Here is a relevant question about the U.S. economy no one is asking:

What if companies, who are cutting expenses by laying off employees, in preparation for an economic downturn are in fact causing the downturn itself?

As the Fed fights inflation through 1) selling its assets in the US equities markets and 2) raising interest rates, the economy is cooling down. Employers and employees are feeling the heat.

Could pre-emptive layoffs mean that a potential recession is in fact a self-fulfilling prophecy?

Historically, when the Fed fights inflation, markets for risk assets are negatively affected. This mean stocks, and especially tech stocks. Crypto has suffered in a similar and more drastic fashion. Bitcoin is around 70% down from its all-time high in November 2021, while many altcoins are down 80% or more.

Markets and the economy are two different things. However, investors and the market do attempt to predict the future of the economy.

Let’s break down some key trends in the job market.

Consumer Sentiment

There is another key economic indicator showing how the broader economy is being affected.

The University of Michigan’s Consumer Sentiment Index is down 42% since April 2021. The July reading of 51.10 was barely up over June. These two months’ surveys are the lowest in history. This survey index goes back to roughly 1990.

That’s not good.

Contagion

In May and June, layoffs affected the sector with roughly 20,000 layoffs each month, per various sources reported TechCrunch.

Major crypto firms including OpenSea, Blockchain.com, Coinbase (NASDAQ:COIN), Gemini have been laying off employees, though this is not a shocker for this embattled sector that has also seen a number of high-profile bankruptcies.

However, mass layoffs are not just happening in tech — they are now spreading to other sectors.

July Layoffs

According to a report from Andrew Murfett, Managing Editor at LinkedIn News, there are a whole slew of firms that have announced layoffs since the beginning of July.

At the end of June, San Francisco was in the spotlight as layoffs were made by numerous tech companies: game developers Niantic and Unity, online newsletter platform Substack and real estate company HomeLight. Elsewhere, data storage provider Qumulo and Parallel Wireless also made cuts.

But the list includes many other companies inside and outside of the tech sector:

- Victoria’s Secret laid off about 160 managers as part of a restructuring.

- Video game retailer GameStop announced layoffs and fired its CFO.

- 7-Eleven laid off approximately 880 corporate employees, following its recent $21 billion acquisition of Speedway.

- Ford plans to cut as many as 8,000 jobs, mostly in its gas-fueled vehicle division, according to a report from Bloomberg.

- Healthcare companies OhioHealth and Alto downsized their staff count.

- Next Insurance, a small business insurance provider, laid off 17% of its workforce.

- Wireless giant T-Mobile.

- Healthtech firm Olive from Central Ohio cut 450 jobs.

- Three applied behavior analysis (ABA) therapy service providers announced cuts: Forta, 360 Behavioral Health, and Center for Autism & Related Disorders (CARD).

- Genetic testing firm Invitae let 1,000 employees go, totaling 40% of its workforce.

- Video platform Vimeo CEO Anjali Sud announced 6% staff cuts in a LinkedIn post.

- Online mortgage banker LoanDepot is laying off about 4,800 employees this year, a 42% cut to its workforce, which numbered 11,300 at the end of 2021.

- ChowNow, a delivery and marketing service for restaurants, laid off about 100 workers ear just days after “instant” delivery startup Gopuff cut 1,500 of its global workforce and closed 76 U.S. warehouses. More recently, food-tech startup Lunchbox laid off 60 employees, a third of its workforce.

- Asurion, a Nashville-based global tech services company, laid off 750 employees. It cut about 300 workers in November 2019.

Whether we are in a recession or not is more a matter of semantics. What is clear is that the economy is slowing down and the contagion has already affected tens of thousands of workers and is likely to affect a lot more soon.

This fact, combined with the past 15 consecutive months of negative real-wage growth, has and will make for harder times for more than just a few families over the coming months.

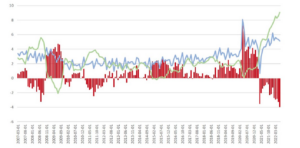

Gap Between Wage Growth and CPI Price Inflation, 2007-2022

Source: The Mises Institute

The final question I am posing for the economy is this: Is the pain really worth it? Will these central bank-inflicted measures solve inflation? Only time will tell.

What Can You Do About It?

Here are some common sense tips you can take now to prepare for any eventuality.

1. Rainy Day Fund

If you currently have a job, and you don’t already have this set up, build a 6-month reserve expense cushion.

If you do not currently have this, this should be your top priority, far more important right now than paying down debts or investing.

You may need to cut down expenses over the next few months to build this up. Better safe than sorry.

2. Résumé

Hopefully you won’t need this, but in case you may be in the job market in the near future, now is a good time to dust off your résumé and revise it, so you are ahead of any future issues. LinkedIn and Indeed provide free résumé building tools if needed.

The disaster that you prepared for does not happen.

3. Sharpen Your Professional Skills

Now is a good time to spend a few extra nights and a weekend day learning a new skill or sharpening some old ones, in case it’s needed to get a new job, or a better one.

This can be done for free on YouTube or by reading some books, but to strengthen your résumé, it would be a better idea to do a paid course.

A good place to do this that I am familiar with is Coursera which offers unlimited courses for $59/month; there are many others. Upwork provides their own suggestions here. As a note, I don’t recommend finding a side hustle on Upwork. Most will spend a lot of time with no to little paid work.

You might expect me to suggest that you learn to be a computer programmer, but as of July 2022 I don’t. It’s not easy for the average person already in the workforce to expect to get good income as a side hustle or for immediate employment. Many others have tried this route and haven’t found work.

And let’s not forget most tech companies have been laying off employees, not hiring them. You are going to face some stiff competition here. If you are already in tech or a programmer, or have a computer science degree, go for it.

For everyone else, here are a few jobs that are in demand and don’t require a university degree. Many are boring, but they pay better than average.

A. Truck/Delivery/Bus Driver. This job requires a CDL, or commercial driver’s license, which you can train for, and which is in high demand.

B. Project Manager. The Project Management Institute provides certification. There is a notable investment of time and it costs around $500, but they boast that project professionals who get their certification make 25% more than the national average.

C. Sales. This is one of the largest professionals in the U.S. and is needed in every field. While the work can tend to be stressful, it can pay well, and on a part-time basis to supplement as well as on a full-time basis.

D. Other Tech Jobs. There are other tech jobs that don’t require programming skills so are faster to learn, and that do pay respectably and are in demand. There is also ample training with certificates online for them. These include Sales Force Administrator, Web Designer (using WordPress), and IT Support.