- Historical data suggests recent rallies may be bear market rebounds, not trend reversals.

- ETF outflows and declining realized capital changes indicate bearish pressure.

- Technical analysis shows that BTC/USD remains in a bearish trend.

Bitcoin prices were not spared when President Trump’s “Liberation Day” tariffs set shockwaves through global markets. The policy has been put on hold for a majority of countries, but the ongoing China-US stalemate has kept volatility high and market participants on edge.

Bitcoin rose around 6.6% on Wednesday to trade back above the psychological $80000 handle as President Trump announced a pause to tariffs.

The announcement was a 90-day pause on new tariffs for more than 75 countries, except China, has been announced. Investors saw this as a hopeful sign that the tariff increases might slow down for now. However, President Trump raised tariffs on China to 125%, showing that the trade fight between the two largest economies is far from over.

The question is whether this is another false dawn and a new lower high, or are we in for another bullish rally? Let us take a look at a few signs that may shed some light on Bitcoin's next potential move.

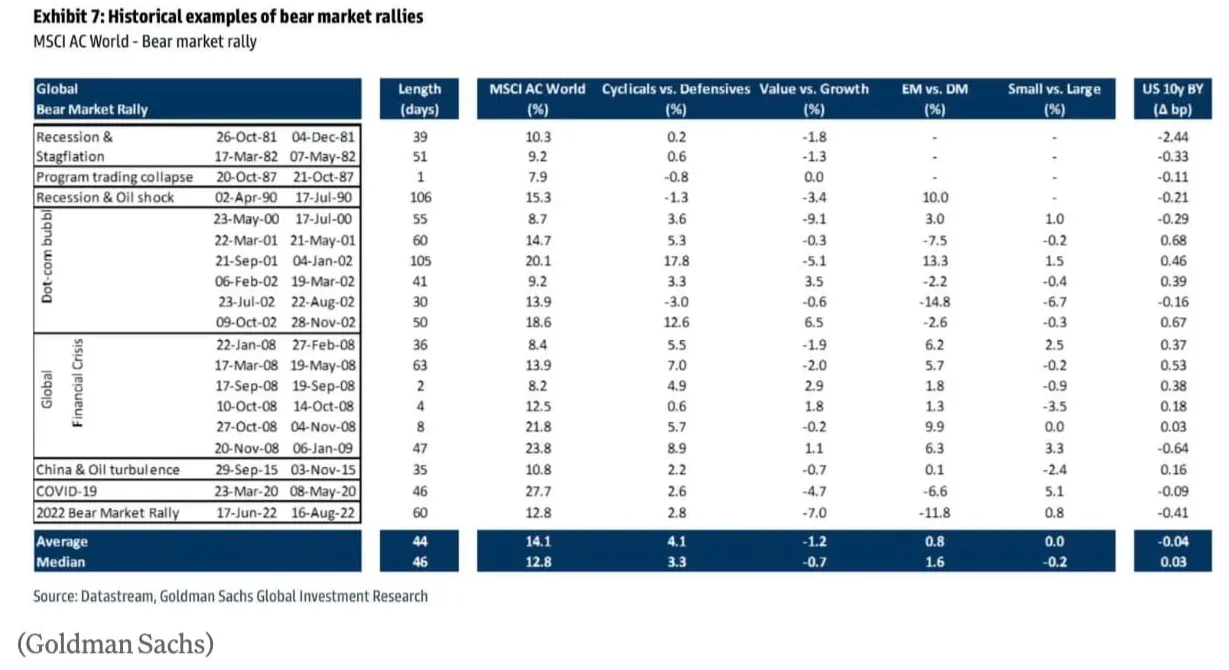

What Do Historical Bear Markets Tell Us?

Many market participants cheered the recent rebound, but experts like those at Goldman Sachs (NYSE:GS) warn that bear market rallies are common and can be deceptive.

Goldman's "Bear Market Anatomy" report shows there have been 19 such rallies since the 1980s, usually lasting 44 days with 10-15% gains, but often followed by bigger drops. Callum Thomas from Topdown Charts shared a similar view, noting that the 1930s bear market had several big rallies before it finally hit bottom. "Is this 90-day recovery just another bear market rally?" he questioned.

Source: Goldman Sachs, Binance

An interesting take and something that market participants need to remain wary of. Until countries begin to sign off on trade deals and we have some movement on the US-China situation, my take is that markets are not out of the woods yet.

