Last week, the Bitcoin price decreased by roughly 20%. However, it initiated a bounce near $6,600 on Nov. 25 and has increased by 10% in less than 12 hours.

While there is no sure-fire explanation about the rapid decrease, there are several hypotheses.

A self-proclaimed co-founder of Bitcoin stated that he caused the crash, in order to retaliate to the negative reaction of the cryptocurrency community towards some of his claims. Ironically, this claim led to even more backlash — giving rise to challenges that he must prove some of his statements, such as his ownership of more than 100,000 BTC.

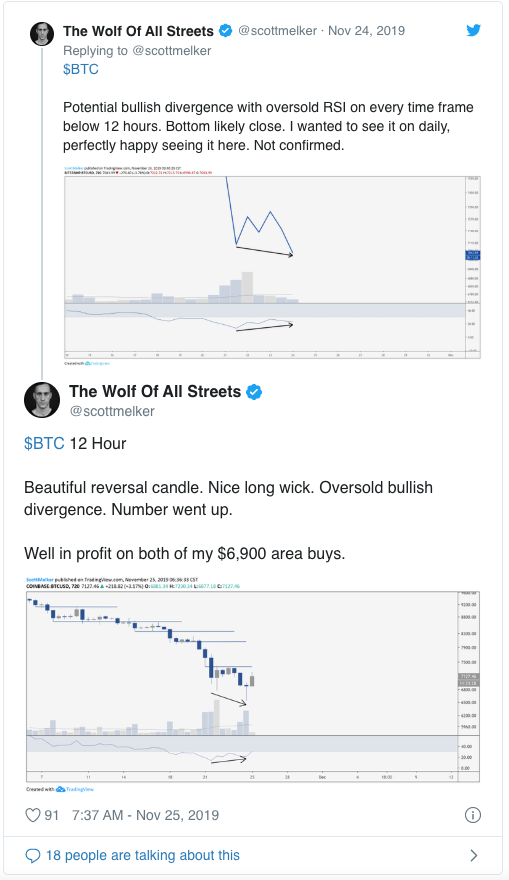

Today, the Bitcoin price reached a low around $6,600 and began a reversal — which is still ongoing. Cryptocurrency trader and analyst @scottmelker stated that the Bitcoin price has printed a beautiful reversal candle with a very long lower wick. Additionally, he noted the presence of bullish divergence in the oversold area.

Bitcoin in a Descending Channel

The price has been trading inside a descending channel since reaching a high on June 24.

It reached the support line on Nov. 21 — creating a long lower wick. The ensuing decrease caused it to fall to the support line once more on Nov. 25.

Another increase ensued and the price is currently in the process of creating a bullish reversal candlestick.

Looking at lower time-frames, we can see a strong bullish divergence in the RSI.

Additionally, the Bitcoin price is in the process of creating a morning star pattern. A price close above the previous bearish candlestick’s open at $7,300 would likely confirm the reversal.

Resistance Areas

In the short-term, the main resistance areas are at $7,400 and $7,600. It is likely that the price retraces slightly once it reaches them.

However, a daily close above the second resistance area would confirm the previous pattern and the reversal scenario.

To conclude, after a long and rapid decrease, Bitcoin seems to have begun a reversal. While this trend is not yet confirmed, it occurred at a likely reversal area and is supported by technical indicators.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Images courtesy of Shutterstock, TradingView.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI