Alliance has been an MLP since the late 1990s, becoming one of a handful to eliminate incentive distribution rights when it bought in general partner Alliance GP Holdings in June 2018. As a mining company, cash flows have by nature varied with commodity prices over the years, particularly its main product coal.

Yet because of its reliance on long-term contracts with financially secure US electric utilities at fixed prices, dividends have actually varied relatively little up until the past decade or so. That’s when the North American shale revolution suddenly unlocked abundant and cheap supplies of natural gas.

With the coal power plant fleet aging and pollution controls increasingly expensive, US utilities began to switch en masse. As coal plants have closed, the long-term contracts that sustained Alliance’s dividend stability have expired or more rarely been bought out. The company’s mines are still performing competitively. But the revenue base has now shifted from nearby utilities to overseas power producers. And as a result, volatility in selling prices, cash flow, and by extension, dividends, has increased.

Alliance’s current quarterly dividend of 70 cents a share is an all-time high. And it’s nearly 30 percent more than what the company paid in late 2019, just before management eliminated the payout for over a year due to weak commodity prices.

Quarterly results haven’t lost their volatility. Alliance reported an 11.2% decline in Q4 revenue, largely due to a 10.7% drop in coal sales per ton due to lower Illinois Basin export pricing. That took down segment adjusted EBITDA by 35.5%.

Nonetheless, Alliance was still able to report dividend coverage of 1.31 times. Aggressive use of free cash flow for deleveraging has cut debt to EBITDA to just 0.3 times as of the end of 2023. And management reports “over 90%” of 2024 coal output guidance of 34 to 35.8 million short tons is both “committed” to buyers and at prices “similar” to 2023.

Selling prices for coal—and to a lesser extent oil and gas from royalty interests—will be key for maintaining the current level of dividends. And the exceptionally high current yield of 14% on Alliance stock reflects investor skepticism they’ll hold near current levels this year.

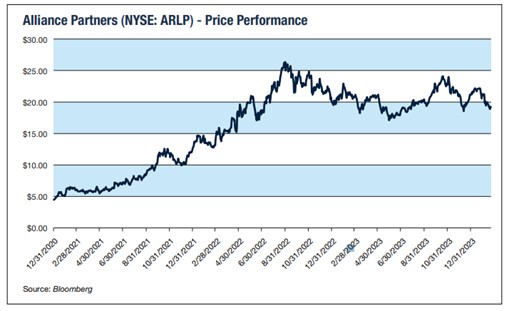

With Alliance shares arguably pricing in as much as a 50% dividend cut, there’s a strong argument to make for a snapback rally to at least the mid-20s later this year, especially if commodity prices do firm as we expect.

Recommended Action: Buy ARLP.