As we near the two-month mark of 2023, Canadians may notice that their stock/ETF investments have improved from a sobering year of returns in 2022. This is likely more pronounced for investors who have decided to weather the storm and hold more “risky” assets – including innovative tech stocks, blockchain, and especially crypto-based ETFs.

In this article, we delve into the winning Canadian ETFs so far in early 2023, possible reasons for their outperformance, and consider whether this rally is sustainable.

Risk plays are off to a hot start

Three of the hottest ETFs in Canada to start the year are:

3iQ CoinShares Bitcoin ETF (BTCQ.U)

This Canadian-listed ETF provides direct exposure to bitcoin—the most widely held cryptocurrency. BTCQ.U tracks the daily price movements of the U.S. dollar price of bitcoin. The ETF is off to an extremely strong start to the year, up 44% YTD.

CI Galaxy Bitcoin ETF (BTCX.B)

Following a similar theme, CI Galaxy’s Bitcoin ETF gives investors exposure to bitcoin. However, in contrast to BTCQ.U, CI’s BTCX.B provides Canadians with exposure to the Canadian dollar price of bitcoin. This ETF has performed similarly to BTCQ.U, up 44% YTD. We would note that the only variance between returns of BTCQ.U and BTCX.B would be the foreign exchange rate between the U.S. dollar and Canadian dollar—with BTCQ.U outperforming when the U.S. dollar appreciates and vice-versa.

Fidelity Advantage Bitcoin ETF (FBTC)

Surely you are noticing a common theme in the best performers this year. Fidelity’s Advantage Bitcoin ETF (FBTC) also provides direct exposure to bitcoin and is up 44% YTD.

All three of the aforementioned ETFs provide direct exposure to bitcoin, however Fidelity’s offering is the most cost-effective ETF. BTCQ.U has an expense ratio of 1.13%, BTCX.B has an expense ratio of 0.45%, and FBTC has an expense ratio of 0.40%.

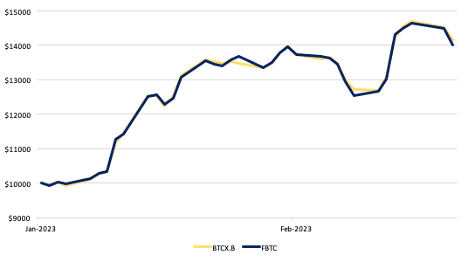

Hypothetical growth of $10,000 invested in BTCX.B and FBTC from the end of 2022

Source: Yahoo Finance. Note: BTCQ.U’s latest pricing data is unavailable on Yahoo Finance and thus was omitted.

Reasons for the outperformance

Crypto assets saw the lowest of lows in 2022 as confidence in their investment potential was shaken by a number of factors, none more controversial than FTX’s implosion at the tail-end of the year. This likely led to an excess in bearish sentiment and a large amount of selling/shorting pressure.

In addition, there are also some macro-factors at play. Thus, we can boil this crypto rally down to a few key potential drivers fueling the trend.

Short Squeeze

Short squeeze, a term made mainstream by the Reddit craze in early 2021 sent various “meme-stocks” and retail investors into exuberance.

Short squeezes tend to occur when a security is heavily shorted, meaning that investors are betting that it will decrease in value. If these securities begin to increase in value rapidly, the short-sellers must cover their position (which is done by buying the security back on the open market), leading to increased upwards pressure.

Shorting was prominent late in the year as institutional investors had serious gripes relating to cryptocurrencies’ resiliency in the long term.

Macro Factors

2022 was a year with very high macro uncertainty. Not surprisingly, investors piled into “safer” investments as opposed to those with highly speculative return profiles like crypto assets. High inflation, rising interest rates and fears of a deep recession dominated headlines thus sending the market into a downward spiral.

The macro-outlook is far more optimistic today than it was at any point in 2022, and this is reflected in the returns of risky investments such as speculative stocks, blockchain and cryptocurrencies.

The “January Effect”

The majority of gains reaped by Bitcoin were in the first month of the year and since then, returns have held flat.

There is a phenomenon that stock markets tend to outperform in January. This is rooted in a few fundamental reasons. Firstly, institutional investors usually avoid taking excess risk in December as they don’t want any big adverse impacts to close out their funds’ annual performance. On the retail side, investors who maxed out their investment contribution room in December will have increasingly more room in the new year.

This leads to a broad-based market rally, with more volatile investments reaping extra gains.

Does this rally have room to run?

To be clear, it is not only crypto having a strong start to the year. The S&P 500 index is up 5% YTD, and the S&P/TSX Composite index is also up 4% YTD.

While these returns of Bitcoin are certainly eye-popping over the span of two months, it is important to keep in mind that these investments are highly volatile—and their performance could swing downwards very quickly.

Furthermore, crypto ETFs took huge losses throughout 2022, which overshadows this short-term rally. Take BTCX.Bfor example. Although it has increased by ~44% YTD in 2023, it has lost ~62% of its value throughout the entirety of 2022. In order for BTCX.B to get back to where it was at the start of 2022, it would need to increase 80%+ from where it currently sits, even after the 44% rally thus far.

Bottom line: Despite the recent rally, there may be further downside for cryptocurrencies given that the reasons for the run listed above could be short-lived. Short sellers could exit their positions, the macroeconomic sentiment could deteriorate, and the January effect is just that—only in effect within January.

Data as of February 23, 2023.

This content was originally published by our partners at the Canadian ETF Marketplace.