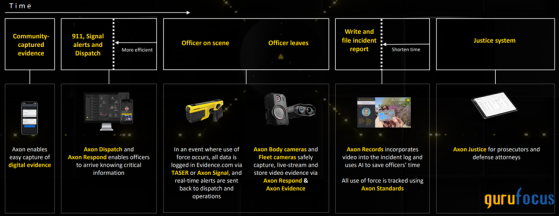

Axon Enterprise Inc. (NASDAQ:AXON) has positioned itself as a leader in the public safety technology industry, specializing in personal protection and law enforcement. While the company is primarily known for its less-than-lethal devices for law enforcement, Tasers, its biggest opportunities lie in digital evidence management, real-time operations and body-worn cameras. Law enforcement agencies, defense attorneys and prosecutors are increasingly adopting integrated software and hardware bundles to improve their daily workflows, and Axon has capitalized on this trend by creating a network of cloud software and hardware solutions, including Axon Fleet, Axon Records, Axon Dispatch and Axon Justice. The company operates in the aerospace and defense sectors, but its innovative technology places it more in line with the tech industry.

Source: Axon Investor Deck

Business model and market positionAxon has built a strong moat, which includes strong switching costs and a powerful product ecosystem. This is similar to Apple Inc.'s (NASDAQ:AAPL) approach, where users enter the ecosystem via iPhone and later use complementary products such as the App Store, Apple Pay, iTunes and Macs. Similarly, its hardware (like the Taser) requires ongoing purchases such as cartridges.

This shift is leading to more recurring revenue as a substantial portion of its sales now comes from services, with over 40% of its total revenue tied to cloud software subscriptions. All of Axon's devices are cloud-connected, allowing real-time updates, improved inventory management and easy evidence sharing across its platforms. This creates high switching costs for law enforcement agencies, making it difficult for them to migrate to alternative providers.

The network effect further enhances Axon's moat, where every new user adds value to existing ones. The Axon Network enables seamless collaboration between police departments, first responders, public defenders and prosecutors. As the network grows, so does the data available to feed and improve Axon's AI algorithms, enhancing operational efficiency.

Source: Axon Investor Deck

While Axon is a global company, most of its revenue comes from the U.S., with a focus on state and local law enforcement agencies. Its primary productsTaser devices and body camerasare far from market saturation, with only 35% and 14% penetration in the U.S. respectively. In recent years, the company has expanded its reach to federal agencies, courts, corrections and emergency services. Axon has also entered the consumer and private enterprise markets, which are still in the early stages of growth outside U.S. law enforcement.

Source: Axon Investor Deck

The global body-worn camera market is expected to reach $10 billion, but for Axon, these cameras act as gateways to its software. The company estimates the software market will grow to $34 billion, generating high-margin recurring revenue. Moreover, its products are being adapted for industries beyond law enforcement, including pharmaceuticals, construction and emergency response teams. The company's total addressable market has ballooned to $77 billion, up from $8.40 billion in the fourth quarter of 2019. The increase reflects both Axon's expanding suite of products and the adaptation of those products to new fields.

One of the company's latest innovations is the "Draft One", an artificial intelligence-powered tool that leverages generative AI to draft police reports by auto-transcribing body-worn camera audio. According to Axon, U.S. officers spend up to 40% of their time on paperwork, and this product dramatically reduces the time required for administrative tasks, freeing officers for more critical duties.

In addition, Axon's acquisition of Fusus has enhanced its real-time operations capabilities. Fusus grants public safety agencies the ability to access, with permission, CCTV camera feeds, including those maintained by the community, to see events unfolding with greater context and clarity.

Fusus has become central to Axon's real-time operations strategy. Its role in consolidating various data streams into a unified map interface is now replacing Axon's older mapping solutions. The technology is also seen as a gateway to expanding Axon's presence in both the public safety and enterprise markets.

Another major tech revolution the company is developing is a "drone as a first responder" solution, anticipating that drones will soon become vital in situations such as car chases or accident response. This is becoming possible through a partnership between Axon and Skydio, the leading U.S. drone manufacturer. Together, they will build out an end-to-end offering for drones in public safety. This follows Axon's recent acquisition of Dedrone as it pursues the burgeoning drone opportunity. Although it is still in the early stages, Axon's leadership team believes drones are the "future of public safety," so it's a safe bet it will continue investing in the space.

The integration of drones with police forces is expected to drive technological improvements in the coming years. Imagine a drone following a car chase instead of a police helicopter, or a drone being the first responder to a car accident to assess the condition of the people involved and report to the base along with all the savings that could bring.

About leadershipRick Smith, the founder and CEO of Axon, is on a mission to revolutionize law enforcement and protect lives by making traditional firearms obsolete. Since founding the company 30 years ago, he has played an instrumental role in driving the business toward fulfilling its ultimate mission. Smith has transformed Axon from its initial success with Taser stun guns into new frontiers, including the use of body and vehicle-mounted cameras for collecting evidence against criminal suspects and the creation of the Evidence.com digital management platform.

