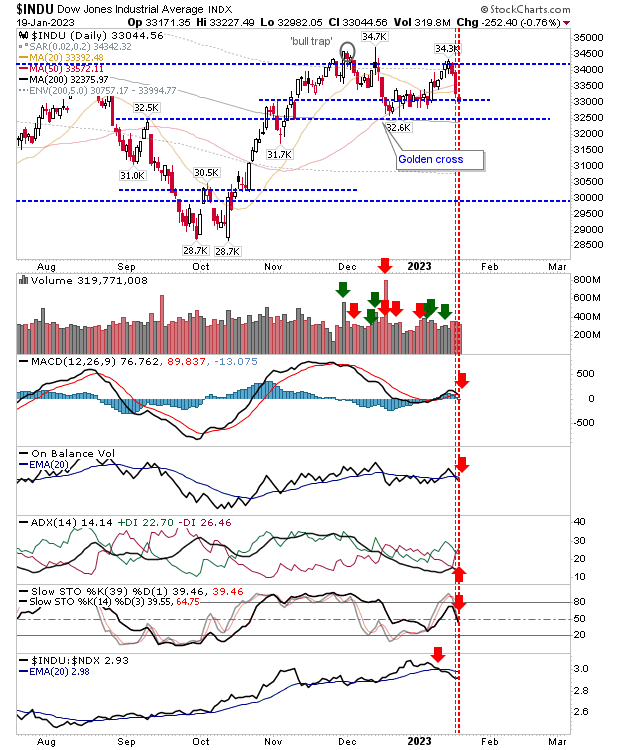

After a positive start to the year, U.S. indexes suddenly found themselves under a heavy bear attack this week. Yesterday, the hardest hit was the Dow Jones Industrial Average as it fell below the 50-day MA and into December's congestion.

Technicals are net bearish, adding to the index's selling pressure. I would be looking for a test of the 200-day MA this week - a moving average currently running along horizontal support of the September swing high and the December swing low.

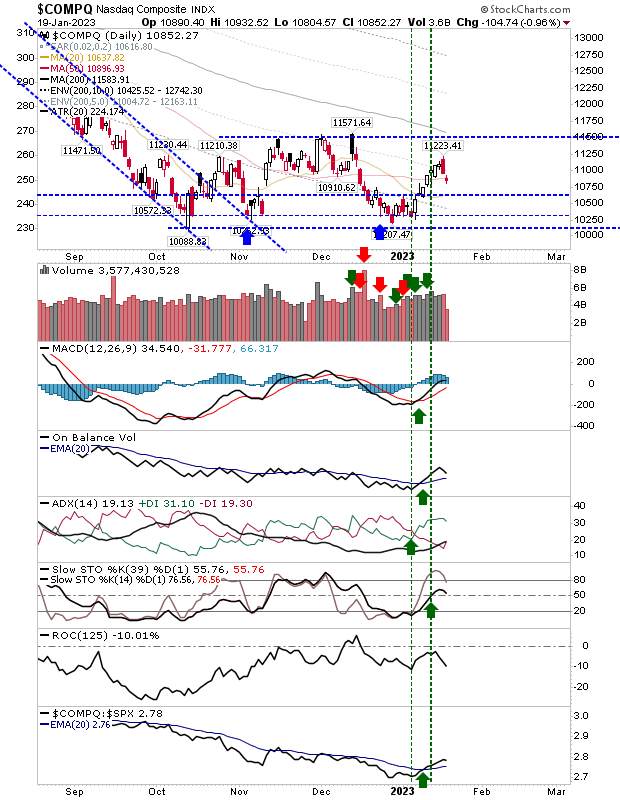

The Nasdaq 100 finished on its 50-day MA and is still holding to bullish net technicals. The index continues to gain relative strength over the S&P 500. So, the net damage was negligible, but it isn't favorable if other indexes continue to decline.

