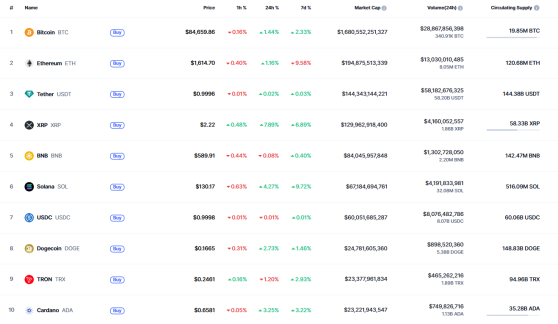

U.Today - The week is ending bullish for most of the coins, according to CoinMarketCap.

BTC/USD

The price of Bitcoin (BTC) has risen by 1.44% over the last 24 hours.

Despite today’s rise, the rate of BTC is looking bearish on the hourly chart. If a breakout of the local support happens, the accumulated energy might be enough for a move to the $84,000 mark.

On the bigger time frame, the price of the main crypto is far from the key levels. If buyers want to restore the lost initiative, they need to restore the rate of BTC above the resistance of $88,772.

In that case, the accumulated energy might be enough for a test of the $90,000 zone and above.

From the midterm point of view, traders should focus on the weekly candle closure. If it happens near $88,000 and with no long wick, the upward move is likely to continue to the $90,000-$92,000 range.

Bitcoin is trading at $84,496 at press time.

This content was originally published on U.Today