- Bitcoin's recent correction has hit crypto mining stocks hard.

- These will remain in the spotlight over the coming weeks as BTC halves.

- Should you invest in Bitcoin mining stocks, or is there a better option?

Recent weeks saw a significant drop in the cryptocurrency market, impacting Bitcoin mining stocks heavily. Many of these stocks mirrored Bitcoin's decline.

Although Bitcoin rebounded yesterday as it started moving upwards again, this doesn't erase the overall bearish trend.

However, as Bitcoin seems to have paused its downward trend and has positive prospects due to various bullish factors, the question arises: Are Bitcoin mining stocks wise investments for potential gains from the cryptocurrency's next upward movement, which might lead to new record highs?

In this regard, it's worth recalling that several renowned banks and firms have recently shared particularly ambitious short-term forecasts for Bitcoin, with Standard Chartered in particular citing a target of $150,000 by the end of the year.

What does the future hold for Bitcoin miners ahead of next month's halving?

However, the price of Bitcoin isn't the only factor influencing the price of mining stocks over the coming weeks. Indeed, the next halving of bitcoin takes place next month, which could cause considerable turbulence in the sector.

Halvings occur every 4 years or so and consist of halving Bitcoin miners' rewards for each block mined. In other words, Bitcoin miners will get fewer Bitcoins for the same amount of work.

On the face of it, then, this is bad news for Bitcoin mining companies, but it's more complex than that.

First of all, by halving miners' rewards, halvings also halve the rate of growth in the supply of Bitcoins, with a theoretically mechanically bullish impact, which has been verified in practice during previous events of this type, with BTC rising both in anticipation of and in reaction to these halvings.

However, the question is whether the rise in Bitcoin's dollar price will be sufficient to offset the fall in the number of BTC mined.

In addition, the reduction in the reward for Bitcoin miners means that the least profitable players in the market are likely to disappear, reducing competition, potentially via a concentration in the sector, which would benefit the biggest players, but probably not in the short term.

All in all, although the recent fall in Bitcoin mining shares looks attractive for taking a position, we must also be aware that the next few weeks will be lively and uncertain for this type of stock, due to the upheavals in halving.

We have, however, reviewed the leading names in the sector, namely Riot Platforms (NASDAQ:RIOT), Marathon Digital (NASDAQ:MARA) and CleanSpark (NASDAQ:CLSK), using the InvestingPro analysis and strategy platform, to try and determine which might be the best investment.

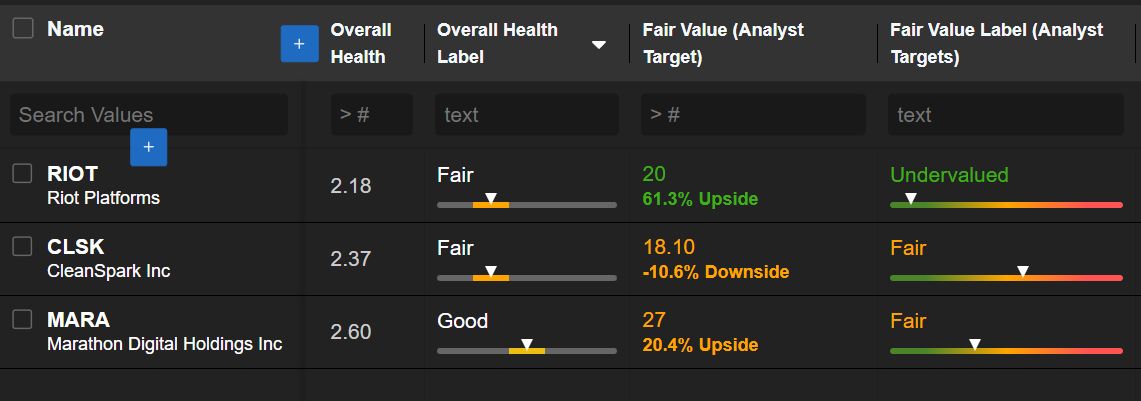

We first assembled a watchlist of these 3 stocks, comparing them in terms of financial health scores and analysts' bullish potential.

Source: InvestingPro

What emerges is that the most undervalued stock according to analysts is Riot Platforms, for which they post an average target of $20, corresponding to an upside potential of 61.3%. On the other hand, it is also the stock on the list with the lowest financial health score.

Marathon Digital has a better financial health score than Riot, but a much lower upside potential of 20.4% according to analysts. Finally, CleanSpark not only has a below-average health score but also a downside risk of over 10% according to analysts.

In other words, Riot would be the bet with the most potential, while Marathon Digital would be the least risky, and CleanSpark should be avoided.

Another stock, selected by our AI, could prove to be a much better bet for betting on Bitcoin via the stock market

However, for investors who want to gain exposure to Bitcoin via the stock market, there is another option besides Bitcoin mining stocks, and one that won't be subject to the turbulence and uncertainties miners will face when halving.

