This article has been written exclusively for Investing.com

The equity market is not only detached from economic reality, it also appears to be dislocated from the bond and the currency markets as well. These differing views could provide a vital look into what markets think about the outlook for the US economy and its place in the global recovery from coronavirus.

Over the past few weeks, the gap between yields on 10-year and 2-year Treasurys has been constantly shrinking. Meanwhile, the dollar has fallen against a number of major currencies this year, including the euro, the Japanese yen and the Swiss franc. For its part, the euro has gained versus virtually every major currency this year. Both trends are sending an eye-popping message; that the recovery in the US is likely to be slow, and places like Europe may see a swifter bounce back.

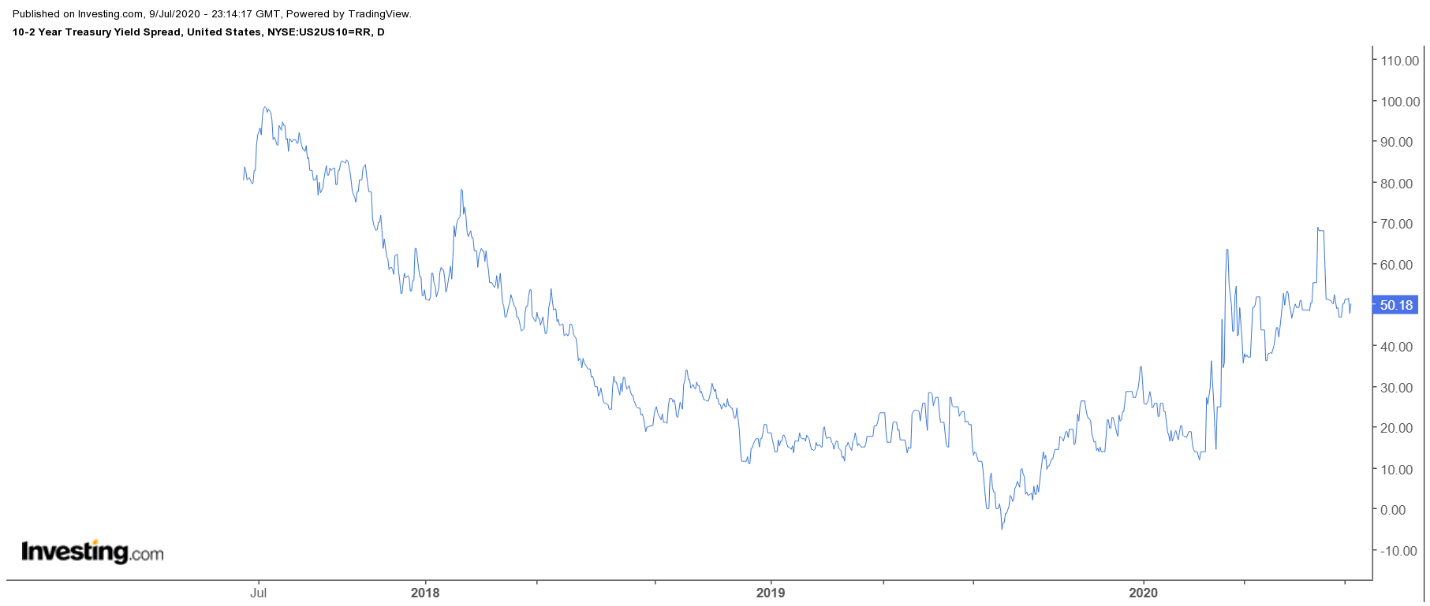

Spreads Are Contracting

The difference between the 10-year and the 2-year Treasury rate fell to just ten basis points in February 2020. However, the spread did begin to widen in early March and ended up climbing to around 70 basis points by the middle of the month, just as the global equity and commodity markets cratered. From that point on, the 2-10s spread held mostly steady, untili it began to shrink once more, falling to around 45 basis points as of July 9.

