In our last update, see here, we presented three Elliot Wave Principle (EWP) options for Bitcoin, but we can now narrow it down to only two: a preferred and an alternate. Moreover, we found.

“Thus, all options tell us to look for a low soon at around the same price levels [$25-24.5K] and then a rally. One rally will just be “a bounce” [to $29.5-30.5K], whereas the other is a more sustainable intermediate-term rally [to ~$35.4K].”

Fast forward, and BTC bottomed on 9/11 at $24,919 and staged a three-day rally, the longest since the high made on July 13 at $31839. Thus, BTC bottomed right in our ideal target zone and staged a reversal. Therefore, a low is in place, and we are looking for the aforementioned higher prices. However, based on long-term cycle/pattern analyses, a constructive low was made in December 2022. Allow us to explain.

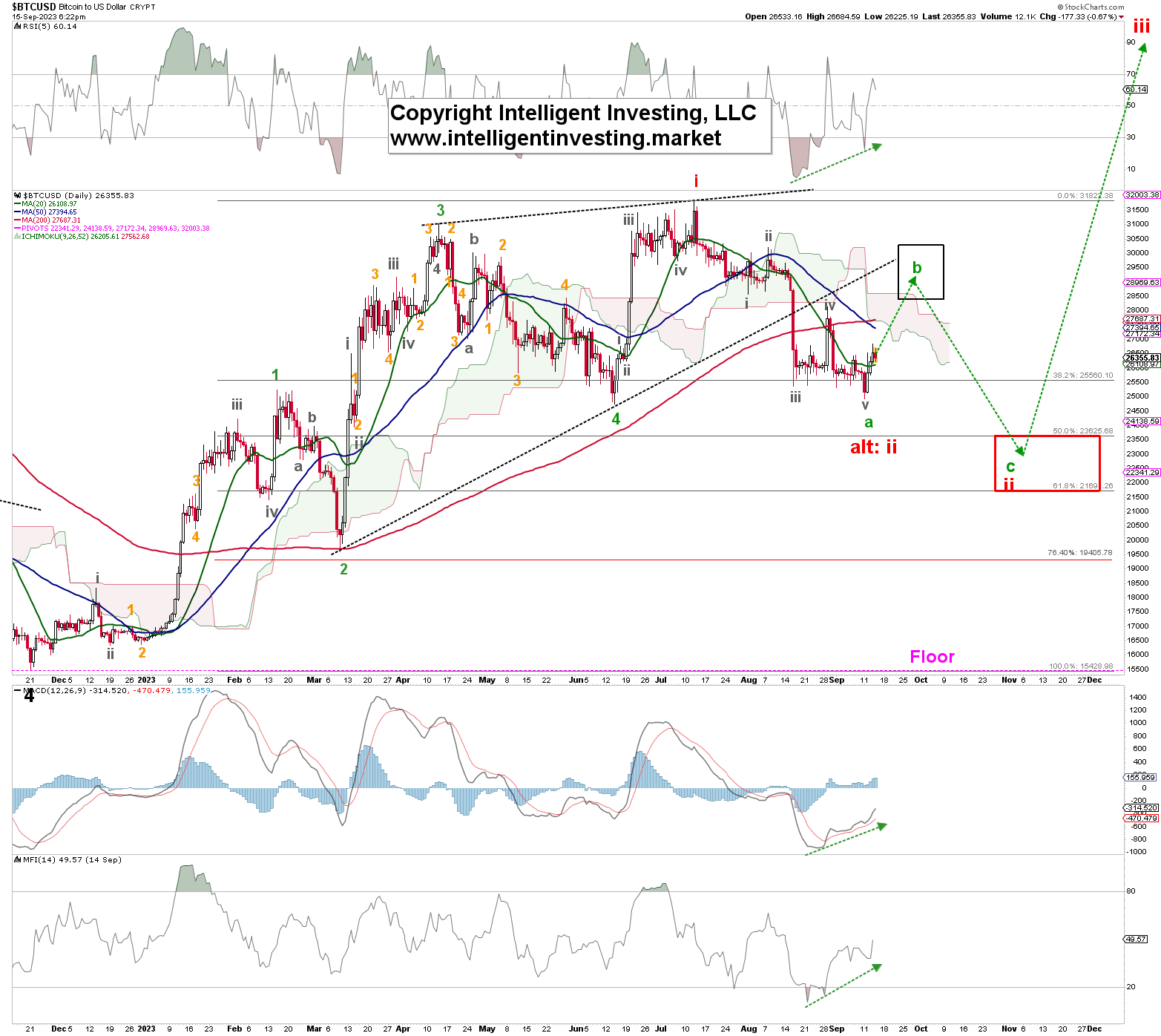

Figure 1. The daily chart of BTC with several technical indicators

Figure 1 above shows BTC completed a leading diagonal 1st wave from the November 2022 low to the July 2023 high. Currently, it is in a corrective wave, red W-ii, which should ideally subdivide into three smaller green waves, with green W-a completed this week. Green W-b to ideally 29.5+/1.0K is now underway, followed by green W-c down to ideally $21.7-23.6K. Once red W-ii ends, W-iii (the third wave) will kick in and propel BTC to six digits. The alternative to this long-term Bullish EWP count is that red W-ii is already complete: labeled as “alt: ii.”

