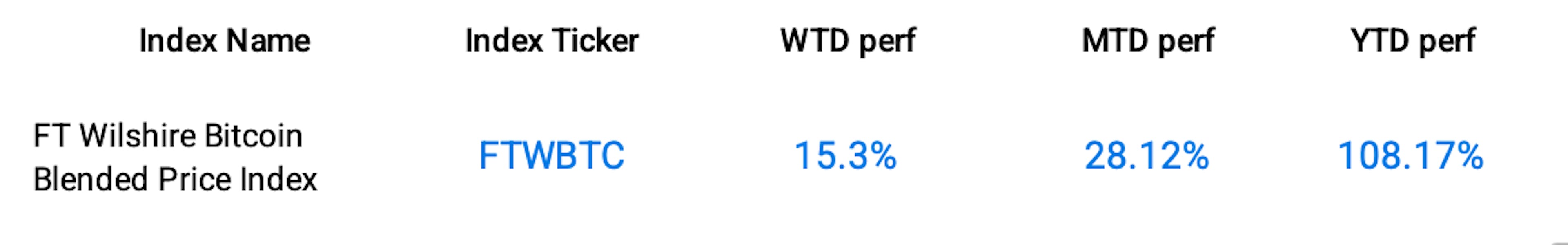

Bitcoin's recent surge - largely fueled by anticipation of the Securities and Exchange Commission (SEC) approving a US spot ETF - is thought to be driving increased global investment in Bitcoin and other digital currencies. On Tuesday, Bitcoin crossed the $35k mark, its highest point in 18 months, before falling back to $34.5k. Despite the minor dip, this still constitutes a weekly growth rate of 13%. The FT Wilshire Bitcoin Blended Price Index also saw an increase of +15.28% over the week, bringing its year-to-date performance to +108.17%.

A key factor contributing to this rise is BlackRock (NYSE:BLK)'s Bitcoin ETF (TSX:EBIT) (IBTC), which has recently appeared on the Depository Trust & Clearing Corporation (DTCC) site – indicating that SEC approval might be imminent. The launch of this fund is eagerly anticipated within US cryptocurrency circles as it would represent the first US spot ETF investing directly in Bitcoin. Currently, crypto funds in the US rely on futures contracts meaning that investors seeking spot exposure often turn to markets like Canada or Europe.

And, in light of the general downturn in financial markets this week, it’s also worth mentioning that some investors are increasingly viewing Bitcoin as a potential safe haven asset during these periods of instability.

Illustrating these trends, the Bitcoin Tracker Euro ETC (BITCOIN XBTE) saw an increase of +16.45% over the week pushing its year-to-date performance up to +122.48%.

Segment Data: Cryptocurrency

Index Data

Funds Specific Data: BTCE, BITCOIN XBTE, BITC, ABTC, WBIT