- David Einhorn's Greenlight Capital has outperformed the S&P 500 with a 42% return over the past three years.

- The fund's largest holdings, Green Brick Partners and Consol Energy are key to its success.

- Green Brick Partners' strong quarterly results and promising fundamentals could continue to boost the fund.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

David Einhorn, a prominent figure in the financial world, has built a reputation through his high-profile critiques of companies like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Allied Capital, and Lehman Brothers, the latter of which collapsed shortly after his July 2007 speech.

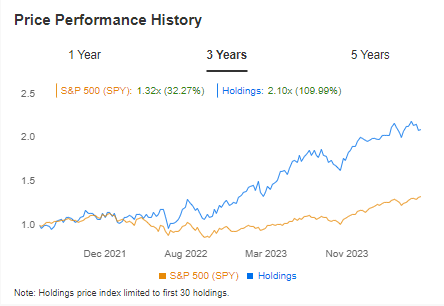

With a net worth of $1.5 billion, the controversial billionaire manages Greenlight Capital, which has delivered a robust return of just over 42% over the past three years, outperforming the S&P 500.

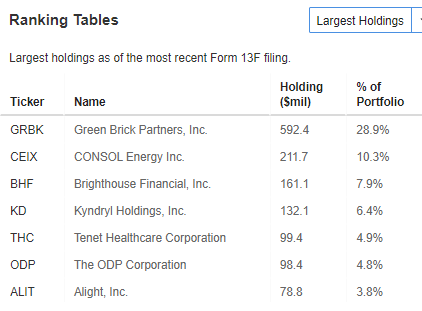

Greenlight Capital's largest holding is Green Brick Partners (NYSE:GRBK), a construction company operating primarily in the southwestern United States, which comprises 28.9% of the fund's portfolio.

This investment is central to the fund's performance, with prospects for continued growth in Green Brick's share price. The fund's second-largest holding is Consol Energy (NYSE:CEIX), making these two companies pivotal to Greenlight Capital's overall return.

According to the mandatory F13 report for mutual funds managing over $100 million, Greenlight's strategic positions in Green Brick Partners and CONSOL Energy (NYSE:CNX) are crucial drivers of its success.

Source: InvestingPro

The fund demonstrates impressive performance, having outpaced the S&P 500 over the past three years, making it a solid choice for investors seeking strong returns.

Source: InvestingPro

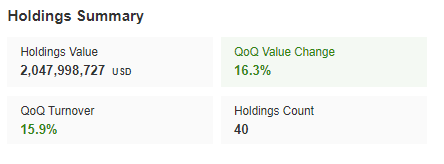

Quarter-over-quarter returns reveal a marked increase in both the rate of return and the overall value of the stock portfolio, now exceeding $2 billion.

Source: InvestingPro

The fund stands a strong chance to continue its upward trend, largely influenced by Green Brick Partners Inc.'s performance.

Green Brick Partners: Worth a Punt?

The construction company recently delivered impressive quarterly results that surpassed expectations, reinforcing a positive outlook for its stock.

Green Brick Partners Inc. reported earnings per share and revenue that significantly exceeded forecasts, bolstering investor confidence.

Additionally, the company recorded 1,071 new home orders in the first quarter, the second highest in its history, and achieved a cancellation rate of just 4.1%, the best in the industry.

These robust metrics provide a solid foundation for further stock price growth.

Source: InvestingPro

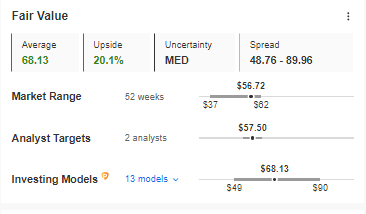

From a fundamental perspective, the InvestingPro fair value index indicates that Green Brick Partners Inc. has more than 20% upside potential, underscoring the company's promising prospects and potential to sustain the fund's upward trajectory.

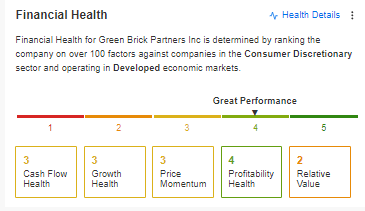

The company's financial health, rated at 4 out of 5 points, showcases its solid performance and rising net profits.

Source: InvestingPro

Yesterday's inflation readings and the Federal Reserve meeting had a positive impact on U.S. indexes. This, combined with the company's robust fundamentals, strengthens the case for the bulls to maintain control in the near term.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.