- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bear Market: Did We Hit Bottom in October?

- The broad selloff witnessed in the first nine months of 2022 appears to have stalled—at least for now

- U.S. midterm elections could give stocks another push in the upcoming months

- However, investors must avoid getting too euphoric; risks remain in place

October was a great recovery month for the U.S. stock market, with the S&P 500 jumping 8.8%. November started off a bit slower, with the U.S. benchmark index losing -1.68% in the first five days of trading. However, needless to say, the selloff witnessed during most months of 2022 seems to have paused for the time being.

With the U.S. midterm elections today, we could get another bullish tailwind should we see a change in Congress composition. A Republican majority in Congress is usually a bullish factor for the markets. Furthermore, the U.S. market has a history of rallying after midterms regardless of the winner.

However, as always, we cannot get euphoric about the current market phase—just as we should not have gotten desperate earlier this year. The key is always to maintain rationality and clarity.

But let’s take it step by step.

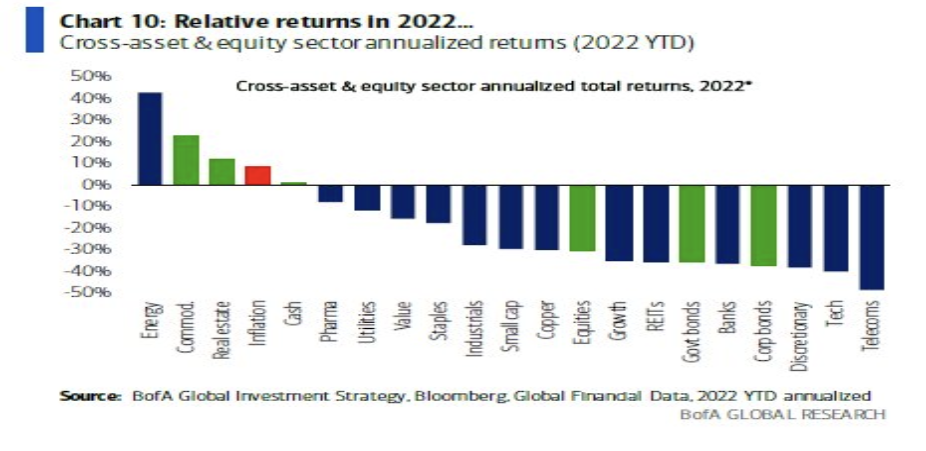

Below, I have put the performance of the different asset classes from the beginning of the year to date. As you can see, on the positive side, we find only energy, commodities, and real estate. Among the worst performers are technology and telecommunications.

Source: BofA

Now, is this really a bear market or a correction (very strong, for goodness sake) of the long-term bull market that started back in 2009?

From the picture above, we see how on average, at the bottom of a bear market, valuations (here, the P/E ratio relative to the S&P 500 index) were around 11.7X on average. Today, in early November, this same value is traveling around 16.7X, meaning that only in 2002 had we had higher valuations at a market bottom.

In all this, let us remember that the worst decline from the highs in this bearish phase was, to date (should the October low be the definitive one), about 27.6%, so a meaningful decline, but compared to the historical data, not so extreme.

So again, we are still finding out whether or not the mid-October low was a bottom for the market. However, I have been slowly buying diversified ETFs and individual stocks over the past few months with an eye on the long-term horizon.

I’ve also been buying some individual stocks for the short term, considering that they might be undervalued at current levels, however, with greater due diligence. Recently, I turned profits in both Meta Platforms (NASDAQ:META) and Netflix (NASDAQ:NFLX).

Of course, buying when everything goes up is easier emotionally. The tricky thing is to do it when everything goes down; you might be labeled as crazy for the duration of the bear market, but then you reap the rewards.

As David Rubenstein, the co-founder of Carlyle Group recently said:

“People shouldn’t be afraid of going in and buying things now. The great fortunes in the investment world are often made by buying things at discounts.”

We’ll see if that turns out to be the case this time.

In the meantime, I ask your opinion: Have we reached a bottom?

Write it down in the comments.

Disclosure: The author has closed his positions in both Netflix and Meta. He is currently still long on the S&P 500.

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

In this episode, we dive into Paul Graham’s essay on how wealth creation has evolved over the past few decades. We explore why inherited wealth is on the...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.