We're talking about MicroStrategy shares, a software company that is making Bitcoin its main strategy for 2020. The company first used its cash, then borrowed heavily to buy as much Bitcoin as possible, so that it is now the world's largest holder of BTC.

Unlike bitcoin miners who face competition from other players in the sector, and have to incur significant costs in terms of hardware and electricity, MicroStrategy simply buys and holds Bitcoin.

As a result, its shares have benefited far more from the rise in Bitcoin than mining stocks, up 130% over the last 30 days, and 145% since the start of the year, a performance that InvestingPro subscribers have been able to take advantage of, as the MSTR stock has been integrated into the ProPicks Titans de la Tech strategy as of December 2023.

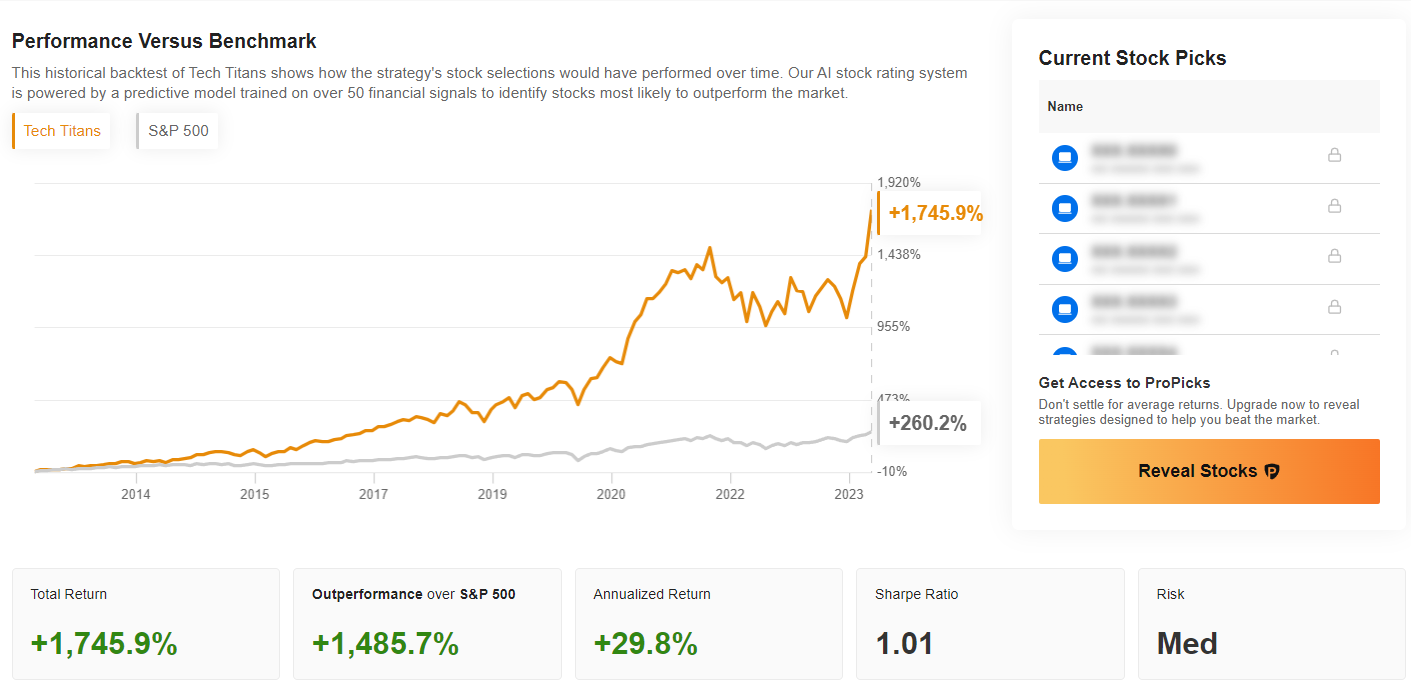

This strategy, offered alongside 5 other thematic portfolios managed by a fusion of AI and human expertise, contains 15 stocks and posted a total performance of 20.8% in February, and is well on its way to doing even better in March!

It is also our best-performing strategy over the long term, having posted a total gain of 1745.9% over the past decade, 1485.7% more than the S&P 500.

Source: InvestingPro

If you're already an InvestingPro subscriber, you can view the ProPicks strategies and get the stock list for each strategy by clicking here.

If you're not already an InvestingPro member, now's the perfect time to remedy the situation, as we're offering a limited-time 10% discount to our readers, thanks to the promo code FRPROPICKS to be entered on the payment page (valid for 1 and 2-year subscriptions).

You'll be able to take advantage of high-performance stock selections, updated monthly on the first day of each month, and therefore easily replicable.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.