The S&P 500 finished up around 20 bps, while the NASDAQ 100 closed up by around 80 basis points. Most of the movement in both indices can be attributed to Tesla (NASDAQ:TSLA), which rose by about 20% yesterday.

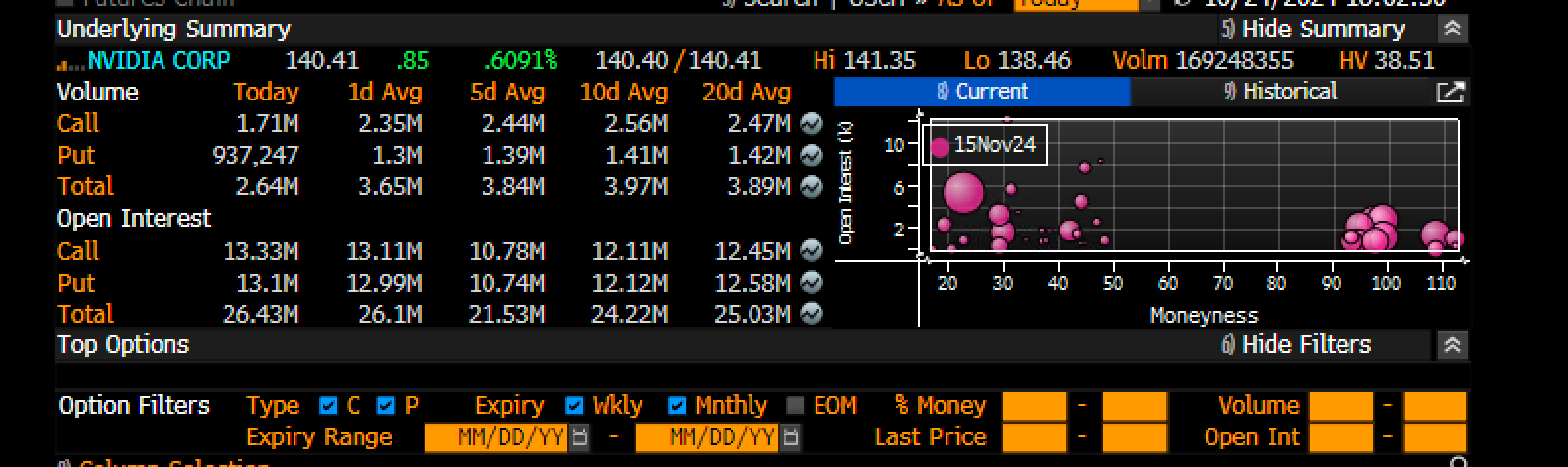

The Bloomberg 500 likely provides the clearest breakdown of the price action, allowing us to see the individual stock impacts on the broader market.

(BLOOMBERG)

