Keynes once said that markets can stay irrational longer than you can stay solvent.

I love this quote because it speaks about the power of narratives, and my humble adaption of that would be:

‘‘Narratives can dominate macro longer than you can remain solvent’’.

This is why today we are going to cover the two strongest narratives out there:

- China is doomed;

- AI is the new revolution and US tech will dominate forever.

The two narratives are visualized in one simple chart:

To understand what’s going on in China, we need to take a small step back.

Why Have Chinese Markets Been in a Free Fall?

The Chinese stock market has been pretty much in a free fall despite regular attempts from authorities to stabilize markets.

In the meantime, the real estate market continues to suffer and Chinese policymakers are grasping at straws trying to stimulate the economy.

To understand what’s going on in China we need to talk about the concept of balance sheet recession.

A balance sheet recession is a toxic economic loop where after being burnt by deleveraging and lower asset prices households and corporations refuse to take in new credit and focus on just repaying their debt and shrinking balance sheets.

That causes a vicious loop of further deleveraging, lower asset prices, and lower economic activity which can’t be stopped with lower interest rates.

Let's first quickly cover how our credit-based system works in normal times.

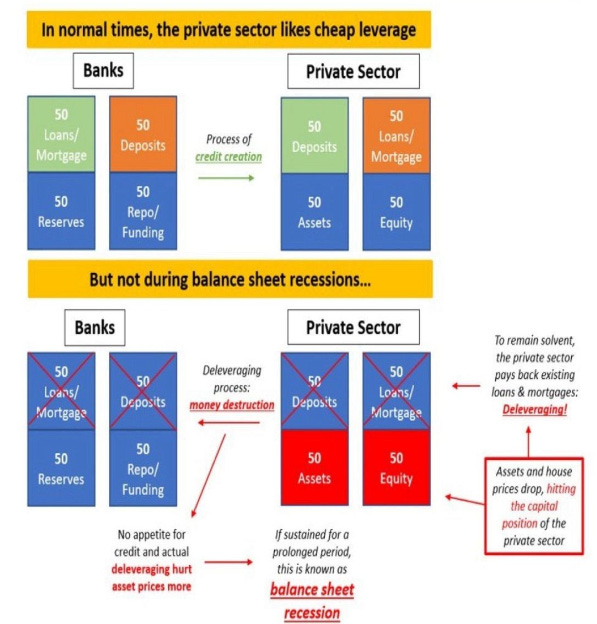

The top part of the chart above shows what happens then:

- The private sector likes (particularly if cheap) leverage and so lending activity is robust;

- Banks make new loan/credit, hence new real-economy money is created;

- That pushes economic growth and asset prices higher.

But what happens during balance sheet recessions (bottom part of the chart) instead?

- After Xi’s clampdown house prices started to drop hence hitting the capital position of highly leveraged Chinese households;

- No softening of this stance and continued weakness in the housing market led developers and households to a rush to stay solvent: pay back your loans/mortgages as fast as you can – deleveraging in motion.

- Lack of new credit plus actual deleveraging hits house prices and asset prices further in a vicious loop also known as balance sheet recession.

How do you structurally fix a balance sheet recession, and is China moving in the right direction?

For sure you can’t fix it by lowering interest rates and Japan shows us why.

In the early 1990s, the Japanese real estate bubble burst and the world’s most famous balance sheet recession unfolded – the BoJ lowered and kept rates to 0% for decades after and nothing happened.

When you hit corporates and consumers’ balance sheets hard through a deleveraging process, asking them to take on…more credit isn’t going to work even if interest rates are low.

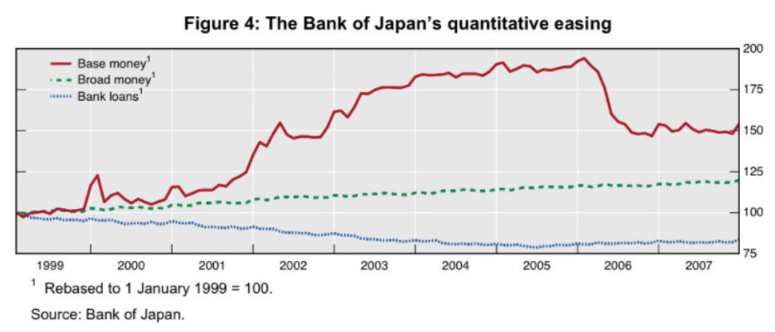

For instance, between 1999 and 2007, interest rates in Japan were mostly at 0% and the Bank of Japan was doing QE (red line) but Japanese banks couldn’t expand any credit to the real economy (blue line).

