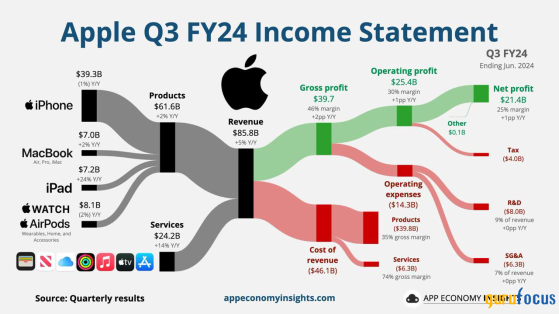

Earnings were pretty solidIn its third fiscal quarter, Apple delivered very strong indicators reinforcing its good prospects for the end of this fiscal year and the medium term. Net revenue was up 5%, driven by services and the resumption of growth in iPads and Macs. While the market expected revenue of around $84.40 billion, the reported figure was $85.50 billion. The tech giant also beat earnings per share projections, delivering $1.40 while estimates were $1.34.

Overall, each key performance indicator surprised the market in a positive way. The company also recorded 24% year-over-year growth in iPad sales, 2% growth for Macs and the maintenance of very strong momentum for its services revenue.

Source: App Economy Insights

Even iPhone sales, which shrank by 1% but showed slight growth on a constant currency basis, show the continued strength and resilience of smartphones and confirm what was mentioned in the call that the iPhone 15 models continue to be chosen by consumers, with the Pro and Pro Max being able to use Apple Intelligence.

While only the newest iPhones will be able to make full use of Apple Intelligence features, Macs with Apple Silicon since 2020 will have these features.

Once again, the positive highlight was the services segment, which reached $24.20 billion and paid subscriptions reaching an all-time high. In addition, the advertising, cloud and payments subsegments achieved all-time highs due to significant operational advances in Apple TV, Apple Pay, Maps and other features.

On the negative side were results in China, which fell by 6.50% and just under 3% in constant currency. Even if the risk of a slowdown in sales and the exchange rate risk persists, it may not be as severe as the installed base in the region has reached a new record, which may be a sign that the environment remains competitive, but with a greater level of stability.

Finally, management's expectation is that in the fourth quarter, revenue will grow at the same rate as in the third, which was close to 5%. In addition, they believe the gross margin will be between 45.50% and 46.50%, which is also close to what was recorded last quarter. This guidance was higher than expected by Wall Street.

The valuation is still reasonableIf we look only at momentum and the market's reaction to recent earnings, sentiment for Apple is bullish. Operationally, the company has returned to growth, continues to deliver good profitability indicators and its outlook for the AI narrative is excellent, with the main view being the company will offer (and possibly further popularize) these functionalities with its broad user base.

And this is mainly revealed by the company's valuation. Apple's forward price-earnings ratio is 30, above its average of 26 over the last five years and very close to Microsoft, which trades at 31 times its net income. One of the things worth reflecting on is whether Apple really deserves the same award as Microsoft since its operations, although resilient and driven by services, still have a greater cyclicality, less recurrence and more timid growth prospects when compared to other big tech players.

This makes Apple's GF Value rank a low 3 out of 10, mainly due to multiples that exceed its own history and are in line with or slightly above the industry. Therefore, on the GF Value chart, Apple appears to be modestly overvalued, which makes a lot of sense in the current context.

In a discounted cash flow model using net income as a proxy, it can be seen that Apple shares (NASDAQ:AAPL) really are not a bargain currently, but they are not extremely overvalued either. With very reasonable assumptions, such as average growth of 5% (Wall Street estimates), a net income margin of 27% (made possible by continued efficiency gains and a better mix between services and products) and terminal growth of 4% with a discount rate of 8%, we find a fair price of $193 for Apple, a downside of just over 10% that seems within the margin of error.

Source: Alpha Spread

Despite the very small margin of safety, the bright side is that as Apple is an excellent company. We are much more likely to see positive surprises than negative ones.

In other words, if Apple comes up with some new factor that boosts earnings (or the narrative that earnings are going up), this could continue to boost the stock.

Apple isn't that attractive anymoreThe downside is that, in relative terms, Apple has lost some of its appeal due to the eroding margin of safety. When we think about increasing exposure to a particular stock, we must always consider the opportunity cost and other allocation possibilities.

As mentioned, while Apple shares rose post-earnings, Microsoft and Amazon experienced dips. This makes Amazon and Microsoft a much more rational buy at the moment based on the history of the last five years.

AAPL Data by GuruFocus

Apple does not lose value because of this, but it makes it less attractive in relative terms since Amazon and Microsoft also have great prospects, large moats and will have a large share and benefit from the AI trend. For fiscal 2024, the consensus expects earnings per share growth of 9.33% year over year for Apple, Microsoft growth of 11.70% (for 2025) and Amazon growth of just over 60%. In other words, while they are all good prospects, Microsoft and Amazon stand out with promises of faster growth.

Final thoughtsI believe the third quarter was a tipping point for Apple. The company appears to have returned to growth (albeit below other big techs) and managed to catch up with its peers in the AI race, which makes the outlook for the medium and long term much better.

The downside is this comes with an expansion in multiples that greatly reduces the margin of safety. Even though the stock is not very overvalued, it makes it less attractive when compared to similar options from consolidated technology-related companies with large moats and exposure to the most important trends in the market such as the cloud and AI.

This content was originally published on Gurufocus.com