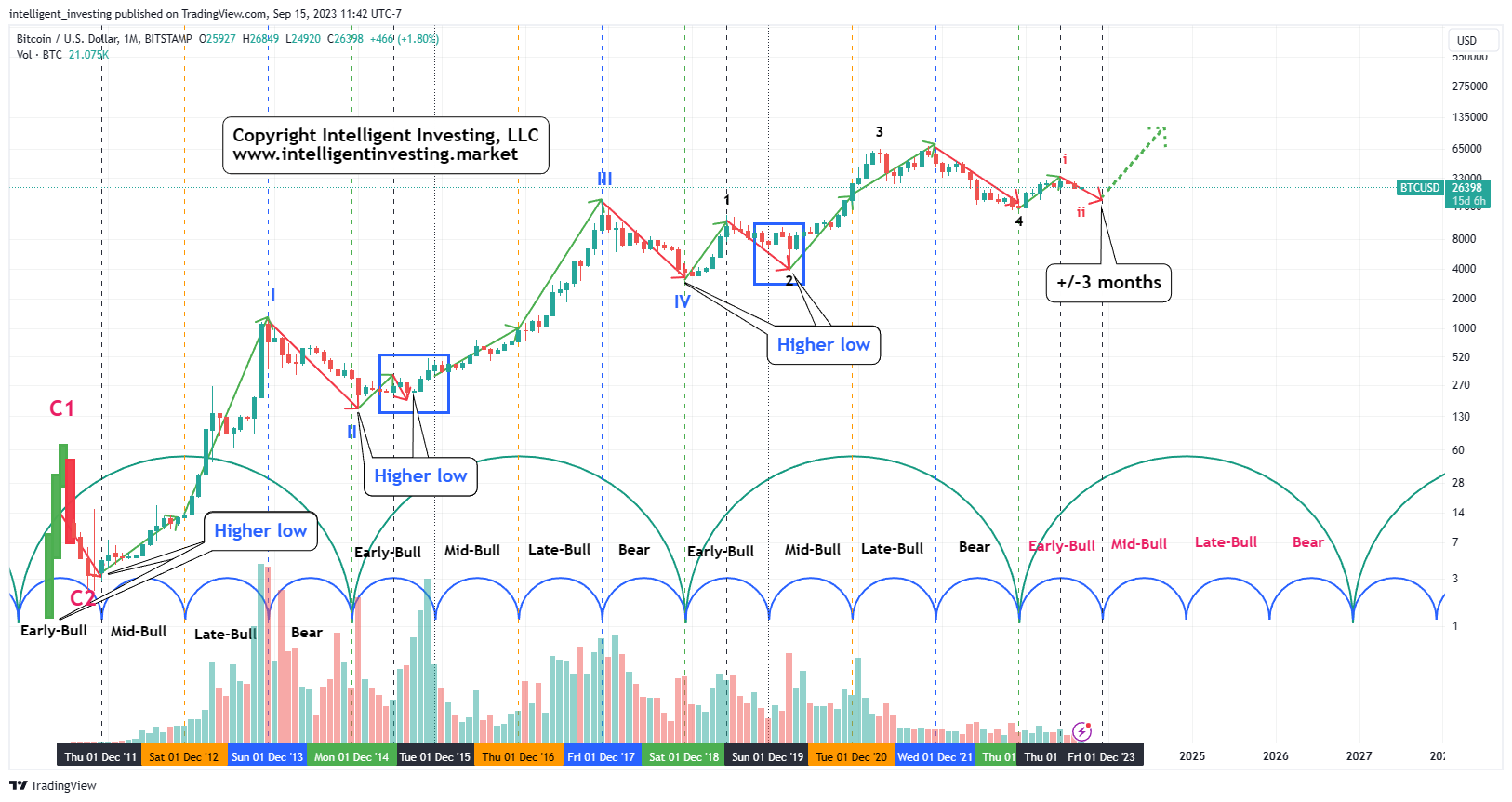

Why are we so Bullish besides the EWP count? Well, figure 2 below shows the long-term price chart for BTC (since 2011) with its halving-cycle-related four phases:

- The Accumulation Phase (Early Bull)

- The Mid Bull

- The Late Bull

- Cooldown Phase (Bear)

Figure 2. The daily chart of BTC with several technical indicator

Each full (green) cycle lasts four years, and each phase lasts one year (blue). It follows each Bear ends around the last month of the 4th year. In this case, December 2022. The Early-Bull phase then has a top after about six months, a dip six months after that (+/-3 months: blue boxes), and the one-year Mid-Bull starts. Etc. No exceptions.