Despite 0% interest rates, bank lending actually contracted.

The PBoC can cut rates further but that’s not going to do much.

The best chance to stop a balance sheet recession is through targeted fiscal stimulus.

Exactly like the US did in 2009 and in a stealthy way ever since the Chinese government can step in and use its balance sheet to throw fresh resources at troubled real estate developers and households.

It’s basically a capital injection that stops the bleeding and allows the private sector to repair their balance sheets over time.

The problem is that China isn’t doing fiscal, or even seriously considering it so far.

Chinese asset valuations are getting cheaper by the day, but China needs a serious fiscal backstop to prevent a more serious balance sheet recession to convince investors that the worst is behind.

Today, investors can be instead easily convinced that AI will be a human revolution and that there is no high enough price to buy stocks like NVIDIA (NASDAQ:NVDA).

NVIDIA trades at >30x price-to-sales ratio, and it is now apparently worth more than the Canadian GDP or the entire Chinese H-shares market.

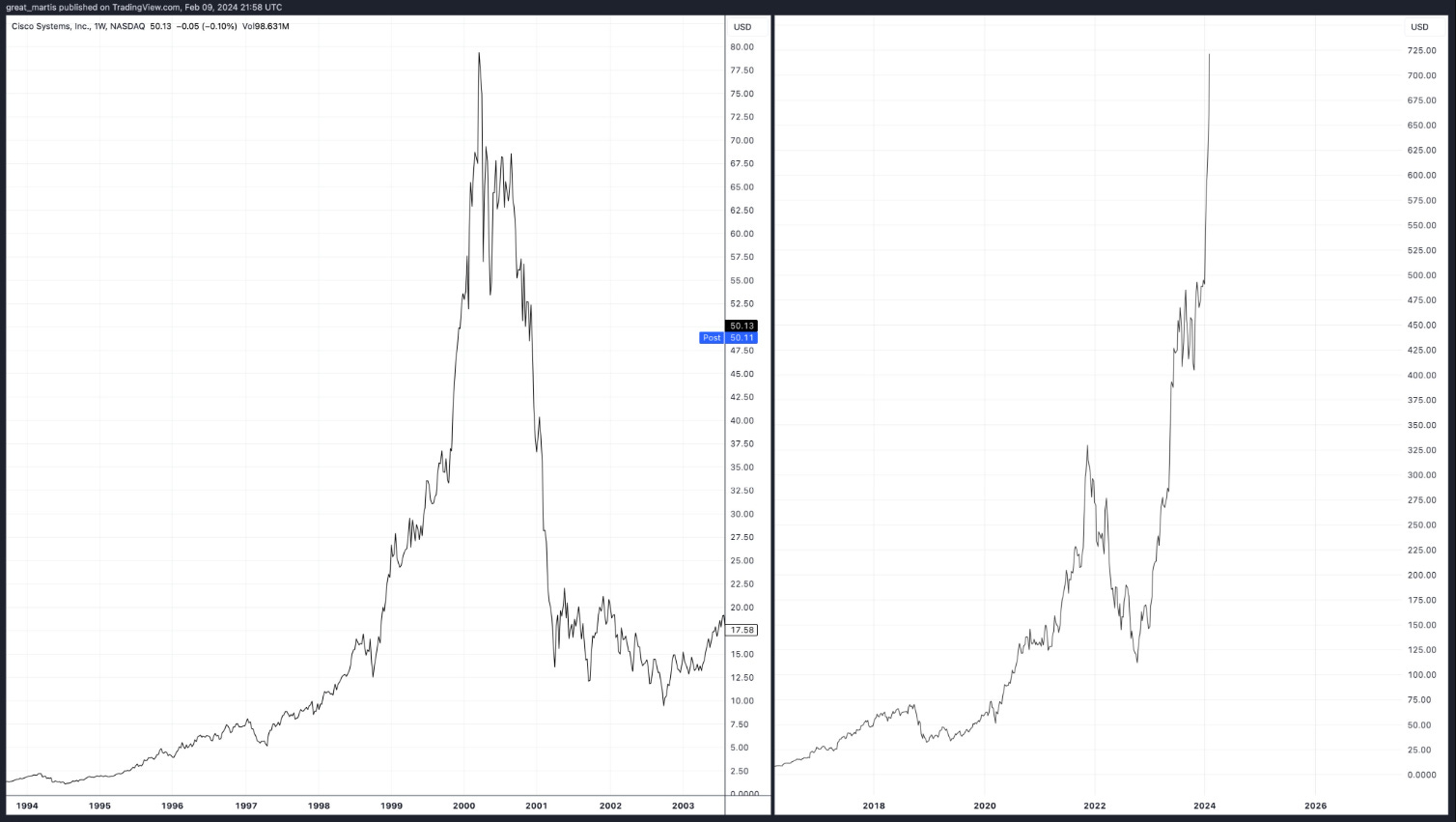

The NVIDIA chart looks a lot like the CISCO chart in 1999-2000, and it makes you wonder whether we are at extreme euphoria given the parabolic move higher:

The other side of the coin is that NVIDIA is a very profitable company that’s growing aggressively: its free cash flow (FCF) per share keeps increasing, and some analysts are expecting it to deliver $100 bn+ of FCF over the next few years.

This assumes NVIDIA won’t get any proper competition down the road:

