-

Bitcoin's consolidation continues amid a bearish outlook, but technical indicators hint at a possible shift in sentiment.

-

Rising profit-taking expectations and dampened risk appetite have contributed to pessimistic market sentiment.

-

Despite recent corrections, Bitcoin's resilience is evident, especially with emerging demand areas and institutional adoption, setting the stage for potential breakout.

-

Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

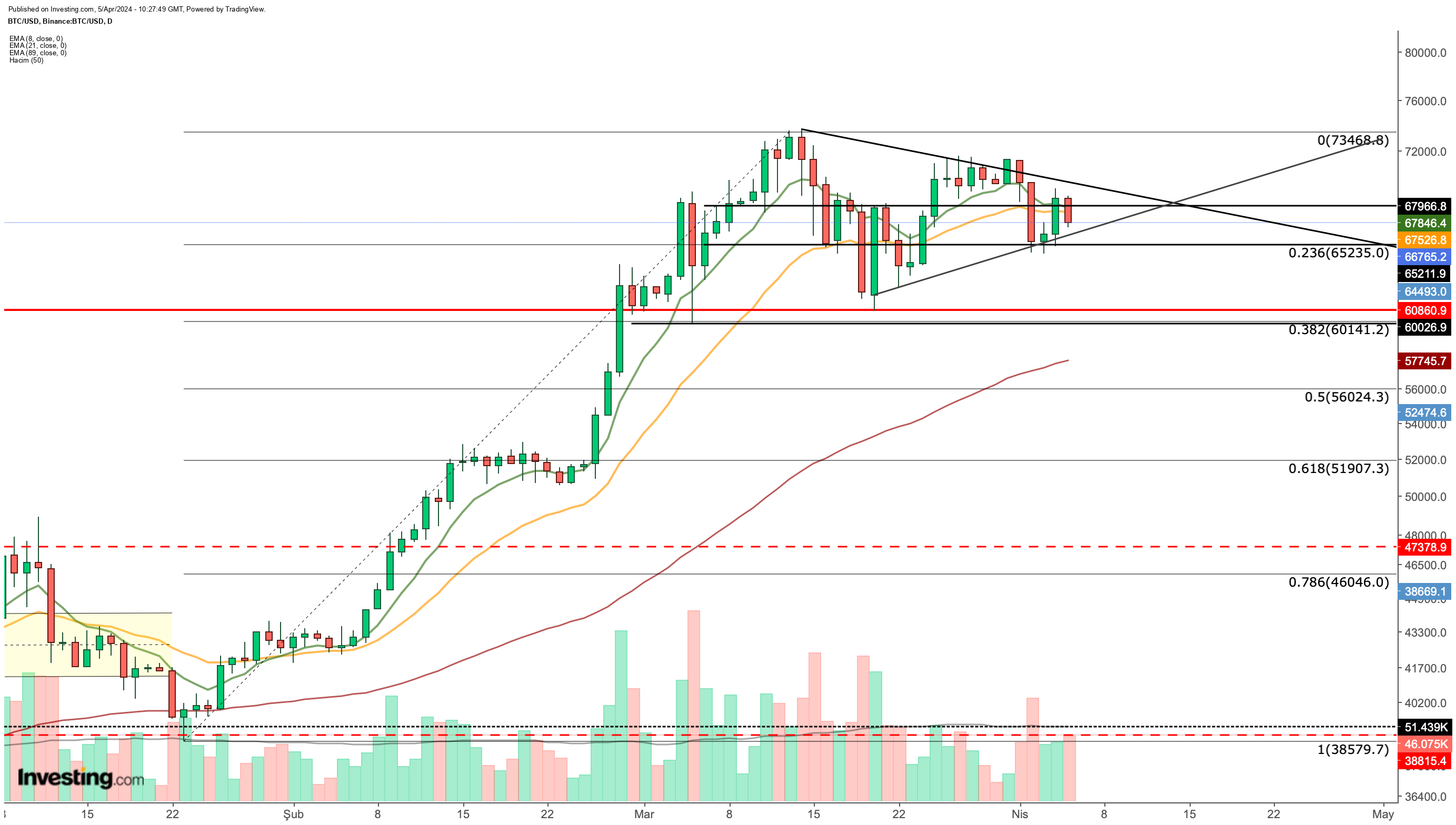

Bitcoin's consolidation phase has entered its fourth week amid a bearish outlook. However, certain technical indicators suggest that the negative sentiment surrounding the crypto might shift soon.

Recently, market sentiment has been pessimistic. Profit-taking expectations have risen due to Bitcoin's rapid ascent in the first half of the year, putting pressure on the cryptocurrency. Additionally, macroeconomic data has dampened risk appetite, impacting Bitcoin's price.

Furthermore, reduced demand for Bitcoin ETFs and the US government's attempt to sell seized BTC have pushed the cryptocurrency below the $70,000 mark, testing levels below $65,000. However, despite this correction, Bitcoin has shown resilience, considering the upward trend observed in 2024.

After testing the $60,000 zone during the March decline, a new demand area has emerged around $65,000 following buying activity at this level.

After March saw the cryptocurrency holding support at Fib 0.382, it faced another round of selling pressure at Fib 0.236, signaling increased resilience against declines.

However, the absence of fresh positive developments stifles new buying interest, leaving ETF investors as the primary group. But, market institutions are pivoting toward cryptocurrencies in response to market trends.

Halving Already Priced In

The upcoming Bitcoin halving this month is highly anticipated for its potential impact on crypto demand.

The prevailing view is that the halving's effects are already factored into Bitcoin's price, having reached new highs before the event. Hence, don't expect any short-term price surges.

Despite this, Bitcoin has experienced an unprecedented surge in demand over the past three months, driven by institutional adoption.

This surge has led to over 4% of the total Bitcoin supply being held in the spot ETF market. However, with the halving reducing Bitcoin's supply, its impact may be felt sooner than in previous years.

Moreover, strong market expectations of future interest rate cuts by the Fed, possibly in the second half of the year, along with similar expectations from the ECB, could drive increased demand for risk assets.

This, in turn, may positively influence Bitcoin, potentially leading to new highs throughout the year.

Nonfarm Payrolls Key for Next Direction

Today's US nonfarm payrolls data could influence pricing, especially after the mid-week ADP Private Employment figures exceeded expectations. A continued positive trend in nonfarm payrolls may exert pressure on risk assets.

In such a scenario, Bitcoin could trend towards the $65,000 level, with a potential reaction purchase towards $67,000 based on the short-term symmetrical triangle pattern.

A weekly close above short-term EMA values around $67,000 could propel Bitcoin toward $80,000, potentially surprising investors with a breakout to the upside

Conversely, close monitoring of the $65,000 limit is essential. A weekly close below this level may signal bears' dominance, potentially pushing the cryptocurrency back to the $60,000 range.

A decline could lead the crypto to the next demand zone around $57,000.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.