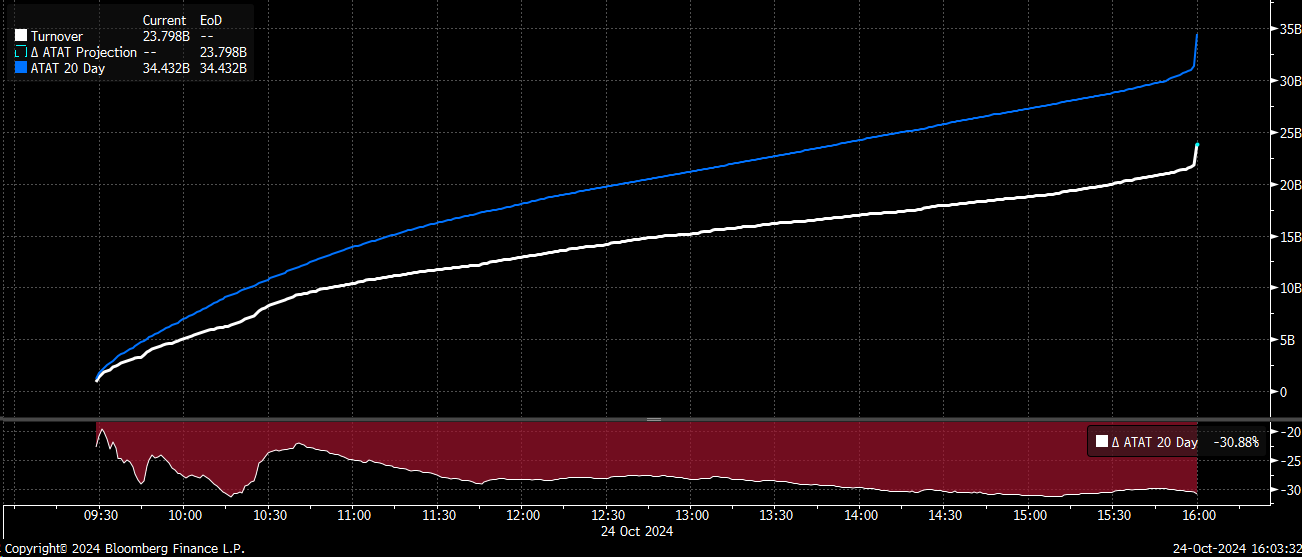

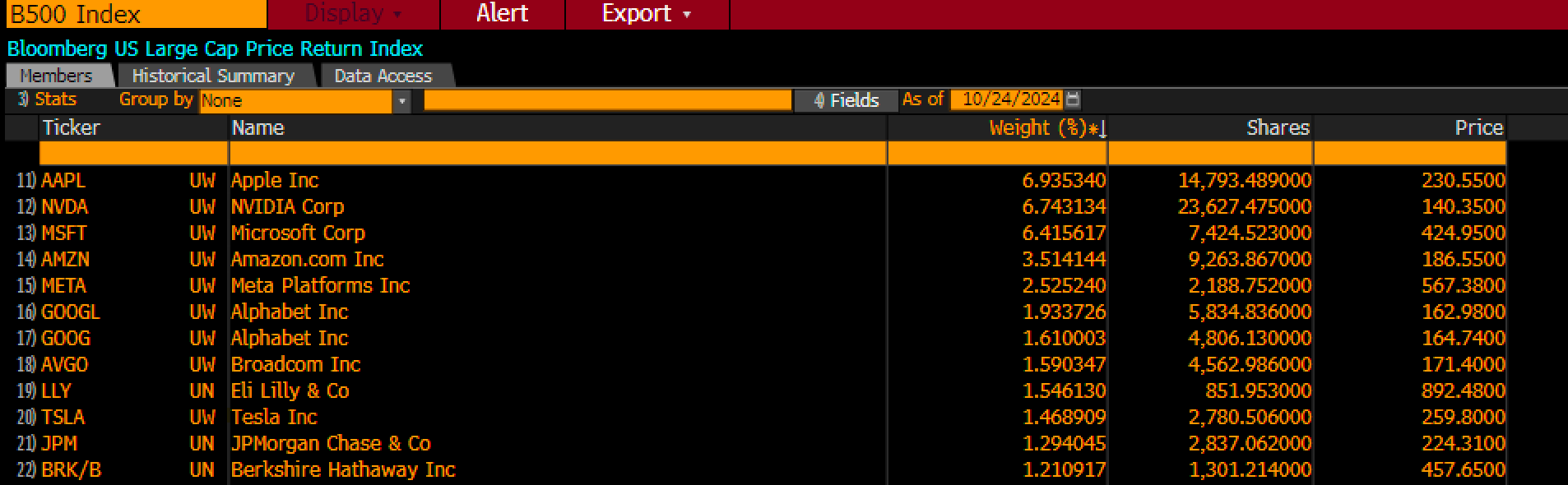

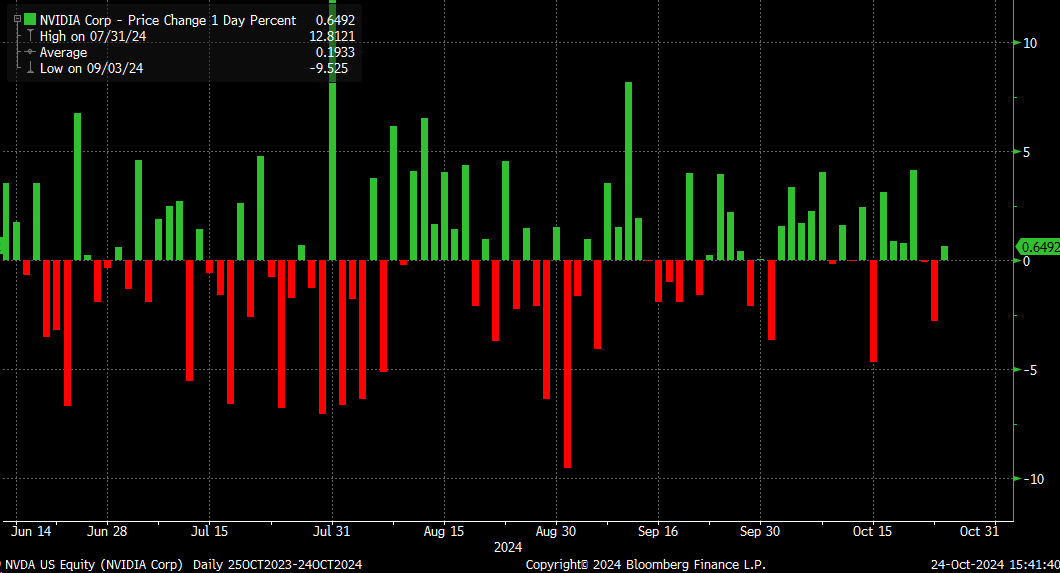

With Tesla’s stock surging, Nvidia (NASDAQ:NVDA) suddenly became less appealing to traders. Call volume for Nvidia collapsed, with only 1.7 million contracts traded yesterday compared to the 20-day average of 2.5 million.

(BLOOMBERG)

Even total volume in Nvidia was down for the day, dropping 31% compared to its 20-day average.

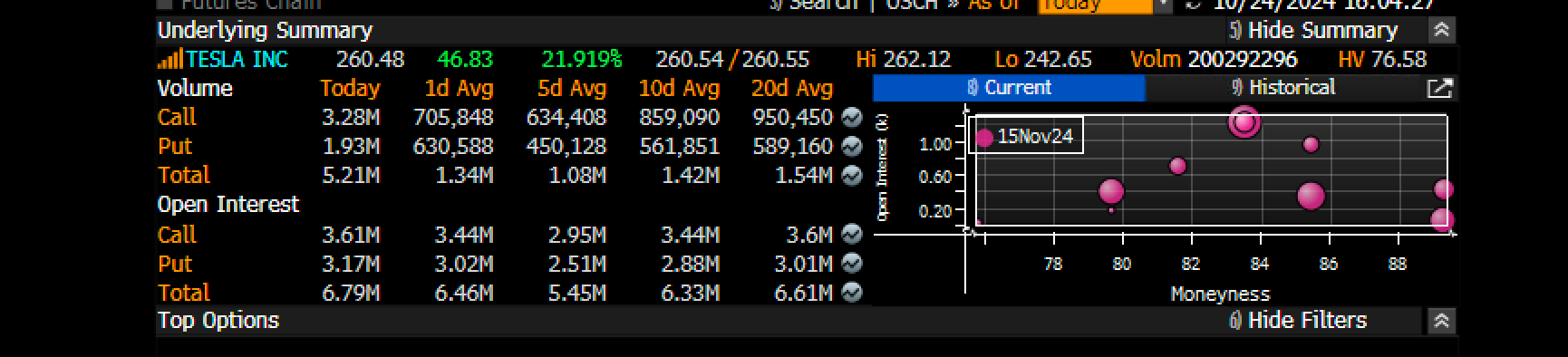

Things appeared to have shifted to Tesla, with the stock up more than 20% on the day—it makes sense. Call volume more than tripled during the session.

(BLOOMBERG)

This could be a significant development. If the option “rounders” have found a new target in Tesla, it could significantly impact the overall market.

Tesla’s weighting in the Bloomberg 500 is only 1.46%, compared to Nvidia’s at 6.75%. For Tesla to have the same impact as Nvidia, rising by 1%, Tesla would need to rise by almost 5%.

If option players shift to Tesla, regardless of whether the trade is profitable or not, Tesla’s impact on the index will not be as severe. A loss of interest in Nvidia could potentially lead to its stock declining, something to keep in mind.

(BLOOMBERG)

On all those days when Nvidia was swinging 3%, 4%, or 5%, it had the equivalent impact of Tesla rising by 10% to 20% in a single day! There have been plenty of those days, with the massive effect on the market.

(BLOOMBERG)

Nvidia’s market cap is $3.445 trillion, compared to Tesla’s at just $840 billion. This means Nvidia is about four times bigger than Tesla by market cap.

As a result, Tesla’s stock would need to rise significantly to match the impact that Nvidia’s daily trading action brings to the market. So, it will be important to keep track of where the option volumes gravitates to from here.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI