- Beyond Meat has slashed its revenue outlook as shoppers find plant-based options expensive

- McDonald's Corp last month decided not to go ahead with a broader launch of Beyond Meat burger

- There is limited visibility on BYND’s path to growth if Americans aren’t liking the taste of its plant-based meat

Once a Wall Street darling, Beyond Meat Inc (NASDAQ:BYND) seems to be in survival mode these days. The maker of plant-based meat is cutting costs and preserving cash as it struggles to increase sales in a highly challenging environment.

The share price of the El Segundo, California-based company shows how swift that fall from grace has been. BYND made its public market debut in May 2019 at $25 a share, becoming the world’s first vegan meat alternative to list on the U.S. stock market. Within two months, its stock soared to $234, giving the company a $14 billion valuation when its yearly sales were just $87 million.

It’s pretty much been downhill from there, however. The stock has fallen more than 80% since reaching that all-time high, and the company’s latest quarterly earnings aren’t doing much to soothe investor and analyst concerns about the future.

Beyond Meat cut its revenue outlook for the full year last Thursday, saying that shoppers prefer cheaper animal proteins amid a near four-decade high inflation rate. In a call with analysts, Chief Executive Officer Ethan Brown acknowledged that consumer buying patterns had shifted away from plant-based meat, which sells at a considerable premium.

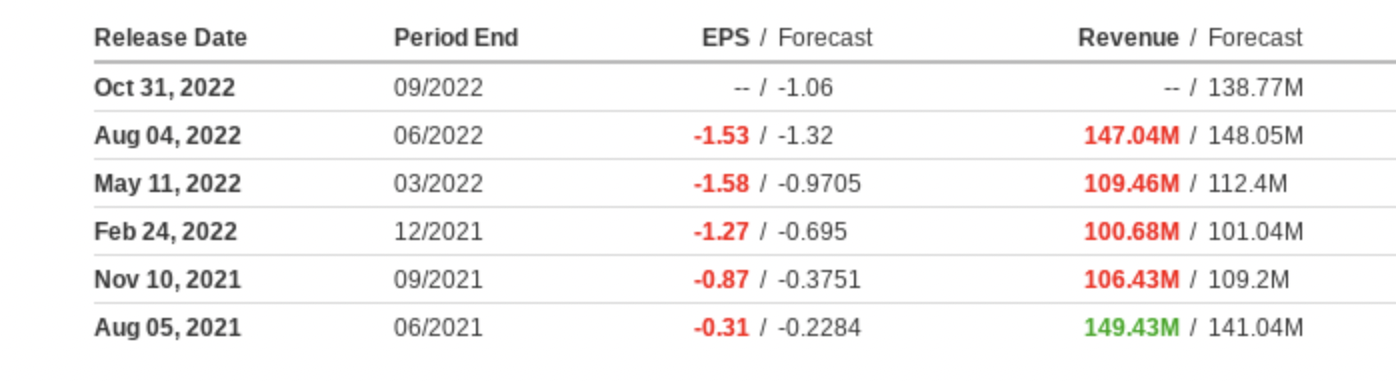

His company now sees sales in the range of $470 million to $520 million for the full year. That’s from the previous range of $560 million to $620 million. Second-quarter sales of $147 million also missed Wall Street’s estimates.

Source: Investing.com

A Myriad Of Challenges

The current inflationary environment, however, isn’t the only factor behind the BYND downfall. The company is facing a myriad of challenges to fuel growth. The biggest one is the company’s struggle to bring new menu items to the market beyond its flagship burgers and sausages.

There are clear signs that American consumers aren’t attracted to plant-based meat options in a big way, a major blow to the company’s forecast that fake meat is a $35 billion opportunity.

McDonald’s (NYSE:MCD) last month decided not to go ahead with a broader launch of Beyond Meat products after concluding its U.S. test of a burger made with plant-based meat on a negative note. Sales for the McDonald’s test have been “disappointing,” according to BTIG LLC analyst Peter Saleh.

Another significant setback is in the multi-billion dollar pizza market, where Beyond Meat promised to bring fake meat in partnership with Pizza Hut, KFC, and Taco Bell. More than a year and millions of dollars later, none of the restaurants has permanently added a faux-meat menu item in the U.S. According to a report in Bloomberg, Taco Bell has yet to test Beyond’s “carne asada” in a single restaurant after the fast-food chain was dissatisfied with samples.

The result of these failures is that the company is now forced to preserve cash and reduce its cash burn rate.

Beyond Meat had $455 million in cash and cash equivalents on hand at the end of the quarter ended July 2, compared to the $548 million it had at the end of the first quarter. The company had $1.1 billion in outstanding debt at the end of the quarter.

