Natural gas bulls' aim to break into the high $3 pricing is hitting a wall.

In a phenomenon all too familiar to participants in this market, cheaper substitutions creep in beyond a certain price point, and the more affordable alternative to gas is coal.

The environment is the reason coal was displaced by natural gas, which burns more cleanly than other fossil fuels, and produces less carbon dioxide per unit energy released. Burning natural gas produces about 30% less CO2 than burning petroleum and about 45% less than burning coal for the equivalent amount of heat.

Yet, economics rule at the end of the day, and gas steadily above $3 per mmBtu, or million metric British thermal units, bites not just consumers but also utilities.

Also, US crude prices at just under $70 per barrel for the benchmark WTI, or West Texas Intermediate, will likely spur more oil production as well as bring “associated gas,” the byproduct of drilling, with it.

‘Coal Kicks Back In’

Houston-based consultancy, Gelber & Associates, commented on the increased likelihood of gas-to-coal substitution in a note to its clients at Wednesday:

“Yesterday’s early rally to $3.14/MMBtu gained support from higher than expected forecasted cooling demand; yet, it was unable to pierce past the front month’s previous 3-month high of $3.15/MMBtu.”

“As fuel switching to coal kicks back in and high $68 WTI prices push for higher associated gas production, it remains unclear if natural gas prices can challenge the previous high once again.”

At Wednesday’s settlement, natural gas futures for July delivery on the New York Mercantile Exchange’s Henry Hub stood at $3.075 per mmBtu, down 3 cents, or almost 1% on the day.

The balance of the Henry Hub strip for summer through March 2022, or spring next year, also settled above $3.

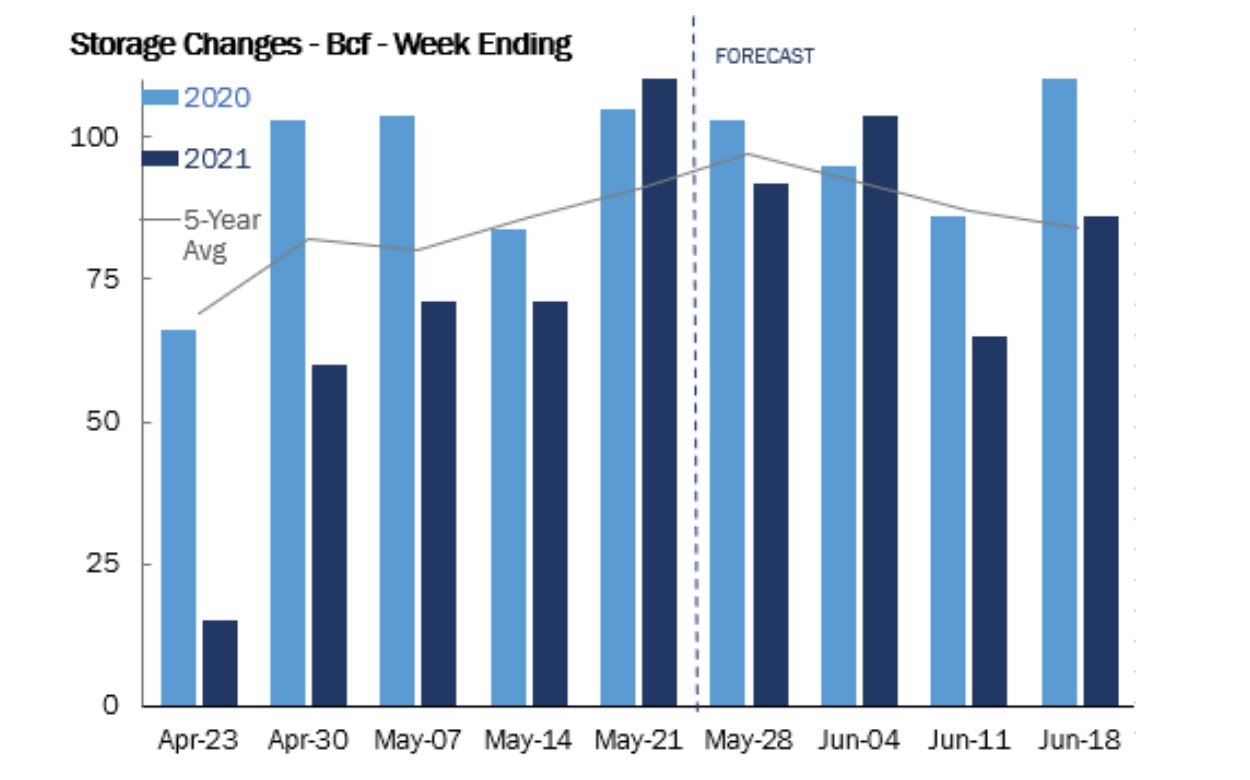

Chart courtesy of Gelber & Associates

Those settlements came ahead of the Energy Information Administration’s weekly storage report on natural gas, due at 10:30 AM ET (14:30 GMT) today.

