On September 29th, 2023 Bloomberg a global financial information news outlet published the results of a survey. The said survey was targeted at 23 renowned and expert economists like Stephen Poloz, and Mark Carney (both Former Governors of the Bank of Canada) and asked in essence a simple question—"Do you think the Bank of Canada is going raise policy rates any further in 2023?".

Out of the 23 experts, 20 said a collective "NO".

This is a sentiment that we at The Canadian Home completely agree with, according to our estimation the likelihood of the Bank of Canada raising the rates any further in 2023 is less than 20%. Although the current rate of 5% is definitely on the high side, the most likely possibility of it holding steady for the remainder of 2023 appears to be a sigh of relief. This is something the current real estate market desperately needs.

THE HOUSING MARKET - AS EXPECTED YET SURPRISING

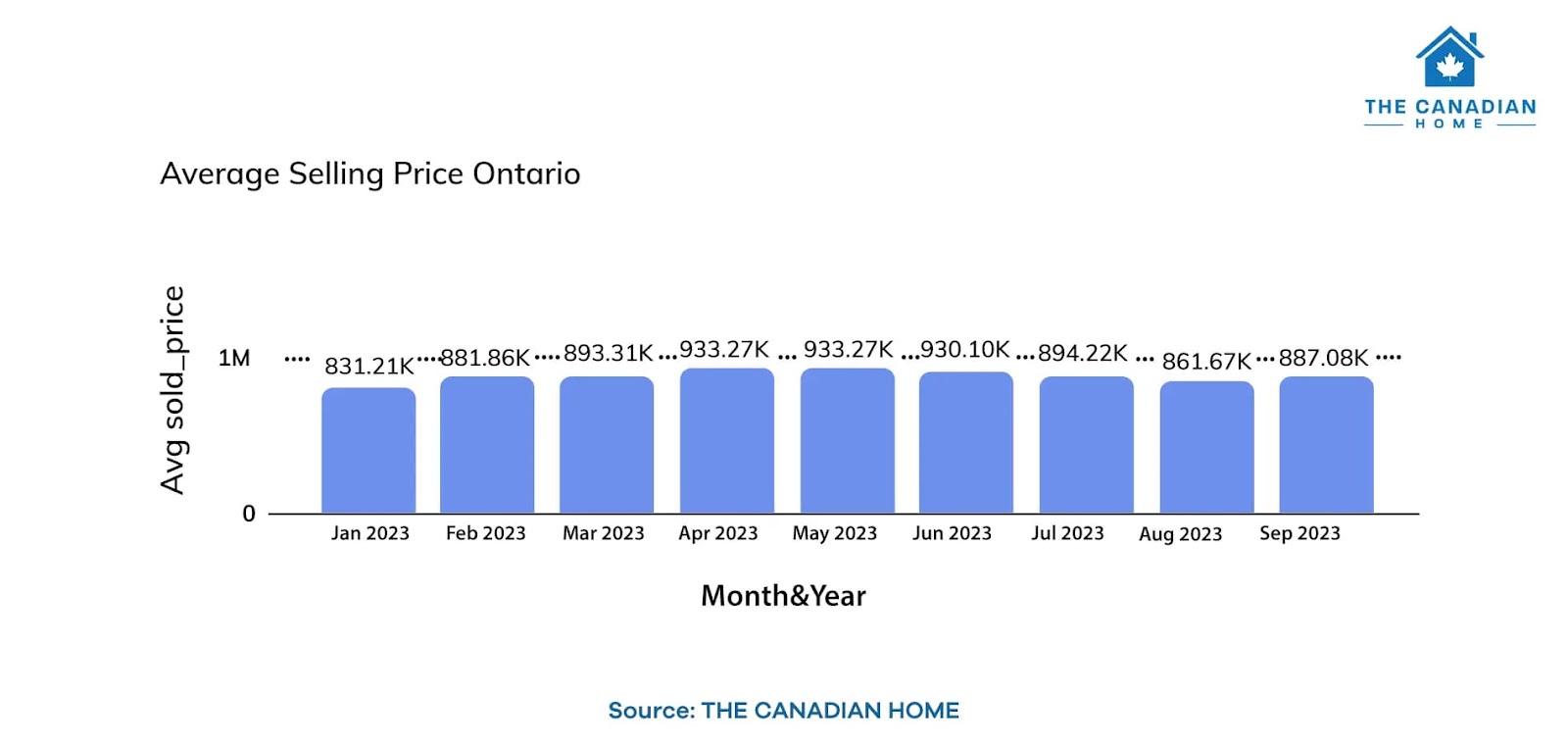

As evident from the chart above, there was a consistent decline in home prices across Ontario from May to August. However, immediately after the Bank of Canada's decision to maintain interest rates on September 6th, 2023, we observed a 3.2% increase in home prices which indicates towards a potential trend: if interest rates remain stable in the coming months, we can anticipate a continued rise in home prices.

According to Manoj Karatha Broker of record for The Canadian Home—"I think it is reasonable to believe that if Bank of Canada decides to hold the policy rate steady on October 25th, then most likely home prices will continue to rise. So, my advice to anyone who has saved enough for a good down payment and has an annual household income of about $150K, you should start looking into properties right about now."

Although this rise in home prices was a common trend across all cities in Ontario there were certain exceptions to the rule. If you are someone who is willing to buy a house now then these 5 cities are your best bet.

Kitchener

Coming in at the average selling price of $737K Kitchener is the first one on our list. Although home prices in this city climbed up to $830K in August, this month, they went down by 12%, the highest price decline in all the cities in September 2023 when compared to last month. From premium quality detached homes to spacious condo apartments Kitchener has something for everyone and that too at a budget-friendly price tag.

Cambridge