In a recent note, analysts at Barclays said that Beyond Meat might have to raise a billion dollars in the coming year, given how fast it is going through cash. Their note also added that there is limited visibility on BYND’s path to recovery, especially when the company’s partnerships take too long to materialize.

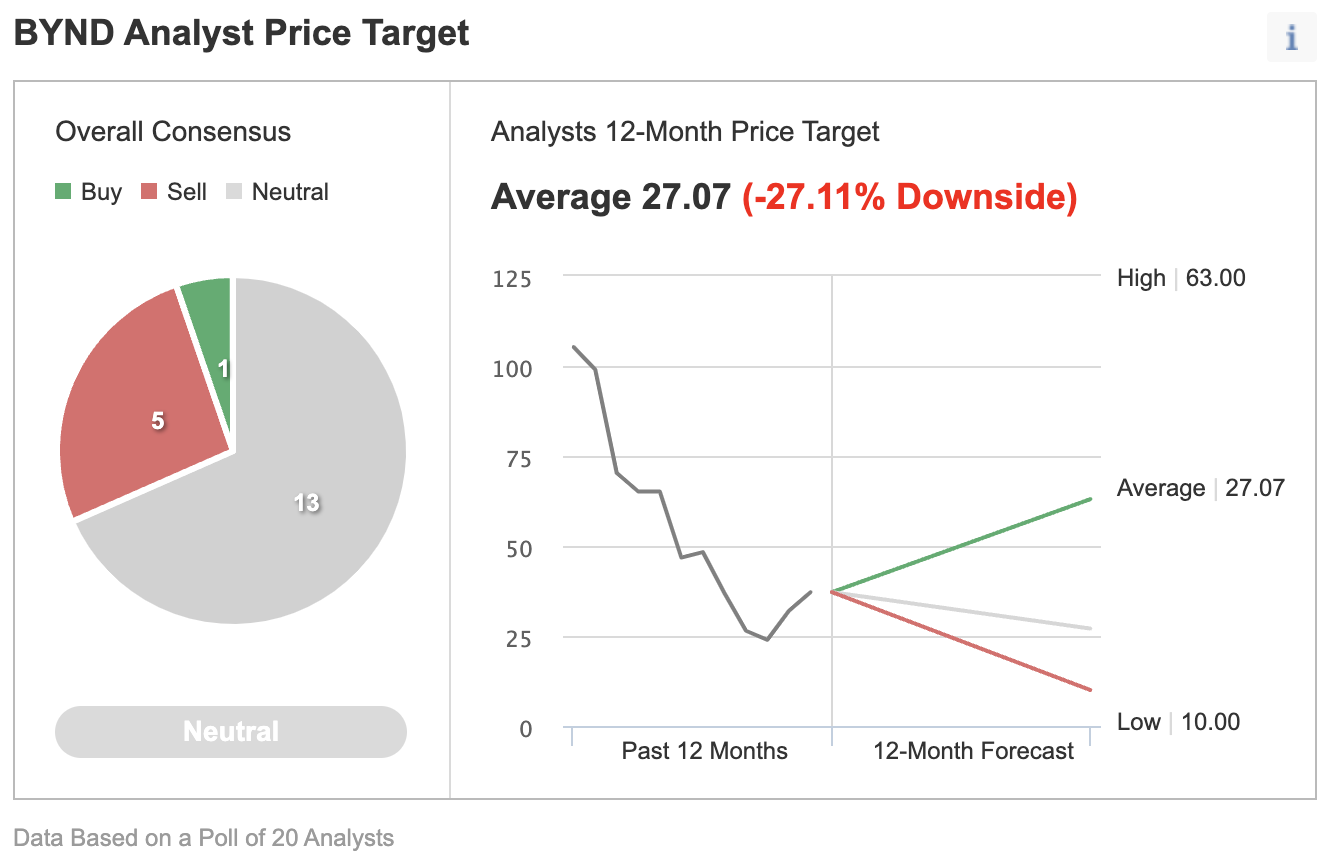

Despite a massive plunge, analysts’ consensus on BYND’s share price shows a further downside risk. In an Investing.com survey of 20 analysts, 13 have a neutral rating, while five recommend selling with a consensus price target that implies a 27% downside.

Source: Investing.com

Bottom Line

Beyond Meat’s growth story is becoming hard to believe when its sales are falling, labor costs are rising, and the partnerships with global food chains aren’t producing the desired results. BYND needs a major turnaround to attract investors again.

Disclosure: The writer doesn’t own BYND stock.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »