Interest rate cut expectations have receded everywhere following the US inflation data, but there are subtle dovish incremental shifts within the BoC’s commentary that suggest should inflation and unemployment continue with their current momentum then the BoC are open to a June rate cut. The Canadian dollar is facing more downside risks.

Cautious optimism on inflation

The Bank of Canada has left the target for the overnight rate at 5%, in line with market expectations, and is continuing with its policy of quantitative tightening. Nonetheless, there are subtle dovish shifts.

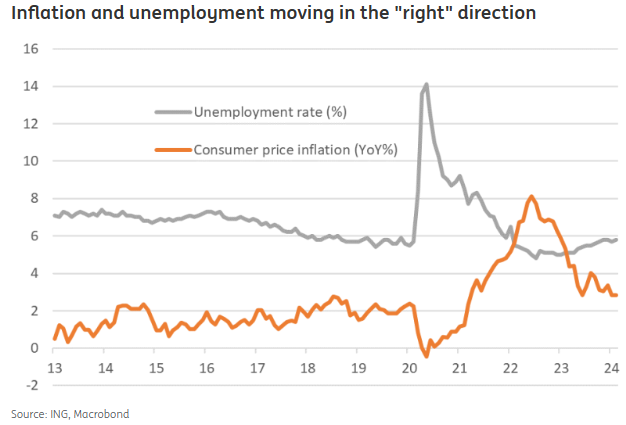

The statement acknowledges that “a broad range of indicators suggest that labour market conditions continue to ease” and with the workforce growing more quickly than those employed, we are seeing a rise in the unemployment rate, which is helping to moderate wage pressures. The BoC do expect growth to “pick up in 2024” after having stalled in the second half of 2023, so while there is “excess supply” in the economy this will be gradually absorbed through 2025 and 2026.

This excess supply has meant an easing of price pressures in the economy and the BoC now expect CPI to move below 2.5% year-on-year in the second half of 2024 “and reach the 2% inflation target in 2025”. The BoC state that inflation “is still too high” but they appear to have adopted a slightly more dovish position, dropping the sentence “the Council is still concerned about the risks to the outlook for inflation, particularly the persistence in underlying inflation”. This has been replaced with “the Council will be looking for evidence that this downward momentum [in inflation] is sustained”.

In the press conference, Governor Tiff Macklem said a June rate cut is “within the realm of possibilities”

A June cut remains our base case

The pricing of a June rate cut has receded from 19bp at the start of the day to just 14bp currently, but we believe this is more a reflection of the surprise strength in today’s US inflation report that has led to a scaling back of rate cut expectations everywhere.

The BoC is not afraid to move independently from other central banks and if we see the unemployment situation continue softening and inflation moderating we believe they will indeed carry through with a June rate cut.

CAD facing downside risks

With Bank of Canada’s rate expectations still reflecting more the developments in the Fed pricing than the domestic backdrop, downside risks for CAD persist in our view. The proximity to a rate cut in Canada is in stark contrast with the reiteration of hawkish stances by the likes of Norges Bank and Reserve Bank of New Zealand, and we still expect CAD to lag most commodity currencies barring major shifts in risk sentiment.

When it comes to USD/CAD, the short-term outlook should continue to be driven by the USD leg. Despite today’s rebound, USD was starting from an already cheap level after the recent repricing higher in Fed expectations, meaning there is more upside room for the greenback in the near term. The widening gap between USD and CAD rates should help build a floor for USD/CAD as high as 1.3600. A move to 1.3750/1.3800 in the coming weeks is possible.