I won’t even pretend to be a stock analyst and therefore I have no opinion on NVIDIA, but there is a big lesson to be learned here.

‘‘Narratives can dominate macro longer than you can remain solvent’’.

Shorting the tech bubble in the first half of 1999 would have probably wiped you out before being able to profit from the sharp downturn in dot-com stock prices.

Momentum is very powerful, and being early can be akin to being wrong.

Buying Alibaba (NYSE:BABA) at $76 in early December looked great ex-ante with a cheap 10x P/E for a tech company - yet three months later it trades at $72.

In a balance sheet recession, assets are indiscriminately sold to repair balance sheets.

If you are looking to fade extreme narratives without getting quickly wiped out, options can be an interesting way to do that.

A long call or a long put option has a fixed, limited downside (the option premium) but a potentially large upside.

The trick here is that this doesn’t come for free: you are often charged for the luxury to ‘‘sleep at night’’ through expensive implied volatility baked in option prices.

Additionally, options bring in another dimension: time.

If you buy 1 month NVIDIA puts you have to be right quick, not in 3 months.

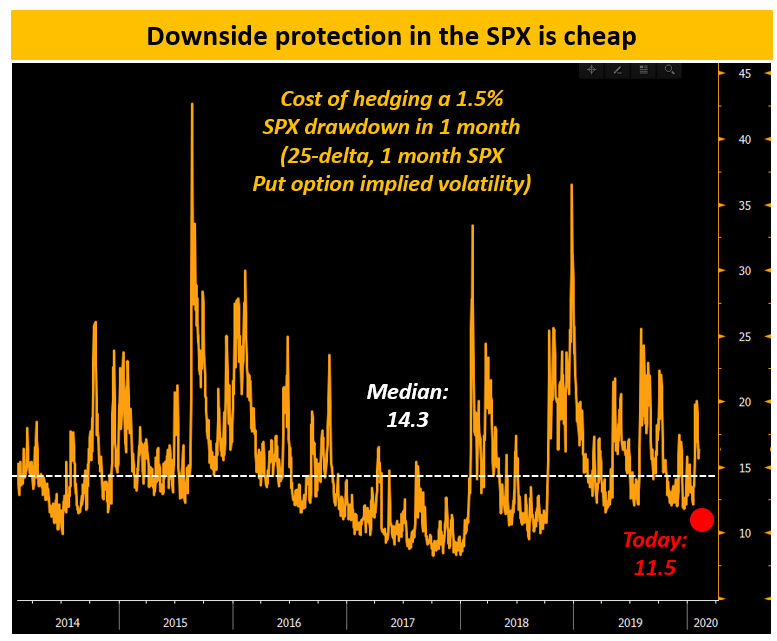

Today, the cost to hedge a mere 1.5% drawdown in the S&P 500 over the next month is low: at 11.5% implied volatility, it sits on the low side of the pre-pandemic range.

That doesn’t mean this hedge will necessarily make money, but it means your ex-ante odds are not bad.

As a friend would say: hedge when you can, not when you must.

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.