BlackRock (NYSE:BLK), the world's largest asset manager, has boldly submitted its proposal for a spot Bitcoin ETF to the U.S. Securities and Exchange Commission (SEC), despite a series of similar offerings being rejected to date. The SEC's concerns surrounding the unregulated nature of the cryptocurrency space, and the potential for fraudulent activities, have been key reasons behind the commission's consistent refusals thus far.

That said, the SEC has already granted approval for Bitcoin futures ETFs, which do not directly invest in Bitcoin but rather employ futures contracts. Prominent examples of such ETFs include the ProShares Bitcoin Strategy ETF.

Additionally, the Grayscale Bitcoin Trust (GBTC), an older investment vehicle whose assets amount to $19 billion, provides American investors with an alternative means of gaining exposure to Bitcoin. However, due to its structure as a closed-end fund rather than an ETF, its market price often deviates significantly from the actual value of the underlying Bitcoin holdings. Grayscale Investment LLC had endeavoured to convert GBTC into an ETF, but the SEC had rejected its application, citing concerns over anti-fraud measures and investor protection standards.

While the United States has yet to witness the launch of a spot Bitcoin ETF, it’s worth noting that Europe and other countries such as Canada have already experienced success in this domain, with ETPs fully backed by physically settled Bitcoin.

Given the SEC's track record and its recent lawsuit against Coinbase (NASDAQ:COIN), the proposed custodian for BlackRock's Bitcoin ETF, one may naturally question BlackRock's optimism regarding approval. Nonetheless, BlackRock has introduced a heightened level of oversight in relation to cryptocurrencies, potentially bolstering its case for SEC endorsement. Notably, the inclusion of a surveillance-sharing agreement is regarded as a crucial element that could sway the scales in favour of approval. This agreement would facilitate monitoring and reporting of potential market manipulation—an issue previously raised by the SEC. Furthermore, speculation has emerged suggesting that BlackRock's filing could serve as a mediator in the SEC's lawsuit against Coinbase, potentially yielding a more favourable outcome for the proposed ETF.

While the SEC remains officially silent on any potential shift in its position, the prevailing sentiment within the investment community indicates a heightened probability of approval for BlackRock's Bitcoin ETF with a notable shift in the landscape as additional investment managers step forward. Following BlackRock's decisive move, both Invesco and WisdomTree have filed their respective applications. Furthermore, Fidelity Investments has disclosed its intention to seek approval for spot Bitcoin ETFs.

These developments collectively reflect the increasing likelihood of a regulatory green light for Bitcoin ETFs and highlight the growing recognition of Bitcoin's investment potential by prominent players in the industry.

Unsurprisingly, Bitcoin reached its highest point in thirteenth months, surpassing the $30,500 threshold. The Bitcoin Tracker Euro ETC (COINXBE) and the Invesco Physical Bitcoin ETC (BTIC) gained +23.50% and +17.76%, respectively, week-over-week, bringing their year-to-date performance to +95.59% and 77.05%.

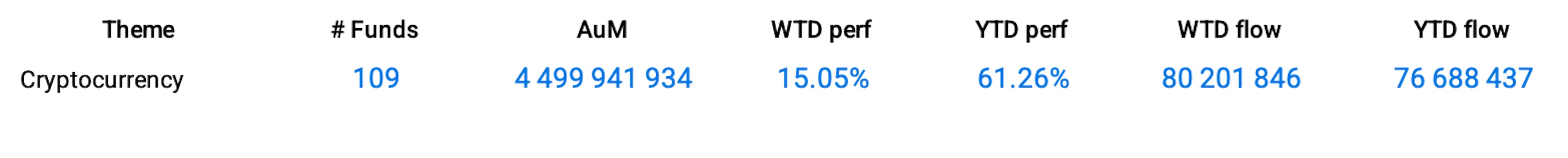

Cryptocurrency Theme Group Data

Funds Specific Data

Fund in Focus: FBTC

Fidelity Physical Bitcoin ETP (FBTC): Trading on exchanges across Europe, FBTC aims to track the price of Bitcoin and is 100% physically backed by Bitcoin held in custody provided by Fidelity Digital Assets. AUM currently stands at €7.03 M with a management fee of 0.75%.