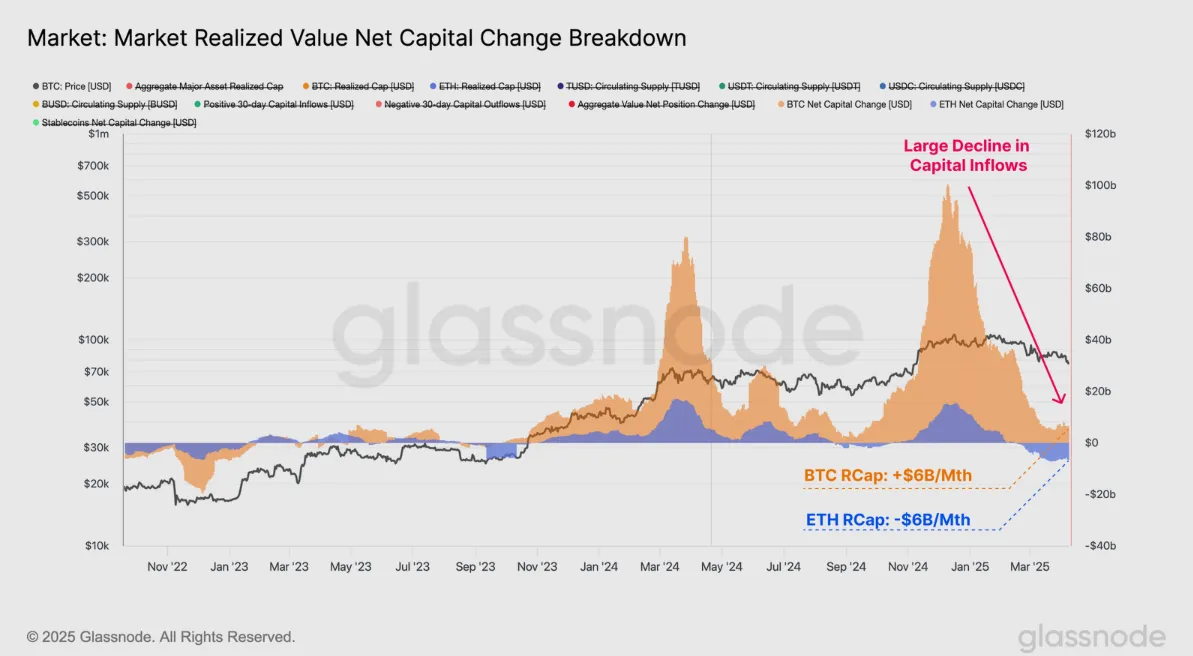

Capital Inflows Have Ground to a Halt

Since the beginning of the year, less capital has been flowing into both Bitcoin and Ethereum. This is shown by the 30-day Realized Cap change, which tracks monthly changes in the total money moving in and out of these assets.

Bitcoin once had $100 billion flowing in monthly, but now that's down to just $6 billion per month. Ethereum, which peaked at $15.5 billion per month, is now losing $6 billion monthly.

For Bitcoin, the slowing inflows suggest fewer new investments are coming in to push prices higher. Meanwhile, Ethereum is seeing money spent at lower prices than it was bought for, leading to a net loss. This makes Ethereum face greater challenges than Bitcoin, which is also reflected in Ethereum's weaker price performance.

Source: Glassnode

Just like the bear market warning above, the decline in capital flows is significant and a warning sign to bulls that the bearish pressure may not be done just yet.

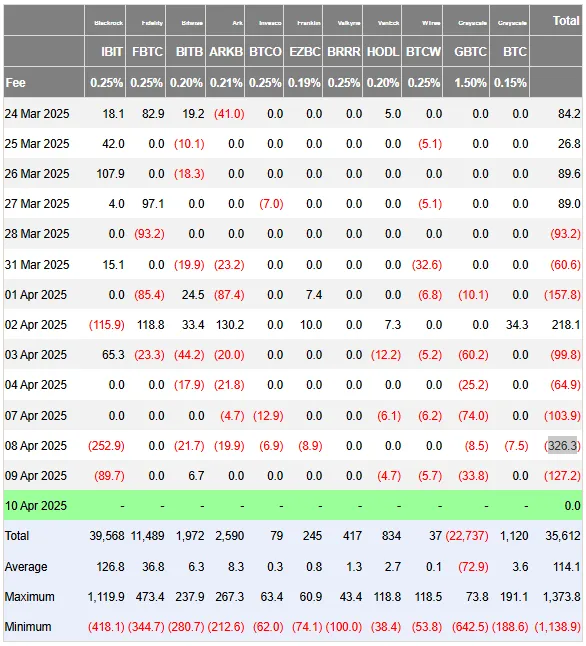

Looking at ETF flows as well, one can see from the table below that ETFs have struggled since the liberation day tariff announcement. However, if we are being honest, ETF flows have been poor since early February with brief spurts of positive flows followed by significant declines.

Since April 2, the Bitcoin ETFs have seen 5 consecutive days of outflows, with the highest amount occurring on Tuesday, April 8, with a print of $326.3 million.

Source: Farside Investors

Glassnode Hints That Seller Exhaustion May Be Starting To Develop. What Does It Mean?

According to research from Glassnode, after the recent sharp market drop, it’s important to look at how investors are reacting, as bear markets often begin with fear and big losses.

By analyzing Bitcoin's realized losses over 6-hour periods, we can get a clearer picture of investor behavior during this downturn.

At its peak, $240 million in losses were recorded in just six hours, matching some of the biggest loss events in this cycle.

However, with each price drop, the amount of losses has gotten smaller. This may indicate that sellers are running out of steam for now at this price level.

The amount of losses is getting smaller with each price drop, which could mean investors are getting used to the lower prices and volatile market conditions. This does not necessarily point to a rally for Bitcoin but rather shows that market participants are expecting such conditions to linger for a while longer.

Technical Analysis - BTC/USD

Bitcoin (BTC/USD), from a technical standpoint on the daily timeframe, remains in a bearish trend. This despite Wednesday's significant bullish engulfing daily candle close.

The recent rise on Wednesday of around 6% failed to take out the previous lower high at 84000 and leaves the world's largest crypto susceptible to further downside.

As you can see from yesterday's daily candle, which is down 4.26% at the time of writing, the bears are not done yet.

The RSI period-14 rejected the neutral 50 level yesterday, another sign that bearish momentum remains very much in play.

Given the dynamics discussed above, a further drop in Bitcoin prices remains on the table with immediate support resting at 78197 and 76000 before the psychological 75000 handle comes back into focus. Below that, we have the 73777, 71935 and 70000 handles to monitor.

A recovery from here needs to record a daily candle close above the 84000 handle for bulls to fully take charge. Beyond that, we have a crucial confluence level around 85000, where the descending trendline and the 50-day MA rest. For now, this seems like a tough hurdle to overcome, and we may need to see some change to market dynamics.

Bitcoin (BTC/USD) Daily Chart, April 10, 2025

Source: TradingView.com

Support

- 76000

- 75000

- 73777

Resistance

- 80000

- 84000

- 85000 (key confluence level)