With the second-highest price drop, 7.5% compared to last month, Cambridge is next on our list coming in at an average selling price of $749K. Although the number of homes sold in this city decreased in September by 21% it is interesting to note that the number of new listings has increased by 24% and properties are selling sooner than ever before. This means that with each passing day, this city is attracting more buyers who are keen to invest in its real estate market.

Oshawa

Third on our list is Oshawa, the famous automotive capital of Canada. Buying a house here means having access to a strong economy and job market in the Durham region. With an average selling price of $767K, Oshawa has a lot to offer to aspiring home buyers. Dominating the housing market at approximately 55%, detached homes offer a wide range of options. Meanwhile, condo apartments in this area boast the second most affordable prices on our list, starting at just $398K. In the month of September, the home prices in Oshawa dropped by 7%, so it's time to make a move.

Niagara Falls

Although 4th on this list, Niagara is definitely topping the charts in affordability, quality of living and high return on investment. With an average selling price of $596K Niagara is the most budget-friendly option on this list. You can get a detached home for less than $700K or a Condo apartment for below $500K in this vibrant city. Not to forget, choosing to buy in Niagara Falls means you get the added benefit of breathtaking natural beauty and a lively community. In the month of September, the home prices in Niagara dropped by 6.5%.

London

Last on the list is London and this one is definitely a banger. With an average selling price of $618K, this city strikes the perfect balance between budget-friendly and premium living. You have the option to purchase a detached home for $696K or a semi-detached property for a more affordable $498K. Additionally, this city offers condo apartments, with prices starting at just $374K, the lowest on this list.

YES, WE KNOW RATES ARE HIGH!

We are not oblivious to the fact that interest rates in Canada are surely on the high side of things right now. But here's a counterpoint, no one can control interest rates. We have said this on multiple occasions- as a homebuyer you should only focus on things you can control. You cannot control interest rates, inflation, or the housing market but you can control what you buy, where you buy it, and for how much. So let's just focus on that.

