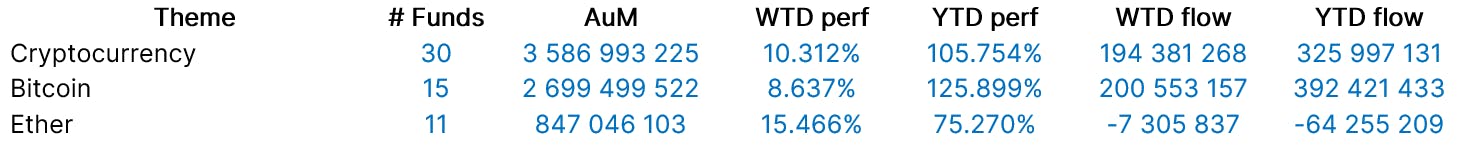

In line with recent weeks, Bitcoin surged once again, crossing the $37,000 mark. This development is largely seen as being driven by market optimism around the anticipated approval of a spot Bitcoin ETF (TSX:EBIT) by the U.S. Securities and Exchange Commission (SEC). Experts believe that such approval could act as a magnet for considerable investments in the pioneering cryptocurrency. As a result, ETFs linked to the cryptocurrency theme gained +10.31% last week, collecting $194 million of inflows.

The bullish sentiment in Bitcoin reached new heights on Wednesday following a CoinDesk report which claimed that the SEC had begun earnest discussions with Grayscale Investments concerning the conditions of its application to change its Bitcoin trust, commonly known as GBTC, into a Bitcoin ETF. The news has served to fire up a renewed sense of enthusiasm among crypto investors.

Contributing to Bitcoin’s recent price surge was also the significant liquidation of short-selling positions, while adding further intrigue to developments, an unidentified 'Bitcoin whale' has reportedly been acquiring huge swathes comprising approximately $15 million worth of Bitcoin every three hours. The identity and motives behind such frequent and sizeable purchases remain the subject of speculation among the digital community with names like Warren Buffet and BlackRock (NYSE:BLK) generating widespread conjecture.

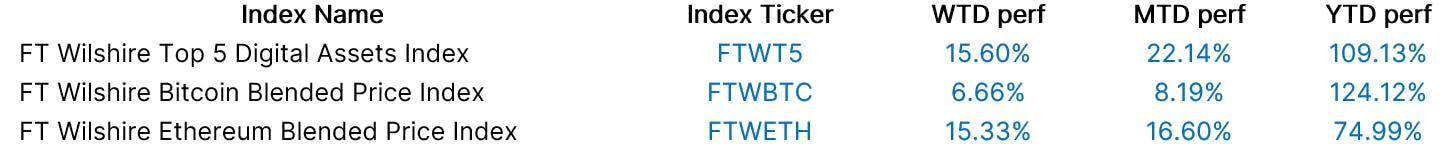

While all eyes remain on Bitcoin's remarkable performance, Ether has been performing even better. It witnessed an impressive rally over the week soaring by 9.13% - and remarkably close to touching the highly symbolic $2,000 landmark on Friday's trading session. Reflecting these trends, the FT Wilshire Ethereum Blended Price Index (FTWETH) gained +15.33% over the week, while the FT Wilshire Bitcoin Blended Price Index (FTWBTC) rose by +6.66% for the same period.

Group Data:

Index Data:

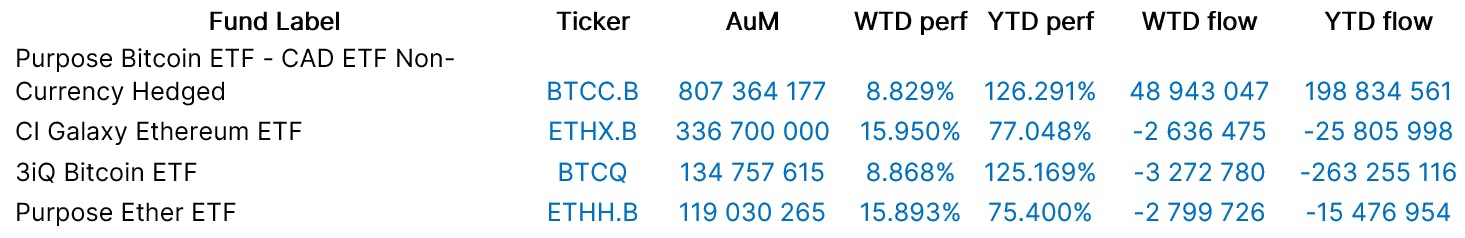

Funds Specific Data: BTCC.B, ETHX.B, BTCQ, ETHH.B

This content was originally published by our partners at the Canadian ETF Marketplace.