Apple (NASDAQ:AAPL) has reached an all-time high recently, even though investing legends including Warren Buffett (Trades, Portfolio), Li Lu (Trades, Portfolio), and Duan Yongping have been significantly cutting their stakes in the company. It is very interesting to see the divergence between the guru's actions and Apple's stock price. I think Apple's stock is undoubtedly overvalued at the current price. The market might be overlooking the potential decline of Apple's gross margin in the smartphone business in the next few years. In this article, I will analyze the factors with the biggest impact on Apple's gross margin trend and share my thoughts on Apple's valuation.

Why Apple's gross margin is unsustainable.

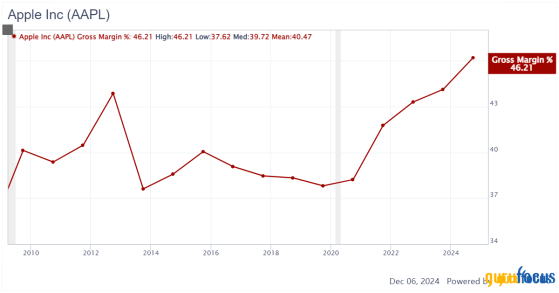

Historically, Apple's gross margins can be volatile mostly due to product mix, supply chain dynamics, and foreign currency movement. However, since 2020, Apple's gross margin has increased dramatically, reaching a 15-year high of 46.2% for FY2024.The sharpest increase in gross margin on a year-over-year basis occurred in FY 2021, when Apple's gross margin increased from 38.2% to 41.8%.

The spike in gross margin in FY 2021 can be attributed to three major factors. Firstly, the mass adoption of 5G phones in 2020 drove a wave of upgrades, which resulted in the surge of iPhone's sales in 2021 worldwide. Secondly, Apple's sale in China skyrocket by 70% in 2021 as Huawei, Apple's biggest competitor in China, faced chip shortages due to U.S restrictions.

Thirdly, Apple's services business, which has a much higher gross margin than the products business, has been contributing more to Apple's overall revenue.

Looking ahead, two of the aforementioned factors face significant uncertainties. First of all, Apple has created the hype that starting in 2025, the introduction of AI-enabled phones will drive another wave of iPhone upgrades. However, AI is unlikely to be a significant game changer for iPhone compared to the 5G upgrade. On the other hand, there is no clear timeline for the mass adoption of 6G technology. It is expected that the large-scale 6G smartphone replacement cycle will not happen until 2028-2030. Therefore, I think Apple will inevitably face a lengthening of product life-cycle in the next 5-6 years, which create gross margin pressure for the product business as well as the related services business.

Secondly, in the Chinese market, the competition between Huawei and Apple will become more intense in the future. Since Huawei launched the Mate 60 series last year, it has continuously taken Apple's market share in the high-end smartphone market. Huawei recently launched two high profile products, the tri-fold Mate XT, and the flagship Mate 70 series. Both became instant best-sellers in China. Apple responded with significant promotions staring from the second quarter of 2024, with prices of various models reduced by 8-10% in e-commerce channels. It is very unusual for Apple to get involved in price wars to attract customers. I think this is a clear sign that Apple will struggle in China.

Another factor that may lead to lower gross margin is the cost pressure. Most notably, TSMC (Taiwan Semiconductor Manufacturing) has a monopoly in the manufacturing of the most advanced chip used in smartphones. In addiition, TSMC's U.S fabs have higher costs than its Taiwan fabs and Apple has agreed to source from TSMC's U.S fabs for at least a portion of its total iPhone production. Therefore, Apple's cost of chips is almost guaranteed to increase in the future. Furthermore, it is reported that India has a higher cost than China in terms of the assembly of iPhone due to the lower yield. However, Apple has to shift more production to India due to geopolitical factors. This will also add to the cost pressure.

Apple is modestly overvalued despite margin pressure and guru selling

It is extraordinary that even with the potential margin pressure, Apple' stock is at all time high. The market simply shrugs off any bad news or concerns. Apple has a GF Value Score of 5 out of 10. Almost all of Apple's valuation metrics are either at the historic high or close to historic high.On a DCF basis, even if we use a very conservative 10% discount rate to account for Apple's high quality and a fairly optimistic FCF growth rate of 13.7%, Apple is worth only $158 per share, significantly below the current market price. At the current market price, Apple's stock provides very little margin of safety.

To justify Apple's current stock price, Apple would have to grow its FCF per share at 20% for the next 10 years. I think this is almost impossible given Apple's size and the competitive dynamics.

It looks like Buffett and Li Lu (Trades, Portfolio) both think Apple is overvalued as well. According to the most recent filings, Buffett has cut his Apple stake by almost 2/3, and Li Lu (Trades, Portfolio) sold almost 60% of his holdings in Apple.

Granted, both Buffett and Li Lu (Trades, Portfolio) still hold some Apple shares (NASDAQ:AAPL). Historically they rarely sold at the exact high price. However, their actions are very telling.

Conclusion

While Apple's stock has reached all-time high, an analysis of Apple's past gross margin trends and the factors affecting the company's gross margin signals troubles ahead. The potential slowdown in iPhone upgrade cycles, Huawei's competitive threat in China, and rising cost pressures could all lead to a decline in Apple's gross margins. Despite these risks and heavy selling activities by investing gurus like Warren Buffett (Trades, Portfolio) and Li Lu (Trades, Portfolio), the market remains overly optimistic about Apple's future. Based on a comprehensive valuation analysis, Apple's stock appears to be modestly overvalued, with little margin of safety for investors.This content was originally published on Gurufocus.com