-

Exceeds Revenue and EPS Expectations: Suncor Energy Inc (TSX:SU). surpassed revenue, Normalized EPS, and GAAP EPS expectations in Q2 2023, reflecting strong operational performance and strategic asset management.

-

Disciplined Capital Allocation: Suncor Energy maintains a disciplined approach to capital allocation, evident in its net debt to Adjusted Funds from Operations (AFFO) ratio of 1.0x.

-

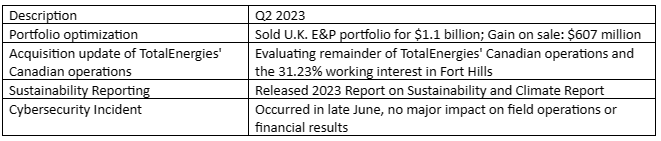

Strategic Acquisition Potential: The potential acquisition of TotalEnergies (EPA:TTEF)' Canadian operations, valued at $5.5 billion, could redefine Suncor Energy's position in the oil sands industry and secure a consistent bitumen supply beyond the Base Mine's life cycle.

Q2 Performance and Operational Growth

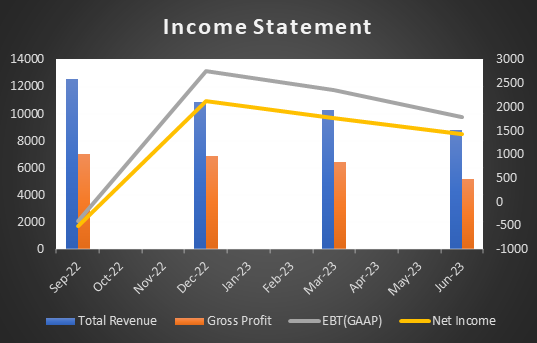

Suncor Energy Inc. has demonstrated strong set of results in the second quarter of 2023, with notable achievements and challenges across various segments. The company's Revenue, Normalized EPS and GAAP EPS have surpassed expectations. Suncor Energy's performance highlights its strong operating results, strategic asset foundation, and disciplined capital allocation strategy. In terms of operating results, Suncor Energy has witnessed growth in Total Oil Sands bitumen production, SCO and diesel production, and non-upgraded bitumen production. The company's increased stake in Fort Hills and the optimization of its regional asset strategy have contributed to these positive outcomes. However, there has been a decline in Exploration and Production (E&P) production due to inherent resource depletion and the divestment of Norway assets in the previous year.

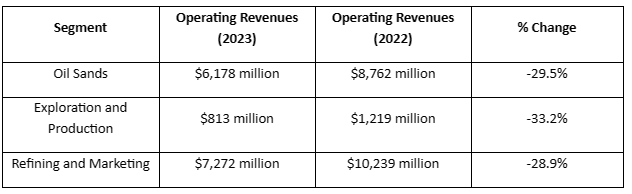

Revenue Fluctuations and Strategic Asset Foundation

Suncor Energy's revenue has experienced declines across segments, including Oil Sands, Exploration and Production, and Refining and Marketing. These revenue fluctuations can be attributed to oil price volatilities, changes in production outputs, and evolving market appetites. However, Suncor Energy continues to leverage its long-life, competitively advantaged assets to establish a robust foundation for future growth. The company's strategic asset foundation, characterized by its integration of physical assets and operational synergies, ensures operational efficiency and stability. Suncor Energy possesses a significant oil sands reserve life index of 26 years, a substantial upgrading capacity, and a notable refining capacity. These factors contribute to its competitive advantage and position the company for long-term success.

Capital Allocation Strategy and Sustainability Leadership

Suncor Energy's disciplined capital allocation strategy further strengthens its growth prospects. The company's judicious approach to investment, reflected in its net debt to Adjusted Funds from Operations (AFFO) ratio of 1.0x, demonstrates its financial prudence. Suncor Energy's strategic capital deployment, including share buybacks and net debt reduction, optimizes resource utilization and enhances shareholder value. The company's integrated oil sands footprint has also proven to be a key driver of growth. With diversified mining and Steam Assisted Gravity Drainage (SAGD) operations connected by a comprehensive pipeline network, Suncor Energy optimizes profit margins and upgrader utilization. This integrated approach, coupled with strategic supply chain logistics, solidifies its dominant position in the industry. Sustainability leadership is a fundamental tenet of Suncor Energy's business strategy. The company prioritizes water stewardship, tailings management, and strong relationships with Indigenous communities. Investments in Indigenous businesses and the adoption of innovative technologies showcase Suncor Energy's dedication to eco-responsible practices. The company's commitment to achieving net-zero greenhouse gas emissions by 2050 further demonstrates its proactive approach to sustainability. Suncor Energy's refining advantage allows it to bolster its market position. With strategically located refineries and a vast market reach, the company efficiently supplies a diverse range of products to a broad clientele. Its expansive retail network further complements its refining operations, making Suncor Energy a formidable player in North American refined product markets.

Future Growth Catalyst

Looking ahead, one of the most significant growth catalysts for Suncor Energy is its potential acquisition of TotalEnergies' Canadian operations, valued at $5.5 billion. This strategic move has the potential to reshape Suncor's standing in the oil sands industry, ensuring a consistent bitumen supply beyond the Base Mine's life cycle. With strong financials and a commitment to financial discipline, this acquisition is poised to further reinforce Suncor Energy's market position.

Income Statement of Suncor Energy

Conclusion

In conclusion, Suncor Energy Inc. has shown both positive and challenging results in the second quarter of 2023. While the company has demonstrated strong operating results, a strategic asset foundation, and a disciplined capital allocation strategy, it has also experienced revenue declines across segments. Given the mixed performance and uncertainties within the energy industry, we advise to” hold” on to the stock while keeping $55 as upside in wake of the current oil bull run.

Disclosure: We don’t hold position in the stock.