A crisis is a terrible thing to waste, and with the lost confidence in regional banks being top of mind for many individuals currently, Roundhill Investments has capitalized on this moment with the launch of the Roundhill Big Bank ETF (BIGB), a solution that will solely invest in the largest banks in America.

Regional banks: Assessing the Current Landscape

With the closure of Silicon Valley Bank, Signature Bank, and Silivergate Capital occurring days apart, regional banks across the U.S. are being looked at with greater scrutiny, with many individuals believing it best to withdraw their monies than take the risk of it being inaccessible to them. Though emergency actions have been taken by U.S. banking regulators to assuage concerns and stem contagion, many individuals are still wondering if the worst is ahead.

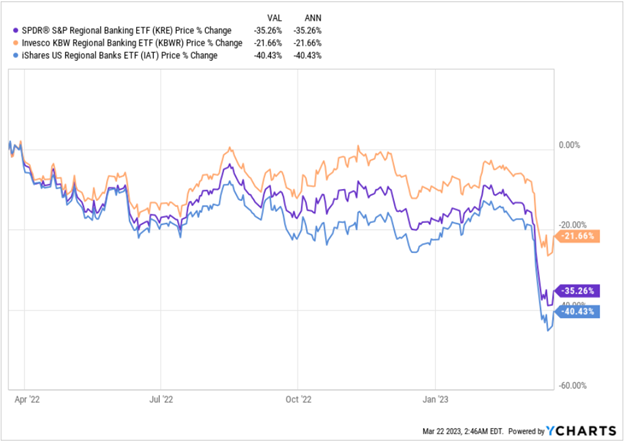

From an investment standpoint, prominent regional banking ETFs are reflecting the despondent sentiment that is present around the sector, as their recent performance has fallen precipitously.

Large Banks: Capital and Confidence

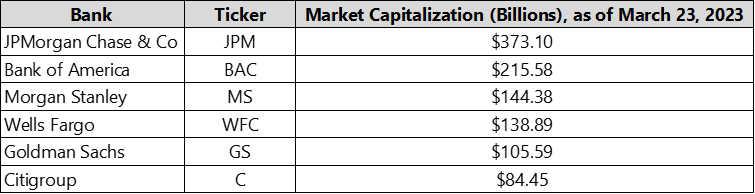

Though the immediate value proposition of large banks are the varied services they may provide to customers, their greatest offering – albeit implicit – is the surety and confidence they engender due to their size and scale of operation. As we all learned in 2008/2009, they are Too Big To Fail, literally. The Big 6 banks, namely, JP Morgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), and Wells Fargo (NYSE:WFC) are among the financial institutions considered Globally Systemic Important Banks (G-SIB), in that, their failure would result in widespread financial implications.

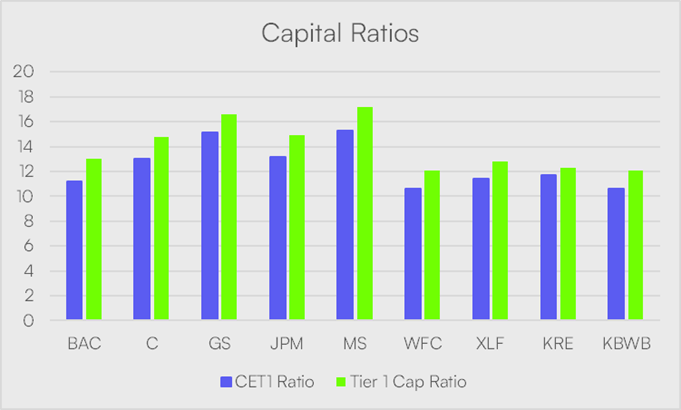

As a result of this designation, banks of this magnitude are required to meet capital adequacy thresholds greater than their peers. In assessing the capital adequacy of banks, the following ratios are frequently referenced: Common Equity Tier 1 (CET1) and Tier 1 Capital.

Common equity tier 1 (CET1) capital, which was instituted by the Basel III regulations and set at a minimum of 4.5%, is the highest quality of regulatory capital, as it absorbs losses immediately when they occur. Additional Tier 1 capital, which makes up the rest of Tier 1 not included in CET1, is made up of capital that absorbs losses before the bank goes under. The average CET1 ratio of the big six U.S. banks was 13.1 at the end of 2022 and their total tier 1 capital ratios were 14.8. This compares favorably to the average capital ratios of the Financial Select Sector SPDR ETF(NYSE:XLF), SPDR S&P Regional Banking ETF (KRE), and Invesco KBW Bank ETF (KBWB).

Source: Roundhill Investments, Bloomberg. March 2003

Simply put, big banks provide a measure of safety – relative to their regional peers -that is attractive at this immediate juncture.

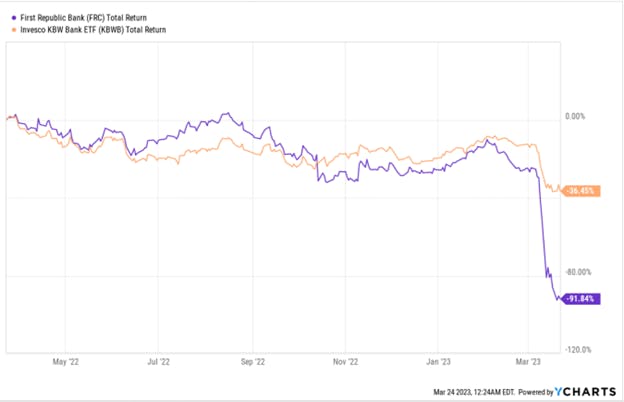

Continued Vigilance of Large U.S. Banks

Though uncertainty remains regarding the regional banking sector, large U.S. banks are doing their part to maintain stability. First Republic, the most recent bank experiencing deposit flight and a significant drop in equity performance received support from 11 banks -which included the Big 6 - as they announced plans to shore up the bank with $30 billion of total uninsured deposits. As stated in their joint press release “The actions of America’s largest banks reflect their confidence in the country’s banking system. Together, we are deploying our financial strength and liquidity into the larger system, where it is needed the most”.

The ability of large banks to act as ballast during this turbulent time is instrumental not only to the banking sector – but to society at large.

As the developments in the U.S. banking sector continue to unfold, for investors looking for safety in the banking sector – Roundhill’s Big Bank ETF (BIGB) offers them the opportunity to invest in the largest banking institutions, that are most capable of weathering this turbulent period.

This content was originally published by our partners at ETF Central.