The 2-10s spread tends to be indicative of fixed-income investors' outlook for the economy. A narrower spread, and particularly one that is heading towards zero, suggests investors believe interest rates are more likely to fall sharply in the near term and stay low for an extended period of time, as the central bank combats economic weakness. In a worst-case scenario, it may even indicate a belief that the economy is heading towards recession. In contrast, a widening spread can reflect the view that rates are more likely to rise in the near term as the economy expands.

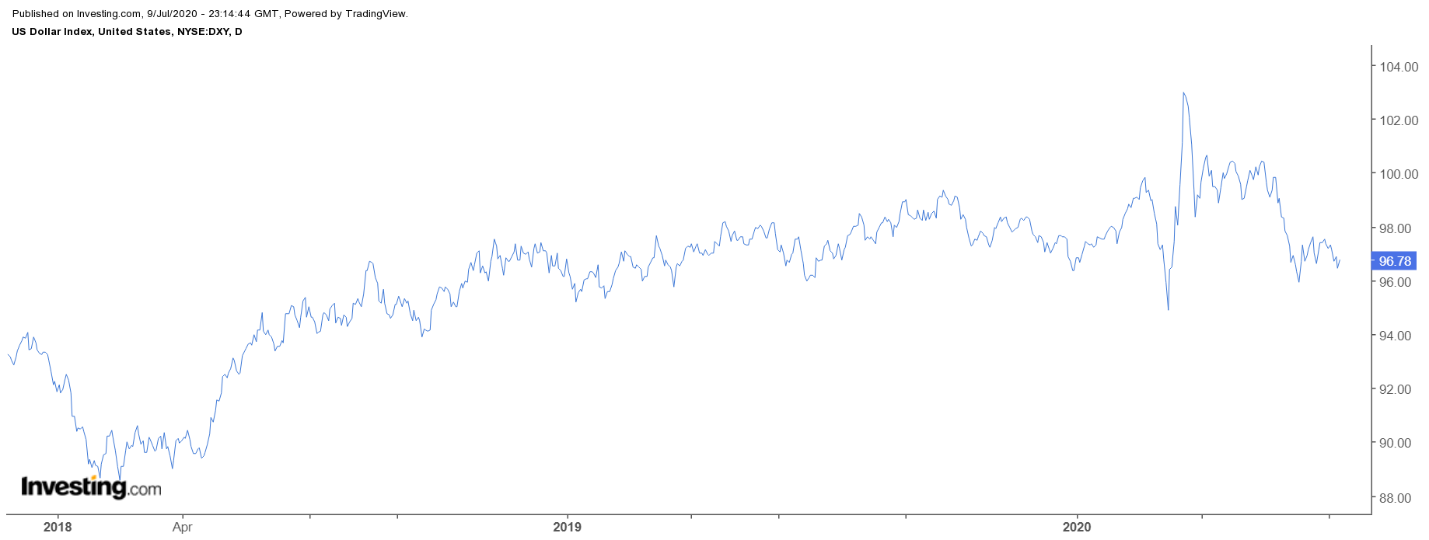

The Dollar Is Weakening

Meanwhile, the dollar index, which measures the value of the dollar against a basket of six major currencies, has been falling since peaking at its highest in over three years at 103 in March. As the pandemic exploded, forcing factories and businesses around the world to close, bringing most transport to a grinding halt, and confining billions of people to their homes, global markets crashed. Investors scurried for the safety of the US dollar, which stormed up by 9% in as many days, to 103, a level not seen since January 2017.

The dollar has now given up almost 80% of those gains, having declined to around 96.75. Traders that loaded up on dollars are gradually selling off those holdings in favour of other currencies. This could be a sign that investors are betting that, for the first time in living memory, the United States might not lead the world out of recession.

One currency that has been a stand-out performer this year is the euro. The currency reached a three-year low of about $1.07 against the dollar in mid-March. Since that time, the Euro has spiked to roughly 1.13 versus the dollar. The strengthening Euro, despite the lower yields in Europe, is likely an indication that some traders view a recovery in Europe taking hold faster. Another possibility is that traders fear a growing fiscal deficit in the US, may also be weighing on the dollar.

