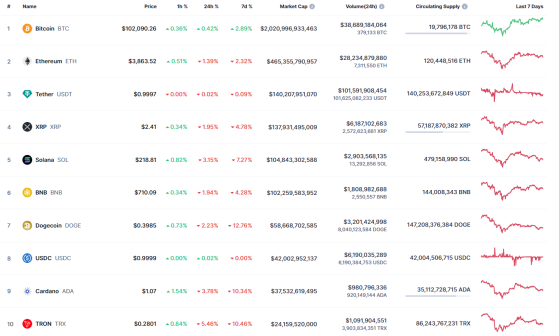

U.Today - Bears remain more powerful than bulls on the last day of the week, according to CoinMarketCap.

BTC/USD

The rate of Bitcoin (BTC) has increased by 0.42% since yesterday. Over the last week, the price has risen by 2.89%.

On the hourly chart, the price of BTC is trading sideways, which means neither buyers nor sellers are dominating. The volume has dropped, confirming the absence of bulls' and bears' energy.

All in all, consolidation in the narrow range of $101,600-$102,600 is the more likely scenario by tomorrow.

On the bigger time frame, the rate of the main crypto has made a false breakout of yesterday's bar peak of $102,638. If the daily closure happens far from that mark, one can expect a local correction to the $101,000 zone.

From the midterm point of view, the rate of BTC is far from the main levels. In this case, traders should focus on the candle closure in terms of its current peak. If it happens around the current prices, there is a chance of a test of the $104,630 level next week.

Bitcoin is trading at $102,019 at press time.

This content was originally published on U.Today