One of the easiest and most controllable sources of risk investors can address in their portfolios are excessive ETF expense ratios. All else being equal, high fees can cause a significant drag on long-term returns and result in excessive tracking error for an ETF compared to its benchmark.

I could go on and on about this, but I figured this timeless quote from the late Chairman and founder of Vanguard, John Bogle sums it up best:

“Investors need to understand not only the magic of compounding long-term returns, but the tyranny of compounding costs; costs that ultimately overwhelm that magic.”

Keeping expense ratios low becomes all the more important when it comes to asset classes with lower expected returns, such as bond ETFs. Given their lower long-term total returns, every basis point saved in terms of fees is another added on to overall performance.

A highly overlooked bond ETF on my radar recently was the BNY Mellon Core Bond ETF (BKAG), which charges a 0% expense ratio. That's right, this ETF costs nothing to hold. Let's take a look at how this ETF works and the use case for it.

BKAG breakdown

In terms of strategy, BKAG is as vanilla as it gets. This ETF tracks the Bloomberg US Aggregate Total Return Index, or "Agg", a highly popular benchmark of U.S. fixed-income markets.

The Agg spans not only government Treasurys, but also agency securities, mortgage-backed securities, and investment-grade corporate bonds of all maturities, averaging out to an intermediate duration.

Most of the popular bond ETFs in the U.S. will track the Agg or a variant thereof, with classic examples being the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG). Both of these ETFs charge a 0.03% expense ratio, which is very low, but still higher than BKAG.

For a 0% expense ratio, investors receive exposure to over 2,500 bond issues, with a weighted average yield to maturity of 4.42% and average effective duration of 6.4 years as of March 31, 2023. For many investors, ETFs like BKAG tend to be a one-size-fits-all bond holding.

BKAG does fall behind BND and AGG in terms of popularity. As of April 20, 2023, BKAG has only attracted $431 million in assets under management, or AUM.

BKAG vs. AGG & BND

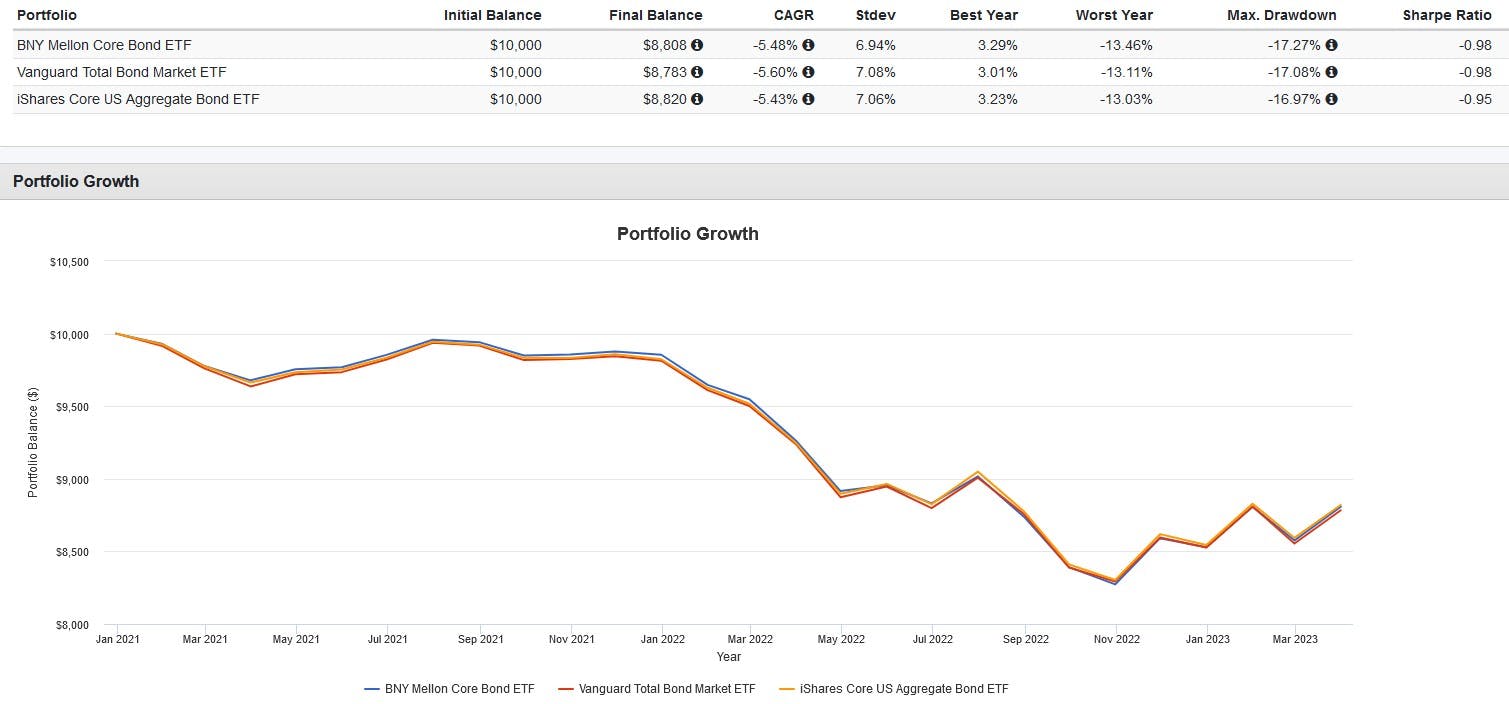

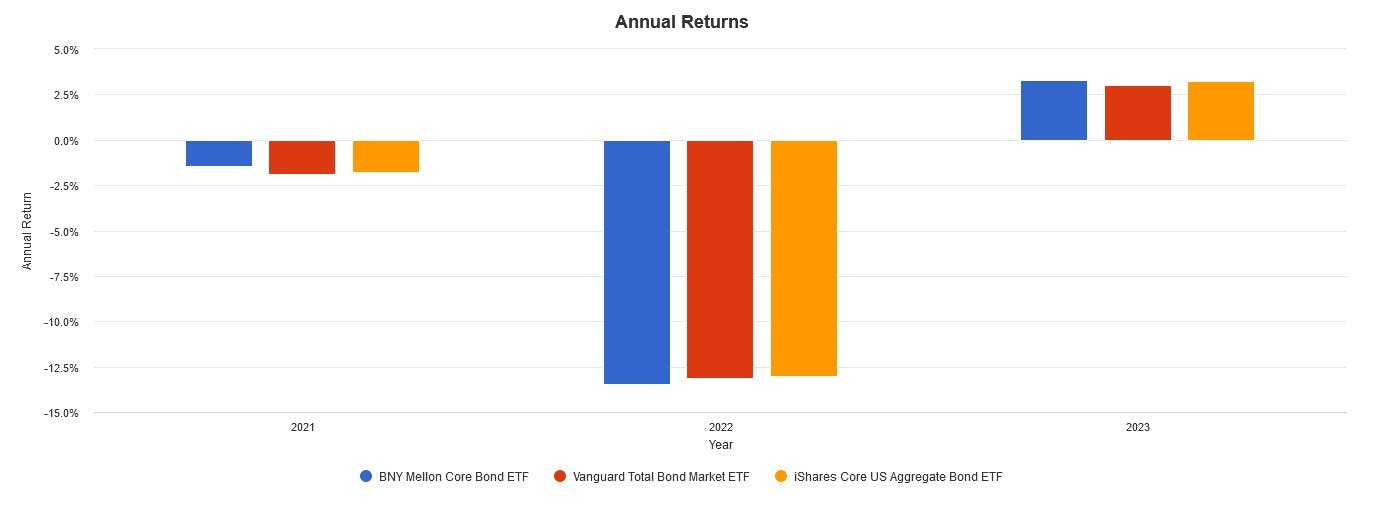

The question is, has BKAG's lower expense ratio really made a difference historically compared to its more liquid and well-known counterparts? Well, BKAG hasn't been around too long, so take this backtest with a grain of salt.

Honestly, whatever variations in returns over this short of a time period are so insignificant. The savings from BKAG's lower expense ratio will likely only make a difference over long periods of time, such as multiple decades. Investors also need to consider the economy of scale that Vanguard and iShares have over BNY Mellon as an ETF issuer, as well as lower bid-ask spreads for BND and AGG.

Still, lower expense ratios are never an unwelcome sight. The fact that BNY Mellon has managed to pull this off despite not being one of the "Big Three" ETF issuers (Vanguard, iShares, SPDR) is impressive on its own. If more ETF issuers follow suit, the resulting competition may benefit investors further.

This content was originally published by our partners at ETF Central.