Applying this to our current situation, BTC topped six months after it bottomed (November 21, 2022, to July 13, 2023) and should decline into December 2023 +/- 3 months. This interval means BTC could have bottomed out on September 11. Hence why, we presented the red “alt: ii” label. If not, the green W-b and W-c will bring us to around December this year. From there, the next Bull can start.

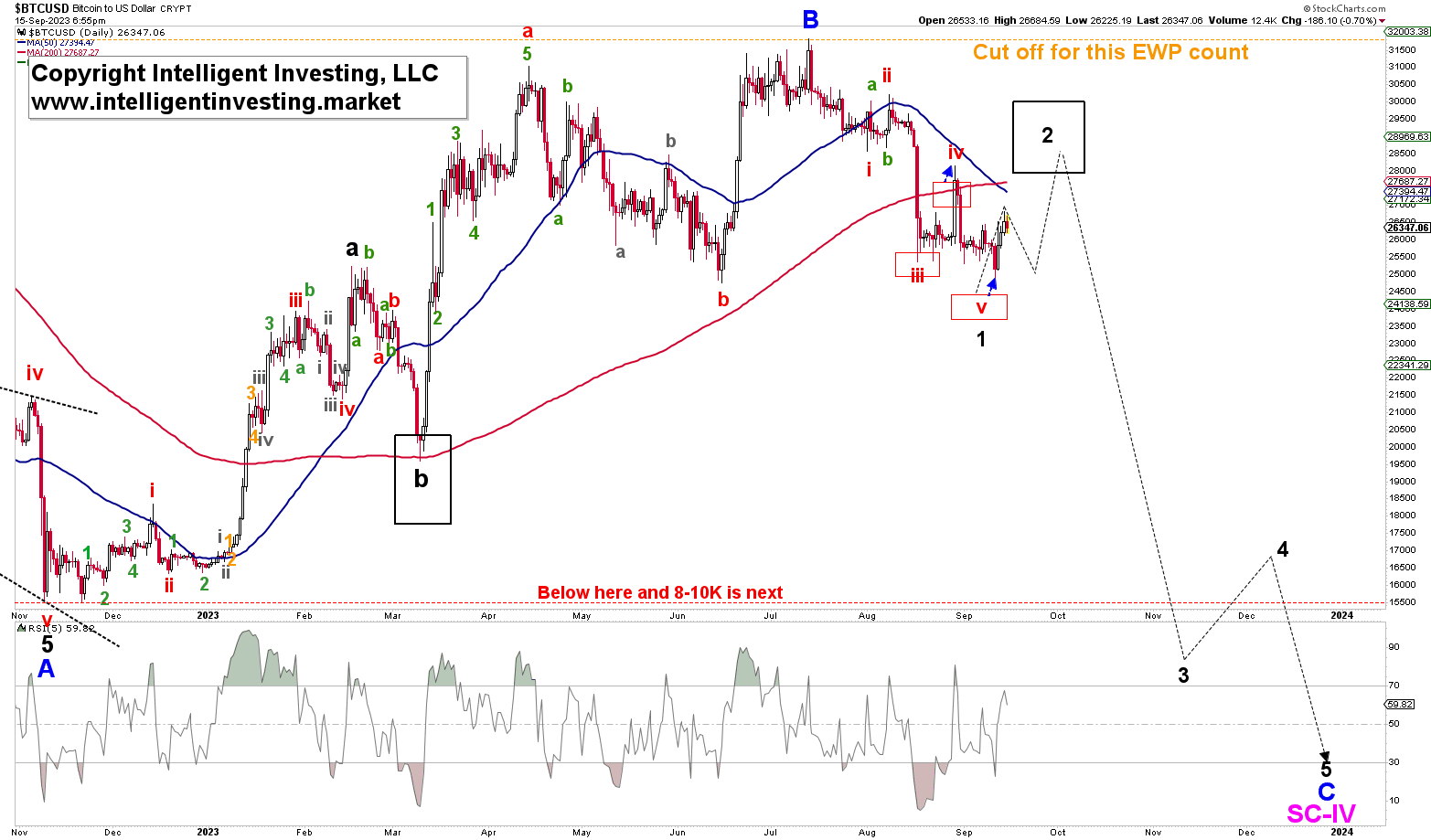

If past performance does not guarantee future results, we continue to carry the Bearish resolution. See Figure 3 below. Confirming this case will require a break below the November 2022 low. It is simply our contingency plan, our insurance if things go completely haywire.

Figure 3. The daily chart of BTC with several technical indicators

Thus, BTC bottomed precisely where we thought it would and should now be at least in a countertrend rally before making a marginally lower low. Alternatively, the low is already in place. Based on BTC’s past cycles, made up of four more minor phases, it should now be close to the next Bull run.