Smith's 4.60% stake in the Scottsdale, Arizona-based company, which is worth several hundred million dollars, underscores his personal investment in its success. As a result, I believe we can expect him to continue leading Axon into the future, driving innovative solutions that make law enforcement safer and more effective.

Despite this, my main concern in Smith's leadership regards stock-based compensation, which has led to significant dilution over the past five years to shareholders. It seems he might not be fully aligned with shareholders' interests and could be more focused on personal gains rather than broader shareholder value.

The way the company handles executive compensation, without share buybacks to mitigate dilution, reflects a potential misalignment with the interests of other shareholders.

Financial resultsAxon delivered strong second-quarter results, with year-over-year revenue growth of 35% driven by a 47% increase in cloud sales and a 28% rise in Taser sales. For the first time, Cloud & Services revenue ($195 million) nearly matched Taser sales ($197 million), signaling a shift toward subscription-based revenue models. The company reported an adjusted Ebitda margin of 24.50%. This continues to drive more subscription revenue with 95% of total sales tied to a membership package.

International sales saw a 49% increase, contributing to the company's expansion. Axon's international bookings increased by 100% year to date, largely driven by the launch of TASER 10, which has revitalized interest in TASER products globally. Smith added that the increasing adoption of cloud services, especially AI-driven products like Draft One, is also starting to break down resistance to cloud technology in regions like Europe, potentially opening up more international opportunities.

Axon's net revenue retention of 122% indicates existing customers are expanding their spending on its platform, with each customer paying 22% more per year. This stickiness demonstrates the value of the company's ecosystem, with AI and machine learning driving further efficiency.

Source: Author generated

The company's balance sheet remains strong. With $1 billion in cash equivalents, marketable securities and short-term investments, Axon is well-positioned to continue investing in future growth. The asset side of the balance sheet looks healthy, with goodwill increasing significantly due to some acquisitions, but it is still a very small part of total assets. Further, the long-term debt (convertible notes) worth $679 million is well covered by cash. Customer deposits have increased 59% year over year and the backlog grew by 41% to $7.40 billion, which was faster than revenue. This indicates the company has secured a significant amount of future business, reflecting strong demand for its products and services. Axon expects to recognize between 15% and 25% of this balance over the next 12 months.

Nothing stands out as being particularly alarming on the liability side of the balance sheet.

Looking ahead, Axon's management is optimistic about its future prospects and raised its guidance. The guidance suggests the company expects revenue to grow another 30% in 2024, targeting at least $2 billion, with adjusted Ebitda expected to reach a midpoint of $468 million.

Despite Axon's strengths, the thesis faces some risks. The company's reliance on government contracts makes it vulnerable during periods of budget cuts, particularly at the federal and state levels. This could limit the ability of revenue growth in the public sector, potentially impacting the company's penetration, expansion and, by extension, its valuation.

ValuationAxon's valuation reflects its growth potential, but is on the higher side. With Wall Street estimating an earnings per share guidance of $4.80 for this year and $5.88 for fiscal 2025, the stock trades at a forward price-earnings ratio of 60 and a PEG ratio of 2. While this valuation may seem extended, the company has rarely been considered a "cheap" stock. However, it might not be fully optimized for net profit, so alternative metrics may be useful.

Another way to assess Axon's valuation is to look at 2026. Based on analyst estimates, I developed a three-scenario analysis, assigning a 50% probability to the conservative scenario, 30% to the base scenario and 20% to the optimistic scenario. I am leaning more toward the conservative side given the current economic headwinds and market nervousness.

Given the assumptions made and accounting for dilution, my price target is $362. At the time of writing, the stock is around $352, which provides an upside potential of 3%, suggesting that it is fairly valued.

Source: Author generated

Final thoughtsAxon has built a resilient business model with a powerful ecosystem and high switching costs, making it a leader in public safety technology. Its expansion into cloud-based services and real-time operations, combined with strong revenue growth and a growing backlog, positions the company for continued success.

Despite this, Axon could be considered a "rainy-day stock" due to its strong performance during economic downturns or periods of social unrest. This resilience is a testament to the management's foresight and operational efficiency.

While Axon is not immune to economic downturns, historically the company has been less affected by economic cycles due to the essential nature of its products. During past recessions, agencies often focused on productivity improvements, which could continue to benefit its business. The company's products save both lives and money, making them critical even during economic hardships.

My investment thesis on Axon can be summarized in three points. First, Axon's network is larger than any of its competitors, giving it a cost advantage. Second, Axon's total addressable market has expanded to approximately $77 billion due to product innovation and adaptation to new markets. With revenue of $1.80 billion over the trailing 12 months, representing less than 3% of the TAM, there is significant room for future growth. Finally, Axon's business is growing rapidly, with revenue increasing by 27% per year since 2013. Recent quarters have shown accelerated revenue growth, expanded gross margins and a net revenue retention rate above 120%.

However, my thesis could be compromised by the lack of alignment between the CEO and other shareholders. I would like to see more consideration from the CEO regarding shareholder interests.

As I am already a shareholder in Axon, I am not adding to my position at these levels. Given the quality of the company, investors might still consider adding a small position to their long-term portfolios and increasing it during any weakness.

This content was originally published on Gurufocus.com