A consensus of analysts tracked by Investing.com are forecasting an injection of 96 bcf, or billion cubic feet, into storage for the week ended May 28 versus the 103 bcf during the same week a year ago and a five-year (2016-2020) average of 96 bcf.

In the week ending May 21, utilities injected 115 bcf of gas into storage.

If analysts are on target, the injection during the week ended May 28 would take stockpiles up to 2.311 tcf, or trillion cubic feet, some 2.7% below the five-year average and 14.4% below the same week a year ago.

Warmer-Than-Normal Temperatures

Temperatures were a little warmer than normal last week with just 64 TDDs, or total degree days, versus a 30-year average of 63 HDDs for the period.

TDDs are used to estimate demand to heat homes and businesses, measuring the number of degrees a day's average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

Gelber & Associates itself called for a gas storage build of 92 bcf for last week, or 4 bcf below the consensus. In an early read into the current week, it said that it expected an injection of 104 bcf. “These two 90+ Bcf injections are set to carry total gas storage well within breathing room of the 5-year average,” it added.

Though the official start of the summer season is still weeks away, significant heat in the forecast for next week has garnered some momentum for natural gas futures, industry expert naturalgasintel.com said in a blog.

Weather models so far have largely maintained the warm outlook, according to forecaster Bespoke.

But recent data indicates that the core of the heat would move back toward the Rockies and Plains around the middle of the month. This would mean less heat in the key eastern population centers.

“We believe this is a real risk, though again, even factoring in five- or 10-year normal beyond day 15 would still give us a top 5 hottest June on record, per national gas-weighted degree days, thanks to the heat we see next week,” Bespoke said.

Texas Surprisingly Lags All-Round Heat

Surprisingly, Texas remained the laggard in temperature readings, as all of next week’s heat is to the north, Bespoke said. From the Midwest to East, 90-degree temperatures were expected as far north as Minneapolis to Boston.

NatGasWeather said the 15-day outlook remained “plenty hot enough” for June 6-12. However, like the overnight European model, the latest Global Forecast System shed a few cooling degree days for the 10- to 15-day period by weakening strong upper high pressure enough to drop temperatures by several degrees over much of the country.

“The weather data needs close watching for this important June 13-17 period because (of) any further cooler trends, and it could lead to disappointment,” NatGasWeather said.

Even with the possibility that storage balances remain largely in check with the next EIA report, most market participants would agree that winter 2021-2022 carries some significant risks, naturalgasintel.com noted.

The portal quoted consultancy Mobius Risk Group as saying that the upcoming winter was poised to be the first in more than a decade in which pre-season inventory levels were likely to be less than 3.5 Tcf, along with tight weather-adjusted supply/demand conditions.

“Interestingly, the March/April 2022 spread currently sits at plus 40 cents, or roughly a dime lower than where it was in mid-February, and 8 cents lower than its late October 2020 peak,” Mobius said.

The contraction of this “bull spread” has been spurred by a rally in summer 2022 (April-October) relative to winter 2021-2022, according to the firm. The winter 2021-2022 strip currently sits on top of the $3.25 mark, which is a level it has reached three times since late October, yet failed to move through.

“On the other hand, the summer 2022 strip has steadily moved higher since mid-March, and now rests on top of the $2.70 mark,” Mobius said. “The last time the summer 2022 strip touched $2.70 was April of 2018.”

The Houston firm also pointed out that recent Commodity Futures Trading Commission Commitment of Traders data shows that from early April to mid-May, the ‘Other Reportables’ category essentially doubled its net short position. This category is assigned to many hedge funds and classically defined speculative traders.

“It is possible that the past two sharp rallies (May 17 and Tuesday) have been fueled by short covering, with a more sustainable fundamental rally yet to come,” according to Mobius. “Of course, as always, weather will remain the undefeated heavyweight champ of the natural gas market.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.