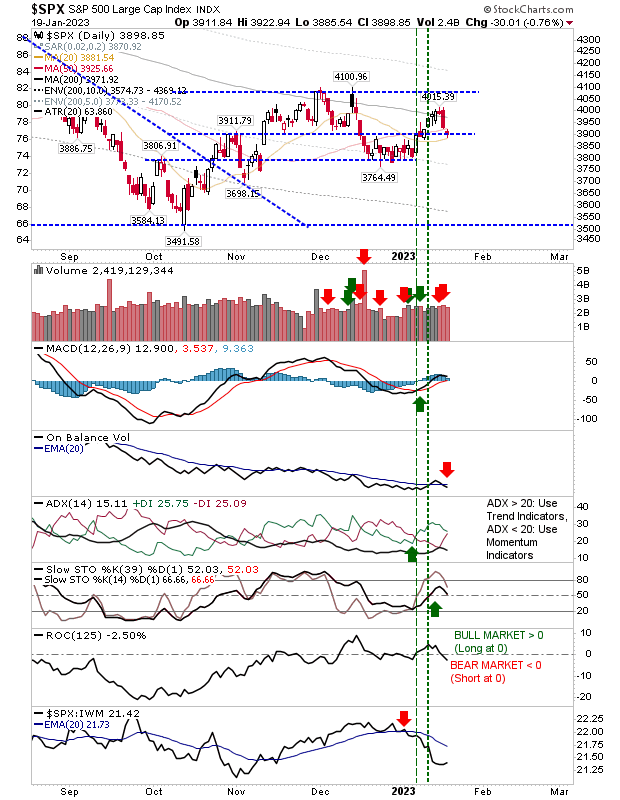

The S&P did not suffer as much as the Dow Jones index and has been relatively low-key in its actions over winter. Aside from the continued loss in relative performance to the Russell 2000, there are a couple of red flags.

The volume climbed to register as distribution, and technicals have become bearish. The index has also been turned for a second time its 200-day MA - although repeated tests of a given resistance have a greater probability of a breakthrough.

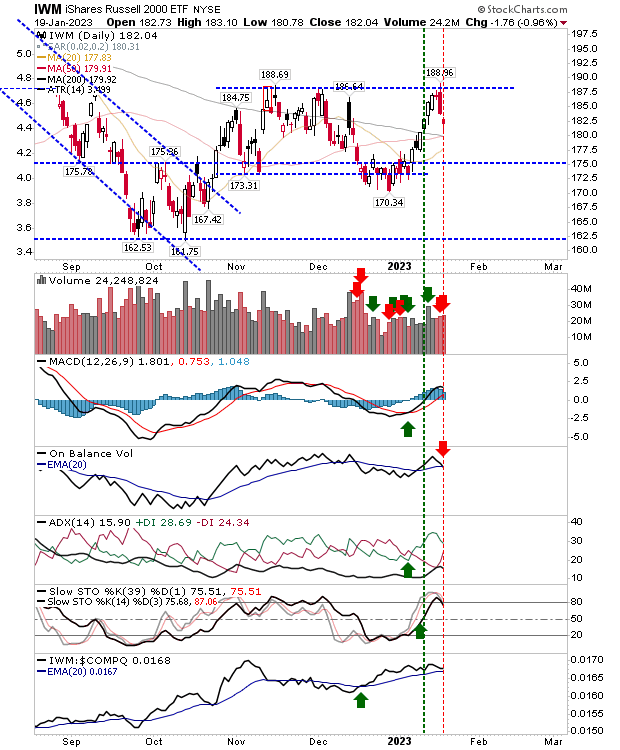

The Russell 2000 has a support to lean on, but it registered two consecutive days of distribution and was rebuffed by the resistance of November highs. The technicals are primarily bullish, which is positive.

We will have to wait and see how much today's pause meant for the next trading session. The current rally was a belated Santa one, but it is now under risk. We want to see moving averages defended because if these fail, we will look at retests of October lows.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI