Bitcoin took a surprising downturn over the course of the past week, shedding 14% of its value from recent peaks seen on January 8th, despite a wave of optimism following the Securities and Exchange Commission's (SEC) approval of spot Bitcoin ETFs. This development, which sparked excitement across cryptocurrency markets, saw Bitcoin's price stabilize at just over $41,500 by the week's end.

Spot Bitcoin ETFs Hit the U.S. Market

The recent debut of multiple Bitcoin spot price ETFs in the U.S. on January 11th has caused quite a stir. The iShares Bitcoin Trust ETF (IBIT) led the way by quickly amassing over $1.06 billion in inflows, increasing its assets under management to nearly $1.03 billion. Fidelity achieved a similar feat just a day later. However, the industry leader, Grayscale, experienced net outflows of over $478 million after transforming its $25 billion Bitcoin trust into an ETF, as investors shifted towards more cost-efficient alternatives.

Meanwhile, companies like ARK/21Shares, VanEck, and Invesco also entered the market with their own ETFs, attracting significant investments and underscoring the growing institutional interest in cryptocurrencies.

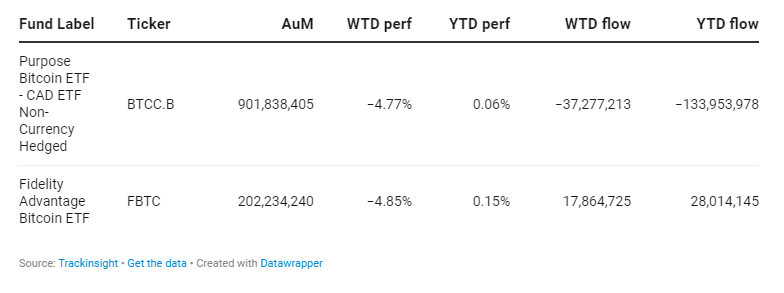

Canadian Bitcoin ETFs Fall Back

Despite these advancements helping bolster infrastructure for the broader crypto market, it wasn't smooth sailing for all, especially Bitcoin, which recorded a year-to-date decline of approximately -6%. Other cryptocurrency ETFs, such as the Purpose Bitcoin ETF (TSX:BTCC) - CAD ETF Non-Currency Hedged (BTCC.B) and the Fidelity Advantage Bitcoin ETF (TSX:FBTC), also felt the pressure, recording weekly losses of about 4.77% and 4.85% respectively.

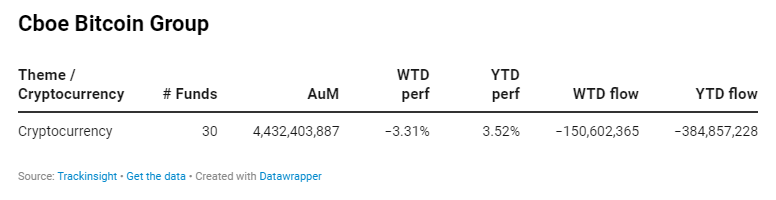

Group Data

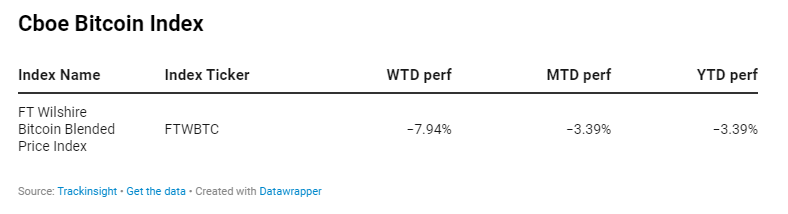

Index Data