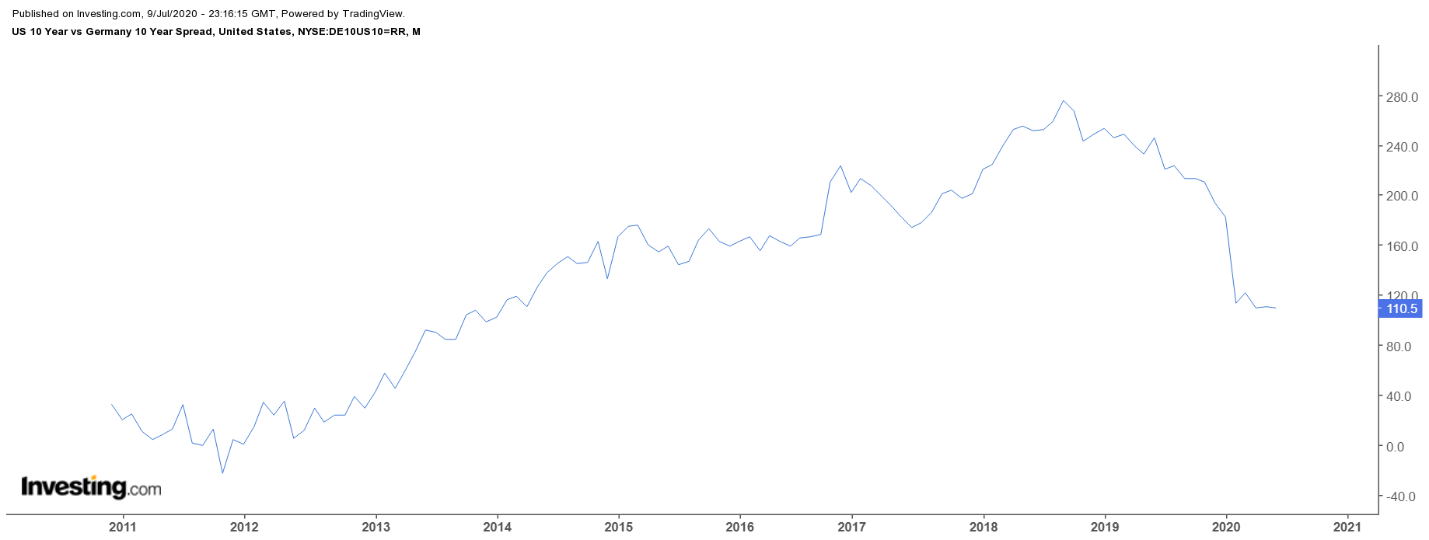

Supporting the view of a slower US recovery is the difference between US benchmark yields and those in Europe. The spread between yields on 10-year Treasurys 10-year German Bunds has reached levels not seen since 2013. German benchmark bonds yield around -0.48%, while their US counterparts yield around 0.54%, indicating that investors would—theoretically at least—be more willing to pay the German government to hold its debt for ten years than to invest in US bonds with the same maturity.

Equity Markets March To Their Own Beat

Despite the warning signs of that the US economy is struggling, despite upbeat readings like the most recent payrolls data, the equity markets in both Europe and the US have performed relatively in line. Since March 24, the S&P 500 and the German DAX have both risen by about 28%.

If it turns out to be the case that the US economy lags a global economic rebound, it would undoubtedly be a significant change of pace. After all, it seems that the US consumer is always what brings the US and the rest of the globe out of recessions, or economic slowdown. But this time could be different, with coronavirus cases still spiking in the US, keeping consumers at home. Meanwhile, other parts of the developed world appear to be on the mend, and that may ultimately be the critical difference between the US and everyone else.

It will be, of course, the path of the virus, which ultimately decides which economies come back online the fastest and which ones struggle.