While much of the current U.S. Equity market run-up is attributed to the growing fervor around Artificial Intelligence and semiconductor technology, there are investment opportunities outside of the AI and technology theme that have a compelling track record of performance, namely, companies with stable cash flow and a strong business model that has been maintained throughout various business cycles.

This article will focus on value investing and highlight ETF solutions that reflect this investment style, highlighting their current market performance and why they should be considered by investors at this juncture.

Price is what you pay, Value is what you get

Value investing is an investment strategy that involves searching for stocks or other securities that are considered undervalued based on their intrinsic value. In the context of large market capitalization (large-cap) equities, value investing focuses on identifying and investing in well-established companies with substantial market capitalizations that are trading at prices below their perceived intrinsic value.

Large-cap companies are typically well-known and have a significant market presence; this is reflected in the Russell 1000 Value Index’s fact sheet, as the average market capitalization (dollar-weighted) of companies considered ‘Value, Large Cap’ is $161.253 Billion as of May 2024.

In the context of large-cap equities, value investors may focus on companies that have temporarily fallen out of favor with the market due to factors such as a poor earnings report, industry-specific challenges, or general market pessimism. These investors believe such companies can rebound and offer attractive long-term returns when the market eventually recognizes their true value.

Simply put, the investment strategy seeks to acquire valuable assets when they are momentarily undervalued and hold them until they reflect their fully realized potential.

A look at the current performance of U.S. large-cap value stocks

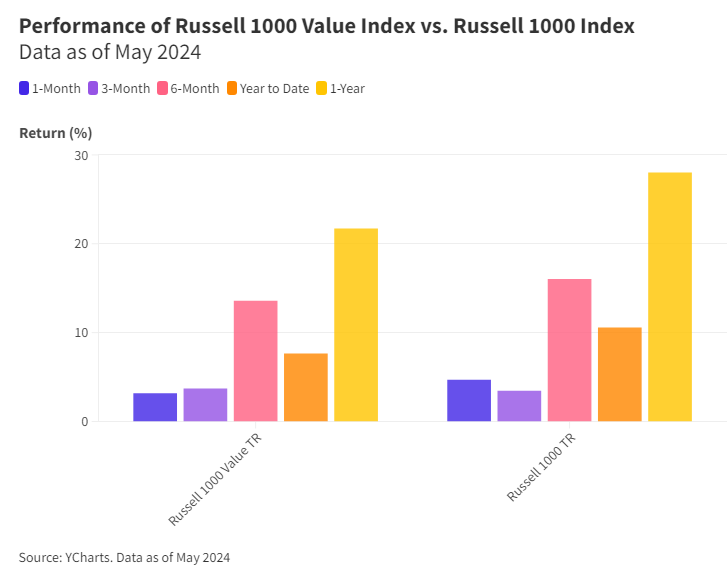

Against the backdrop of an elevated interest rate environment and a U.S. economy exceeding expectations, large-cap U.S. value equities have exhibited compelling returns for the year thus far, as of May 2024.

With U.S. inflation trending downward and expectations of stronger consumer spending in the latter half of the year due to sustained improvements in the labor market and stable spending levels by the business and government sectors, the outlook for the U.S. economy is expected to be better.

