This article was written exclusively for Investing.com

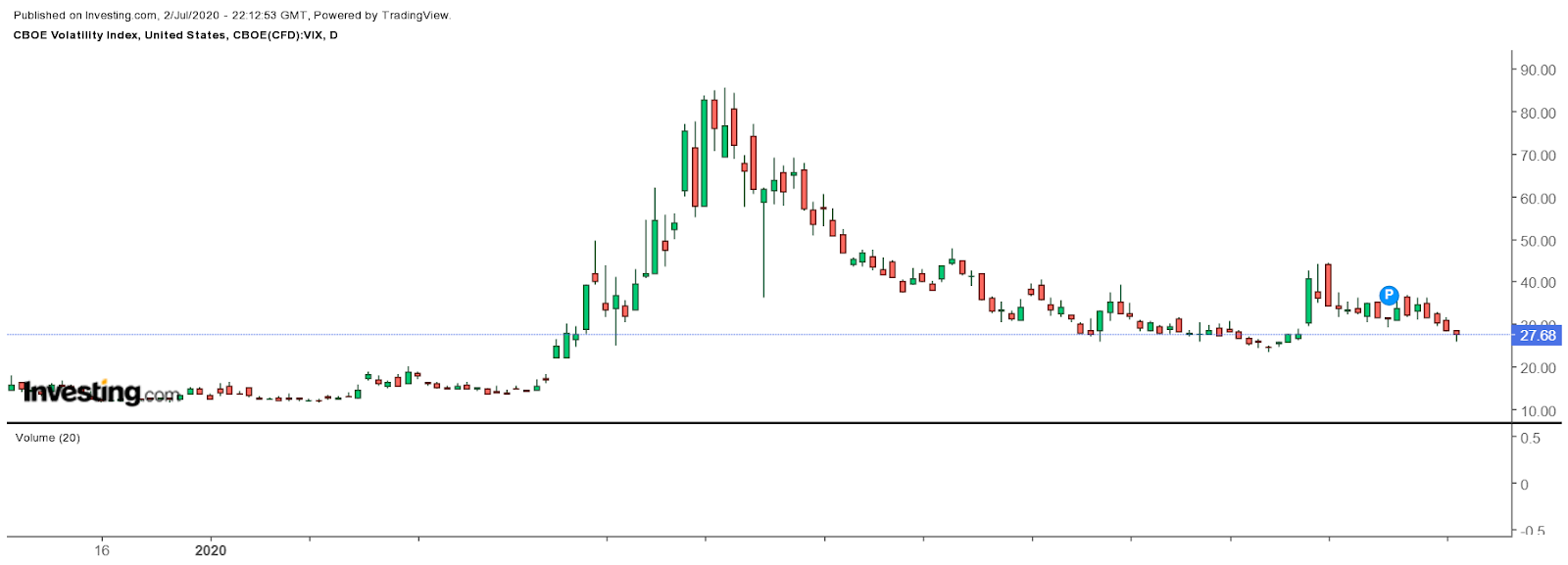

The first half of 2020 was a roller-coaster, and based on options betting, the third quarter may prove to be just as volatile. In recent days there have been several bearish bets put on that suggest the S&P 500 could fall by about 7% before quarter-end. At the same time, there is evidence that some investors are betting that, by the middle of September, the VIX could more than double in value and return to the peaks seen in March, as fear over COVID-19 gripped world markets and volatility surged to its highest in over a decade.

That anyone should bet on a correction in the market should not come as a shock, especially given the gain in the S&P 500 of almost 20% in the second quarter. The significant advance for the index came rather smoothly, without much of a fight from the bears. Still, there are plenty of concerns on the horizon, such as rising coronavirus cases, which could easily and quickly derail the rally and some investors are preparing for this eventuality.

Hedging Against A Drop In The S&P 500

On July 1, open interest for S&P 500 Sept. 30 puts at a strike price of 2,930 rose by 29,580 contracts. Additionally, puts at 2,465 for the same expiration date increased by 29,333 contracts, while Sept. 30 calls at 3,230 rose by 29,373 contracts. The spike in open interest was the result of a put spread where a trader bought the 2,930 and 2,465 puts and sold the 3,215 calls, based on data provided by Trade Alert.

The trades would suggest that an institution is betting that the S&P is below 2,930 before or by the expiration date. It also assumes that the index is not above 3,215 by the expiration, after selling the calls. Overall, this is a bearish bet and suggests that the index will fall from its current level of roughly 3,130. It is also possible that this trade is part of a strategy through which an institution is trying to hedge its portfolio against a significant drawdown in the S&P 500 over the next three months.

Volatility to Spike

Separately, there was a substantial increase in VIX options trading as well. Open interest for Aug. 19 70 calls by roughly 9,138 contracts on July 1, while open interest for Sept. 16 calls at 80 and 85 rose by 10,512 and 15,294, respectively.

VIX options data shows these calls were bought, meaning the owner, or owners, believe the VIX will trade at, or above, 70 by the expiration date, up from its current level of around 27. It is effectively a bet that volatility will increase dramatically over the coming couple of months, and that could mean that the equity markets drop.

The VIX has only ever traded above 70 during two periods in its near-30 year history—during the depths of the 2008/2009 financial crisis and in March this year, as the spread of coronavirus began to accelerate across the United States.

Risks on The Horizon

There are plenty of reasons for a trader or institution to place these bearish bets or protective positions, especially given the significant advance in the S&P 500 off the March lows and that it currently trades at around 20 times 2021 earnings estimates, marking a historical high.

Additionally, coronavirus cases are once again on the rise, and despite many states reopening and businesses generating jobs. There are plenty of risks; as cases rise, states are now taking measures to try and control the spread of the virus. Investors may well be hedging against the prospect of more restrictions being imposed to slow the spread of the virus that could hamper the economic recovery.

Either way, the S&P 500 has had a fantastic move higher in the second quarter, and a pullback, along with some volatility, isn’t only natural, but it may be healthy for the long-term viability of the recovery.