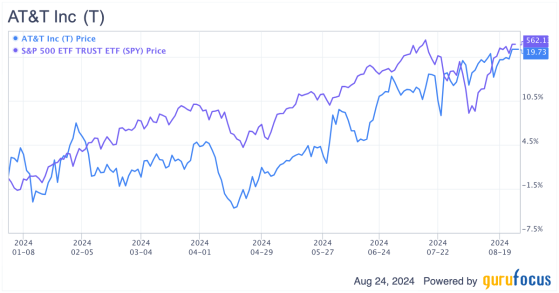

AT&T Inc. (NYSE:T) has shown notable resilience during the recent market turmoil, with the stock steadily climbing and almost matching the S&P 500's performance. After years of underperformance, its shares are finally on an upward trajectory, highlighted by a 5.20% surge following the announcement of second-quarter results.

Although revenue fell short of expectations and adjusted earnings per share barely met analysts' forecasts, investors rewarded AT&T for its improving margins and free cash flow trajectory. The narrative around the telecom giant is shifting; once criticized for its heavily leveraged balance sheet, the company is now on the verge of a strategic turnaround.

T Data by GuruFocus

A significant part of AT&T's turnaround was driven by management's decision to divest its non-core assets, such as DirecTV and TimeWarner, and refocus on its core business. This strategic refocusing has the potential to set the stage for a more streamlined business model aimed at delivering stronger shareholder returns while also continuing to reduce the company's leverage.

Further, AT&T offers an attractive 5.80% dividend yield, making a compelling case to invest at current levels. In this analysis, I will share my perspective on why the stock presents decent value right now, even amid its own challenges and the broader market volatility.

Growth potential in fiberAmong the catalysts that could drive mid-single-digit earnings per share growth for AT&T in the coming years, the expansion of its fiber network stands out as the most critical. In my perspective, the company's fiber network is a premium asset with significant strengths. As the leading fiber broadband provider in the U.S., it is well-positioned to leverage its scale and capitalize on cross-selling opportunities with its other product offerings. Even with its leading market position, the company's fiber business continues to grow as its total fiber subscribers reached 8.80 million during the latest quarter, reflecting a robust 14.30% year-over-year increase with 1.10 million new users added over the past year.

Additionally, AT&T's average revenue per user in fiber has expanded by $2.30 to $69 as of the second quarter. If all goes according to plan, both the number of subscribers and ARPU should continue to grow as AT&T continues to build out its fiber network. This growth potential in fiber is a crucial driver of the company's future performance and could significantly enhance its value proposition in the years ahead.

Refocusing on core businessAs AT&T refocuses on its core business, it is exploring options to divest its 70% ownership stake in DirecTV, the third-largest pay-TV provider in the U.S. Acquired in 2015 for $67.10 billion to expand beyond the wireless sector into pay television, DirecTV has underperformed expectations and lost subscribers due to the rise of online streaming services. This declining customer base has significantly reduced the cash distributions AT&T receives from DirecTV, dropping sharply to $586 million in the first half of 2024, compared to $974 million a year earlier. By divesting non-core assets like DirecTV, AT&T can better align its business with a focused total return capital allocation strategy, allowing it to concentrate on strengthening its communications operations.

Financial performanceStarting with AT&T's most recent earnings report, the company's total revenue dipped slightly by 0.40% year over year, missing market expectations due to ongoing declines in its business wireline and wireless equipment segments. However, the Wireless Service segment remained a bright spot, maintaining steady 3% growth, which management expects to continue throughout 2024. A particularly encouraging sign was the 29% year-over-year increase in postpaid phone net adds, which reached 419,000 in the second quarter, up from 349,000 in the previous quarter. This growth was largely driven by reduced churn and the success of AT&T's fiber business, which saw revenue grow nearly 18%.

Source: AT&T Investor Relations

Contrary to the opinion of bearish AT&T investors, the core business is far from showing signs of deterioration, with strong customer growth driving impressive top-line Ebitda and margin expansion. Despite a modest growth outlook for overall revenue, AT&T has made significant strides in improving its margins. I believe this is a key factor behind the stock's recent positive momentum, with the adjusted Ebitda margin rising from 36.90% to 38% in the latest quarter, with adjusted Ebitda increasing by 2.60% year over year.

AT&T also continues to be a cash-generating powerhouse. The critical difference now is it is using this cash to strengthen its balance sheet rather than pursuing unrelated acquisitions that do not align with its core business model (which I view as a positive considering AT&T's acquisition decisions in the past). As a deep-value stock, the company's quality metrics, particularly free cash flow, are crucial for investors. After three years of decline from 2020 to 2022, the company achieved 39.20% year-over-year growth in free cash clow in 2023, with the FCF margin improving from 9.30% to 13.70%. This trend indicates the company is moving in the right direction.

Additionally, the sustainability of its dividend adds another layer of appeal. AT&T requires around $2 billion in quarterly FCF to cover its current dividend payout of 27.75 cents per share. In the second quarter, the company's free cash flow-based payout ratio was an encouraging 43.41%. When it comes to dividends, cash flow is kingif a company cannot generate sufficient cash flow to support its dividend, the risk is too high, regardless of the yield. In AT&T's case, the outlook for dividend sustainability appears strong, reinforcing my positive outlook on the company.

The telecom giant has long been perceived as a company burdened with significant debt, which has kept some investors at bay. With that said, it has also been focusing on paying down debt, which ballooned during the zero-rate environment during the Covid-19 pandemic. Although the market has penalized AT&T for its substantial debt, the company has made notable strides in cutting it down in recent years. Management remains committed to further reducing leverage, with long-term debt having peaked at $179 billion in 2022 and now down to $125 billion. AT&T's goal is to reach a net debt-to-adjusted Ebitda ratio of 2.50 by the first half of 2025, which is a positive target. Consistently paying off the existing debt will help the company avoid the need for refinancing at the current higher interest rates. While the company's debt load is still relatively high, I believe AT&T's strong cash flow generation is more than adequate to handle this debt, making it a less significant issue for investors going forward. Moreover, as debt reduction remains a key priority, the impact of AT&T's debt burden should diminish over time.

Valuation perspectiveAT&T is attractively priced, making it well-positioned to weather any market-wide pullbacks driven by ongoing recession fears. Interestingly, the recent market downturn has had little impact on the stock, underscoring its resilience. Further, the company's substantial dividend yield will continue to attract investor interest, providing a buffer against market volatility.

From a relative valuation standpoint, AT&T currently trades at a forward price-earnings multiple of 8.80.. This is quite low, especially when compared to its 10-year average of 10 and a 10-year high of 15. Moreover, its peers are trading at significantly higher multiples, with the average at 11.60, Verizon (NYSE:VZ) at 9, Swisscom (XSWX:SCMN) at 16 and T-Mobile (NASDAQ:TMUS) at 21.20. I believe that AT&T's multiple is poised to move closer to 10 as its debt burden becomes less of a concern, along with the company's consistent ability to generate strong FCF and its solid dividend yield comes into play over the next few quarters. If this materializes, the stock would be trading around $22.50, showcasing a safety margin of about 14%.

T Data by GuruFocus

A discounted cash flow model for AT&T, using a discount rate of 10%, a conservative 6% growth rate over the next five years paired with a 2% terminal growth rate (which I believe is quite conservative given its increasing growth in the fiber business and improving margins), still indicates a potential upside of 17% (fair value of $22.86 per share versus market price of $19.72).

This suggests a solid margin of safety for a deep-value stock like AT&T. On the whole, I see significantly more positives than negatives in AT&T's future, with numerous profit-driving catalysts are expected to emerge.

Final thoughtsAT&T's strategic pivot to focus on its core business and strengthen its balance sheet is beginning to show promising results. The divestiture of non-core assets like DirecTV and TimeWarner is allowing the company to streamline operations and concentrate on high-growth areas, such as its leading fiber network. This refocusing has not only improved AT&T's margins, but also reinforced its position in the telecommunications sector.

Further, the company's commitment to reducing its substantial debt and its consistent ability to generate strong free cash flow provide a solid foundation for future growth. The sustainability of its 5.80% dividend yield makes it an attractive option for income-focused investors, while the ongoing fiber expansion offers significant long-term upside.

Although AT&T faces challenges, such as competition and market volatility, its proactive management and strategic realignment position it well to overcome these hurdles. With its stock currently trading at attractive valuations and the potential for meaningful appreciation, the company presents a compelling investment opportunity for those seeking value in the telecommunications sector. As it continues to execute on its turnaround plan, I believe the market will increasingly recognize AT&T's potential, making now a favorable time to consider investing.

This content was originally published on Gurufocus.com