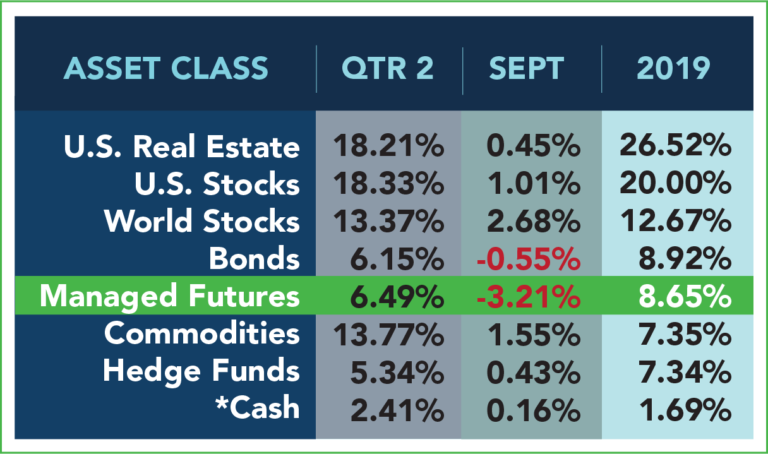

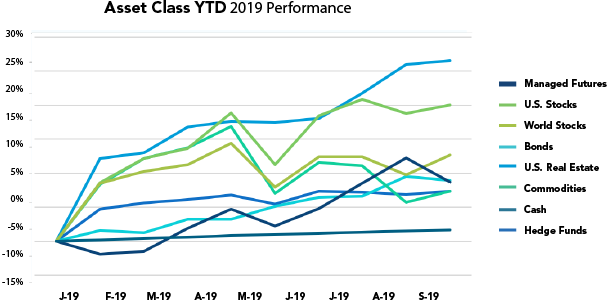

Is anyone going to be able to stop U.S. Real Estate and US Stocks?

Yeeeeshh, those two classes rebounded big time in September, to get back into the 20%+ club. In the world of MF, there was a classic reversion to the mean after a big August, causing managed futures to drop a couple spots, while commodities went positive following a big oil move in the wake of attacks on Saudi infrastructure. With one quarter to go…

Sources: Managed Futures = SocGen CTA Index,

Cash = US T-Bill 13 week coupon equivalent annual rate/12, with YTD the sum of each month’s value,

Bonds = Vanguard Total Bond Market (NYSE:BND)

Hedge Funds = IQ Hedge Multi-Strategy Tracker (NYSE:QAI)

Commodities = iShares S&P GSCI Commodity-Indexed (NYSE:GSG);

Real Estate = iShares U.S. Real Estate ETF

World Stocks = iShares MSCI ACWI ex US ex-U.S. ETF (NASDAQ:ACWX)

US Stocks = SPDR S&P 500 (NYSE:SPY)

All ETF performance data from Yahoo (NASDAQ:AABA) Finance.