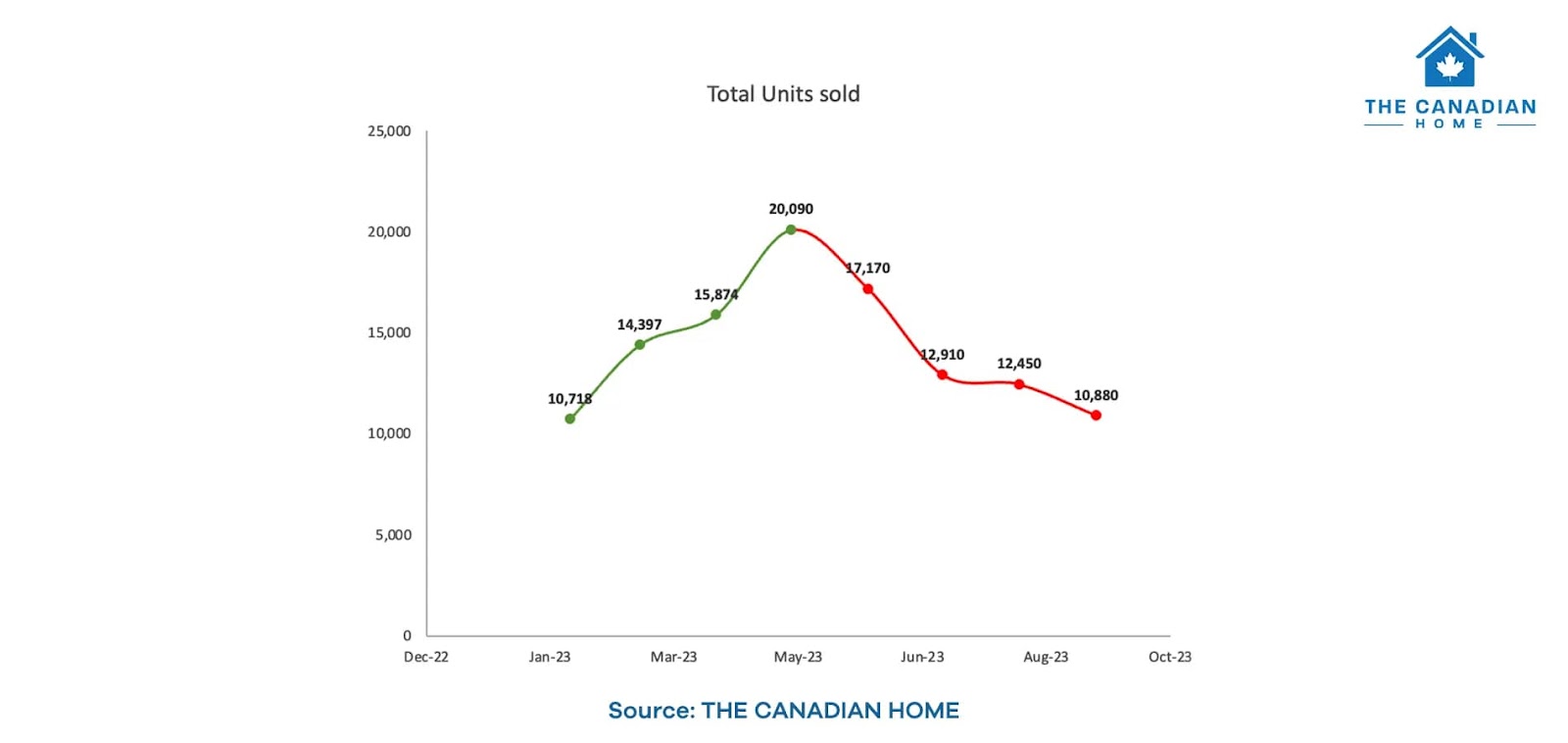

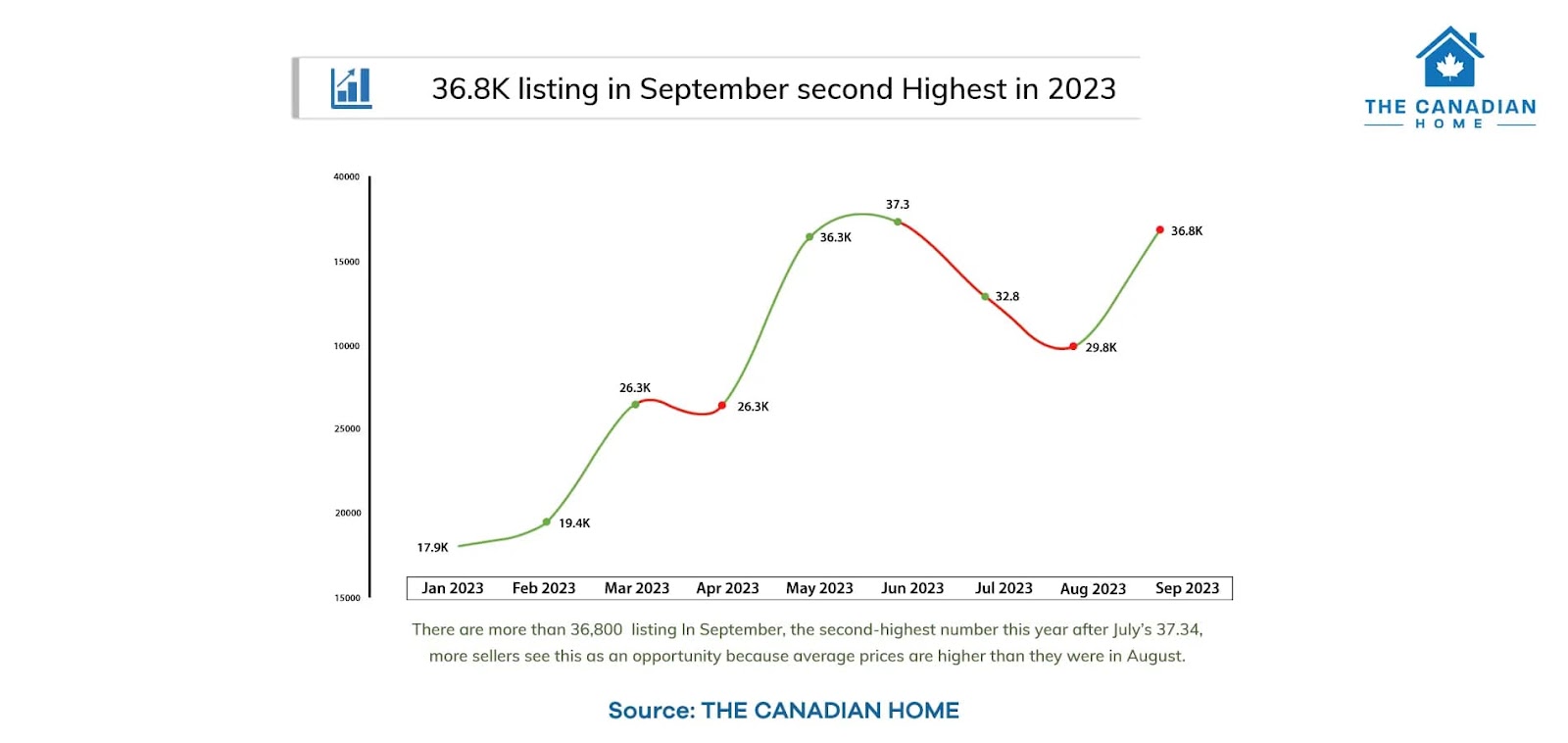

According to Robin Cherian CEO of The Canadian Home-"If you have the budget to buy a home right now but are hesitating because of interest rates then you are missing out on a lot of negotiation power. Even if rates stay the same for a little while, there's no guarantee they'll drop significantly anytime soon. Right now, there are more houses on the market than there are buyers, which means you could get some really good deals if you have an expert helping you. So, don't miss out on this chance."

And, he is absolutely right! The latest numbers clearly show a surge in the number of new listings across the board in Ontario and a consecutive decline in home sales. Economics dictates that this conflict between demand and supply is bound to create a market where buyers will have a lot of negotiation power. The choice to use this power or not is of course yours. If in case you do decide to exercise this power then you will need an expert realtor by your side and that is something right up the alley of The Canadian Home.