Bitcoin surged above $45,000 last Tuesday for the first time in almost two years amid growing optimism surrounding the approval of a spot bitcoin exchange-traded fund, and the escalation in geopolitical tensions in the Middle East with Houthi attacks on commercial vessels.

However, barely a day after reaching the peak, the digital asset experienced a sharp reversal, plunging by up to 9% towards $41,000 and once again reminding investors of the risks associated with investing in cryptocurrencies.

That said, Bitcoin wrapped up the volatile week with a 4% gain, as rumors continue to swirl around the U.S. Securities and Exchange Commission (SEC) giving the green light to a first spot Bitcoin ETF (TSX:EBIT) in the forthcoming days.

Against this bullish backdrop, Goldman Sachs (NYSE:GS) is allegedly in talks to secure its position in the crucial role of "authorized participant" for BlackRock (NYSE:BLK) and Grayscale's bitcoin ETFs, as reported by sources from CoinDesk.

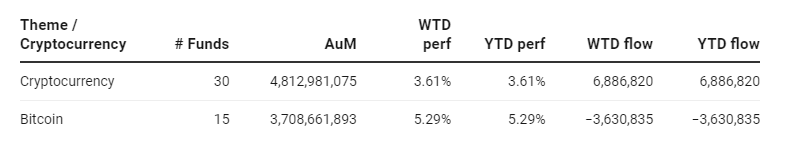

Group Data

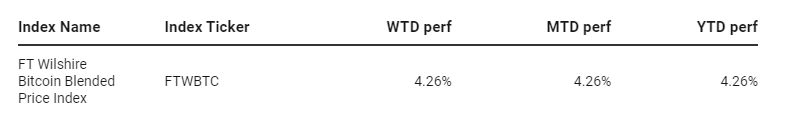

Index Data

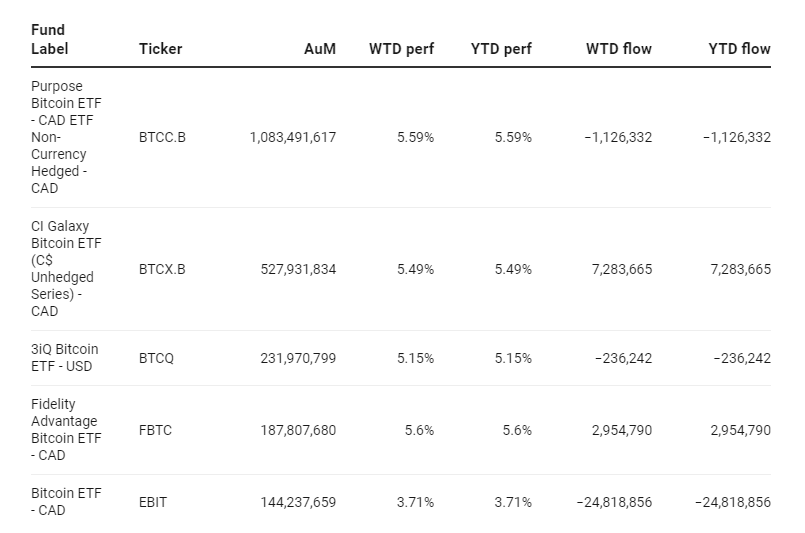

Funds Specific Data