From the) Worldwide Developers Conference on June 10 to the time of writing, Apple Inc. (NASDAQ:AAPL) has gained $297 billion in market cap, once again surpassing $3.20 trillion and regaining its position as the largest company in the world, although still very close to Microsoft (NASDAQ:MSFT) and Nvidia (NASDAQ:NVDA).

Apple has achieved an incredible milestone, shifting perspectives and going from one of the companies that was not at the top of the artificial intelligence trend to one that will benefit greatly from it, having announced new features for its products. Most importantly, this has the power to boost growth, making it even more profitable and strengthening the moats of its ecosystem.

On the other hand, in this context, it is also important to analyze the company's margin of safety given all the euphoria surrounding this trend, which, however real it may be, is interesting to look for sustainable returns in relation to the company's price when investing.

WWDC 2024 overviewThe main highlights of the event included notable advances in Apple's Vision Pro and spatial computing, which, although still in their early stages and of little relevance to the company, are interesting. The presentation of iOS 18 brought several design improvements, including Dark Mode, new privacy features and the integration of Apple Pay between iPhones. These updates are set to significantly improve the user experience.

The iPad announcement also captured attention, especially with the introduction of AI designed for calculations, studying and various other activities, surpassing expectations of only announcing a calculator app for the iPad.

MacOS (with Mac Sequoia) introduced significant innovations, such as iPhone Mirroring and improved notifications. However, the standout feature by far is Apple Intelligence, which promises advanced capabilities on devices equipped with the M1 chip and the latest iPhone 15 models. This includes a collaboration with OpenAI to integrate GPT-4 Chat into Siri, marking a big leap in artificial intelligence features on Apple devices, ranging from writing tools to integrated and personalized personal assistance.

The event emphasized personalization and privacy, addressing the growing concerns about these issues, especially in light of the doubts raised by other solutions such as Microsoft's Copilot+ and its Recall tool. This highlight shows how Apple, after falling behind in the AI race, has managed to turn things around and reaffirm its moats with a rebranding of the trend, turning the technology into Apple Intelligence and making great use of its ecosystems.

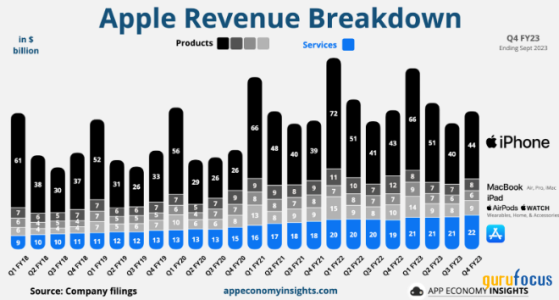

Apple is (kind of) cyclicalBut how does all this fit in with the company's financials? Well, just emphasizing that the company is integrating AI into its devices is already good for its reputation with the market, which is valuing it highly. But it is possible to go further. First, Apple has been able to emphasize its ecosystem very well, with iPhone mirroring, Apple pay, reinforcing quality and more. But the most important thing is the company has a cyclicality in its sales model, where its products change every few years. And in recent quarters, this cycle hasn't helped boost growth. While revenue services have been showing double-digit growth in recent periods (and also mitigate some of this cyclicality), the iPhone and its other products have shown mediocre performance.

In the quarter ending March 2024, iPhone revenue fell by 10% quarter over quarter, while the Mac shrank by 17%. In the graph below, you can see this has been going on for some time, with iPhone sales peaking at $72 billion in first-quarter 2022 with the launch of the iPhone 13.

Source: App Economy Insights

After quarters of timid growth for the iPhone, the moment for a new boost in the cycle seems to have arrived. As already mentioned, many of the features announced, such as Apple Intelligence, will only be available for the newer iPhone 15 models and most likely also for the iPhone 16 models that will be announced in September. Therefore, it is quite possible to infer that a significant number of people who have not yet exchanged their older iPhones will do so soon.

To give you an idea, in January, the adoption of the iPhone 15 Pro Max was 3.60%, while that of the iPhone 15 Pro was 2.30%. Essentially,the overwhelming majority of the base uses older iPhones, so if they want to have access to these new features, they will have to upgrade.

iPhone 15 adoption rate worldwide from September 2023 to January 2024 by model:

Source: Statista

It is difficult to estimate an exact amount, especially given that these features may end up impacting more people involved in the technology niche who are excited about it, while others may still take some time to want to adopt the new features and expect greater obsolescence of the device. Another crucial factor is to understand what the next cycles will be like. In 2026, will Apple once again announce important features that will not exist in the iPhone 15 and 16? How relevant could these features be? My guess is the biggest leap will be now, with a hardware upgrade to support these technologies and the next updates, however technological they may be, may attract the attention of more specific niches (which need a more powerful device for filming and other services).

Another factor driving this cyclicality is the macroeconomic aspects. Indicators such as inflation, interest rates, the population's disposable income and unemployment have a direct impact on Apple's products. This is true not only for sales in the U.S., but also for other countries where Apple has a smaller market share and is seen as a premium (perhaps even luxury) product. Thus, a relief in the macroeconomic cycle also helps its operations.

In the U.S., Apple has more than 60% of the smartphone market share, while in the rest of the world this is reversed, with Android currently accounting for just over 70%. This can be seen as an opportunity for growth, with premiumization trends in some countries. This trend should also be accelerated by the new functionalities exposed in the new products.

Source: Backlinko

Apple's safety margin isn't very goodEven with all this optimism, if you do some math, you can see that Apple's shares are not a bargain. The company's revenue for the last 12 months was $381 billion, the highest being $394 in September 2022. Let's imagine this cycle really does get stronger, and that in the next fiscal year the company reaches $430 billion (which would be extraordinary compared to recent timid growth). Let's also consider a net margin of 30%, an increase of more than 3 percentage points. This would give us a net profit of $129 billion, indicating a price-earnings ratio of 25.50.

The price-earnings ratio for the next 12 months based on market projections is 31, compared to an average of 24.90 over the last five years and an average of 19.90 over the last decade. The multiple in the exercise in the previous paragraph seems feasible to me at some point, but it would still be quite a challenge, and that challenge is only to get close to your average multiple.

A multiple of between 25 and 30 for a company of such quality, which could surprise positively at some point, does not seem expensive enough to me to be bearish, especially considering AI's momentum could last for a significant period.

A discounted cash flow model confirms there is little margin of safety in the shares. With optimistic assumptions, such as a growth rate of 12% in the first 10 years and 5% in the last 15 years, and a discount rate of 8%, there is a fair price of $193 for Apple shares (NASDAQ:AAPL), 10% lower than the current price of $212.

The bottom lineIn my opinion, Apple is still going through the motions, and this was even more evident at WWDC 2024. As Steve Eisman mentioned, the current market seems to care a lot about stories as narratives seem to be more important than real fundamentals. This intensifies when we do a DCF calculation. Even with optimistic assumptions, the result is still not as attractive as it should be. As much as Apple is one of the best companies in the world, you need a certain risk premium and a margin of safety when investing.

My outlook is bullish for Apple's operations, believing the company will benefit from the AI cycle and remain one of the largest companies in the world. On the other hand, its current price ($210-plus per share) does not seem to justify great optimism given the limited upside, so even with optimism for the company, I would consider investing in Apple stock only at more reasonable levels that guarantee me a greater margin of safety.