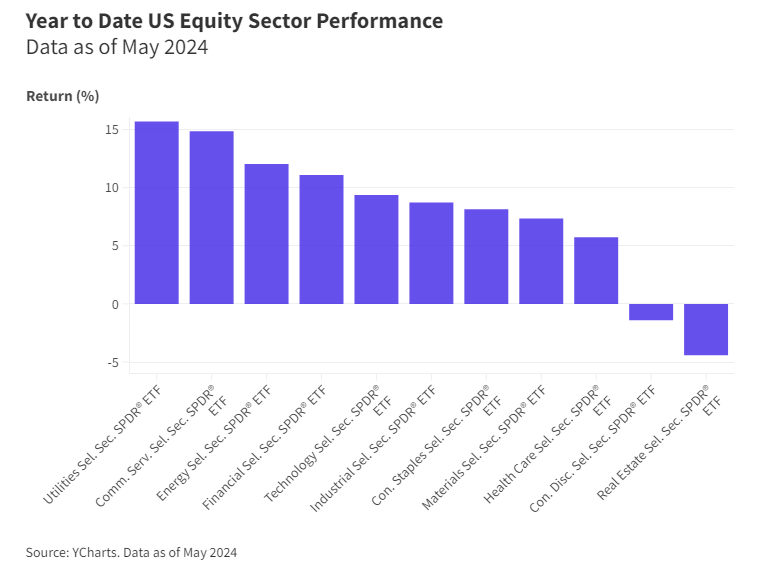

Given that value equities traditionally have more exposure to economically sensitive, cyclical corners of the market, such as Financials, Industrials, Energy, and Materials sectors, their improvement will positively impact the investment style.

3 Value ETFs to for Canadian investors to consider

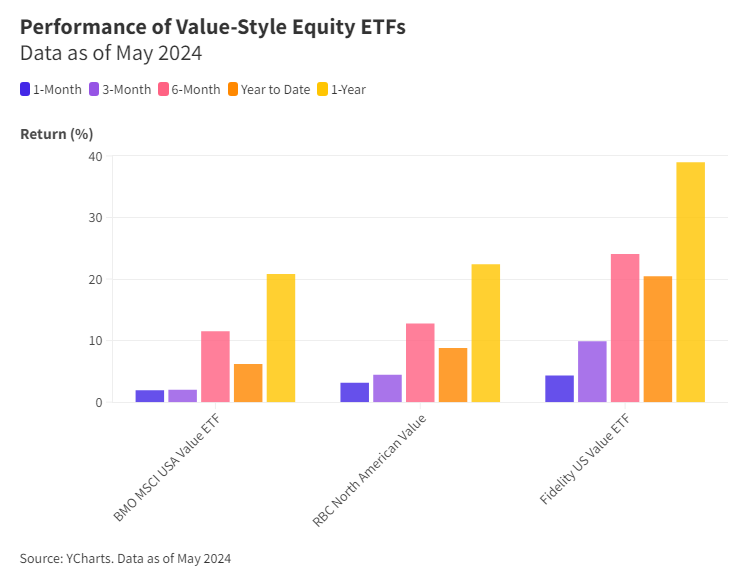

For investors interested in value-style focused investment solutions, the following ETFs provide exposure to large-cap U.S. equities companies and reflect the value investment factor within their investment strategy.

BMO (TSX:BMO) MSCI USA Value Index ETF (Ticker: ZVU) seeks to replicate the performance of the MSCI USA Enhanced Value Capped Index. The ETF invests in U.S. companies with higher value characteristics based on price-to-book value, price-to-forward earnings, and enterprise value-to cash flow from operations. MSCI USA Enhanced Value Capped Index is based on the MSCI USA Index, which includes large and mid-capitalization stocks across the U.S.

RBC (TSX:RY) North American Value Fund (Ticker: RNAV) seeks to identify undervalued quality companies in Canada and the U.S. based on criteria such as assets, earnings, and cash flow. The manager’s active management approach provides for a lower level of volatility than a portfolio of growth companies.

Fidelity U.S. Value ETF (Ticker: FCUV/FCVH) seeks to replicate the Fidelity Canada U.S. Value Index, which primarily invests in equity securities of large- and mid-capitalization U.S. companies that have attractive valuations. Stocks are selected for low prices relative to fundamentals based on four factors: (i) free cash flow yield; (ii) EBITDA to enterprise value; (iii) tangible book value to price; and (iv) earnings over the next twelve months to price. A composite factor score is developed and adjusted accordingly with a size factor from these four factors, which in turn is the basis of the portfolio’s formation.

Takeaway

While many investors are firmly focused on growth-oriented opportunities, such as AI and semiconductors, meaningful opportunities remain in other segments of the market. As the U.S. economy gradually improves, companies and sectors commonly associated with value-investing are expected to benefit from the recovery.

In the present, there are value-oriented ETFs that provide exposure to high-quality, well-managed businesses trading at attractive prices. For investors seeking exposure to such solutions, the aforesaid ETFs are worth consideration.

This content was originally published by our partners at the Canadian ETF Marketplace.