Investment management firm BlackRock Inc. (NYSE:BLK) provides risk management and advisory services, launches and manages exchange-traded funds, mutual funds and hedge funds and participates in a broad range of roles in a large number of transactions.

The company generates revenue based on the number of transactions and valuations of underlying assets where it is involved. With monetary easing and interest rate cuts leading to increased and cheaper capital, it is likely the number of transactions and valuations of assets will rise along with its revenue. BlackRock was co-founded in 1988 by CEO Larry Fink with a long-term vision. Over time, both the company and the man have become Wall Street icons that the markets pay attention to.

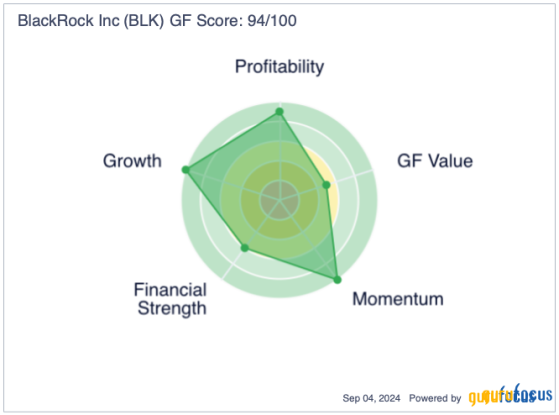

It is no coincidence the stock has a GF Score of 94 out of 100 and we will dive into the reasons that the company is likely to outperform the broader market in the next 12 months. BlackRock, by the very nature of its business, is a natural short-term trade prior to interest rate cuts and monetary easing, but also an attractive long-term investment.

Business overviewInvestos who bought the stock at the start of the century would be up by over 6,000% today. The share price has more than doubled in the last five years despite a major pandemic-related downturn, high inflation, higher interest rates and tight monetary policies across the globe. This feat by itself is an indicator of the resilience of the business, even when everything seems to go south. At the time of writing, the stock is trading around $885 per share.

BlackRock can be separated into two main business units: investment-related (investment advisor, administration fees and securities lending) and technology services. The main source of revenue is investment-related with second-quarter sales of $3.88 billion, up 2.60% from $3.78 billion in the first quarter. Technology services is a much smaller unit, but growing faster with revenue of $395 million compared with $377 million in the previous quarter (up 4.80%). When we break it down by asset class, most of the revenue is made in equity (40.10%) and fixed income (19.50%) with a combined total revenue share of 59.60%.

These two asset classes are the most likely to see an uptick in activity as interest rates come down and monetary easing takes place in the U.S. (67% of the company's revenue is in the U.S.) and Europe (29% of revenue). Indeed, when monetary easing takes place, more debt is contracted for refinancing (to refinance the higher interest rate debts) and leveraged buyouts, which both support the fixed income segment. The equity side also becomes more active as a greater number of transactions take place and demand generally rises for equities as capital becomes cheaper.

Source: BlackRock second-quarter 2024 earnings supplement

BlackRock has witnessed a net acceleration in organic asset and fee growth rates since the fourth quarter of 2023, boosted by large exchange-traded fund inflows over the past three quarters. Owning shares is a way to benefit from other investors' passive investing and the related growing trend. The company disclosed in its second-quarter earnings that $83 billion flowed into BlackRock-managed ETFs. With monetary policy easing and subsequent rising liquidity in the market acting as tailwind, it is likely for this inflow growth to continue over the next several quarters.

FinancialsSince the Global Financial Crisis, BlackRock has had revenue growth of 10% per year. For the first half of the year, the revenue grew by 6.60% and is likely to reach the double digits by the end of the year. There is some momentum there as revenue seems to already be accelerating (in comparison, last year's revenue growth was flat amidst high interest rate and global economic uncertainty) with interest rate cuts approaching. Additionally, BlackRock is a properly managed company from a liquidity perspective and from a shareholder's perspective.

BlackRock has consistently carried more cash than debt on its balance sheet for the past decade. This allows the company some leeway in merger and acquisition activity and, at the same time, keep shareholders loyal and rewarded for their patience.

Mergers and acquisitionsIn relation to M&A, BlackRock already announced the acquisition of two large companies, for around the same price ($3 bn each): Preqin, a U.K.-based provider of private markets data and Global Infrastructure Partners (GIP, world's largest independent infrastructure manager with over $100 billion in AUM). The first acquisition is particularly interesting given the role data is playing in the markets and is a good fit for the technology services business unit of BlackRock. GIP is a tactical play by the company to mitigate potential economic downturn and subsequent market risks with the world possibly facing recessions across various geographies after tight monetary policies across the global: infrastructure is probably the most resilient equity segment in every major economic crisis.

Shareholder value a priorityThe excess cash is used to pay dividends, giving the stock a respectable dividend yield of around 2.35%, which is above the S&P 500 average. At the same time, the dividend yield is not very high and allows the company to not be trapped by dividend payments. Together with a median of 1% share buybacks per year over the span of a decade, it is obvious BlackRock cares about its shareholders without compromising the business.

The company's current free cash flow margin of 22% and the improving ROE (currently at 15.40%) over the past 15 years ensures the shareholders both a bright near- and longer-term future.

Valuation driven by macro tailwindsAt first glance, the stock may be a bit expensive when looking at the price-earnings ratio (10% to 15% above fair value when the historical average is used).

However, using the historical average of the price-earnings ratio may not be the most relevant metric for the stock. Indeed, the company does not perform in a linear fashion: BlackRock performs better in a monetary easing trend and worse in a tightening phase. If we take the last five-year cycle, the best revenue and earnings growth rates were achieved in 2020-21 and the worst in 2022 (-7.70%). Revenue growth is picking up again this year and is likely to accelerate for at least the next couple of years as more transactions occur and valuation multiples of assets under management expand.

Risk factors to my caseThe principal risk for the stock is a market downturn, which could lead to lower valuation of assets and lower transaction amounts, resulting in less fees perceived by BlackRock. There was a market downturn in 2022 with high interest rates and a reduced level of economic activity, leading to decline in growth for the company. There are some strong points, however. The fundamentals of the business have been consistently challenged over the decades, with a real business resilience shown during the Covid-19 pandemic and periods of a high inflationary environment. Given the phase in the monetary cycle, lower inflation and a likely uptick in both transactions and debt financings, it is likely that BlackRock could see its earnings accelerate.

Bottom lineBlackRock is both an interesting short-term tactical play and a long-term bet that the number of transactions in increasingly globalized markets will continue rising, requiring more involvement (in the form of advisory, risk management, data provision, etc.) and hence pushing its revenue and earnings up. Shareholders have benefitted over the years from stock price appreciation, dividend payments and share buybacks. The timing of an entry in the stock appears to be particularly opportune ahead of a likely first interest cut and the start of monetary easing.

This content was originally published on Gurufocus.com