Blackstone (NYSE:BX) Mortgage Trust Inc.'s (NYSE:BXMT) prospects are in the limelight amid a changing interest rate environment and a recent dividend cut. The mortgage real estate investment trust has shed approximately 10% of its market value in the past six months, illustrating investors' dissatisfaction with the systematic environment and the company's execution.

Considering these factors, the question becomes: Is Blackstone Mortgage Trust a "buy-the-dip" opportunity, or will it succumb to its current headwinds?

The vehicle's salient features are examined and discussed to address the central question.

What is Blackstone Mortgage Trust?As its name implies, Blackstone Mortgage Trust generates income by investing in mortgages. Although it operates through various verticals, the company primarily invests in senior floating-rate mortgages.

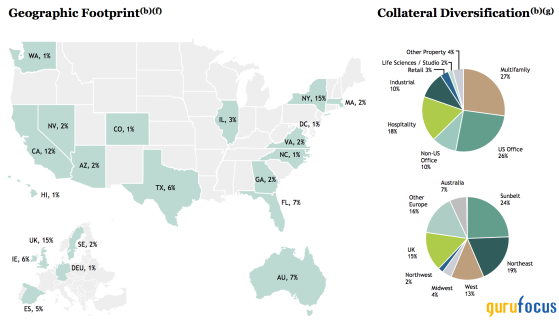

As illustrated in the following diagram, Blackstone Mortgage Trust is geographically diversified with exposure to the U.S., Europe, the United Kingdom and Australia. Moreover, the company emphasizes sub-asset class diversification by splitting its exposure between multifamily residential, core commercial and non-core commercial property.

Source: Blackstone Mortgage Trust

A bird's-eye view of Blackstone Mortgage Trust's portfolio expresses its commitment to high-quality mortgages. Nevertheless, it delves into suboptimal mortgages to generate excess returns.

Source: Blackstone Mortgage Trust

A glance at Blackstone Mortgage Trust's market-based attributes reveals that most of its returns derive from interest income. However, abrupt changes in its market price are common, especially in volatile interest rate environments. Therefore, a holistic analysis of the vehicle's optics is required before judging its outlook.

Source: Koyfin- price return vs. total return

Emerging fundamental headwindsAs mentioned, Blackstone Mortgage Trust faces numerous systematic and idiosyncratic headwinds. In fact, the company's second-quarter earnings presentation proclaims some of its challenges.

First and foremost, it is critical to note that variable-rate mortgage loan prices and their interest components are correlated. The mortgage's price component recedes when existing borrowers refinance in lower mortgage rate environments. Moreover, lower mortgage rates reduce a bond's interest component of a bond, leading to lower coupon payments.

Since the turn of the year, mortgage rates in Blackstone Mortgage Trust's primary operating jurisdictions have fallen. The company's repayments have been solid. However, a knock-on effect may emerge in due course, whereby its prepayments might increase.

Higher prepayments will likely emerge in droves as talks of a U.S. interest rate pivot and a recent shift in Euroregion monetary policy have taken shape. Moreover, Blackstone Mortgage Trust reported $385 million of non-performing loan resolutions during the first half of this year. A reoccurrence of noteworthy non-performing loans might force refinancings, introducing added prepayment risk.

Source: Blackstone Mortgage Trust

Further, net income is crunched due to higher credit risk. Blackstone reported a net loss during its second quarter, with its loss per common share settling at 35 cents. Although the net interest income receded, the company's credit loss provision was the main reason it slumped into a loss. The credit provision increased more than fivefold year over year, reaching $152.40 million.

Source: Blackstone Mortgage Trust

The mortgage lender's exacerbated reserves line item is primarily due to 55% of Blackstone Mortgage Trust's office properties being on a "watchlist" or impaired.

Although an isolated observation, Blackstone's inflated reserve aligns with broader concerns within the commercial mortgage lending industry. For example, commercial mortgage delinquency rates increased to 1.42% in the second quarter from 0.82% a year earlier. In addition, an interest rate pivot is nearing, which might spike corporate credit risk premiums due to the inverse relationship between interest rates and the credit risk cycle.

Source: St. Louis Fed

An uncertain credit environment, higher delinquency rates and portfolio-specific woes can lead to additional provisions toward the back end of 2024. Therefore, Blackstone Mortgage Trust's net income is unlikely to rebound, especially as mortgage rates are trending downward.

Another risk is that lower collateral values may introduce liquidity concerns. Over the course of this year, the United States, Europe and Australia have been experiencing disinflation. It is unlikely that a few interest rate cuts will lead to immediate reinflation. As a result, collateral valuations may decline in late 2024 and early 2025, leading to lower nominal recovery rates.

Blackstone Mortgage Trust's liquidity-to-loan value is robust. However, increased liquidity requirements may arise if recovery rates decrease, particularly if the likelihood of loan defaults increases.

Source: Blackstone Mortgage Trust

Dividend cutInvestors were left disappointed after Blackstone Mortgage Trust reduced its second-quarter dividend by 25% to 47 cents per share. Even though Blackstone's management announced a $150 million stock repurchase program, the fund slashed its quarterly dividend by 25%.

The lower distribution reflects its long-term earnings power. Blackstone Mortgage Trust maintains a forward dividend yield of approximately 10.26%. However, the vehicle's fundamental challenges mean additional dividend cuts are possible.

ValuationBlackstone Mortgage Trust's fundamental risks can be quantified by observing its valuation metrics. The REIT has a trailing price-book value of 0.80, which many might consider a sign of value. However, a time series analysis shows the company usually trades at a discount.

| Quarter | Price-book ratio |

| Current | 0.8 |

| Q2 2024 | 0.73 |

| Q1 2024 | 0.79 |

| Q4 2023 | 0.82 |

| Q3 2023 | 0.83 |

| Q2 2023 | 0.79 |

| Company | Price-to-Book Ratio |

| Armour Residential REIT | 0.85 |

| PennyMac Mortgage Investment Trust | 0.88 |

| Redwood Trust | 0.86 |

Risk-return metricsQuantitative risk analysis is imperative when assessing a mortgage REIT because it delineates the vehicle's risk-return attribution.

Blackstone Mortgage Trust has a positive Sharpe ratio, suggesting its volatility-adjusted returns are commendable. However, a deeper examination of the company's quantitative measures communicates worrisome aspects. For instance, Blackstone has excess kurtosis and negative skewness, indicating it is susceptible to tail risk. Moreover, the downside capture ratio exceeds its upside capture ratio, encapsulating that it occasionally suffers from extended drawdowns.

| Metric | Value |

| Sharpe Ratio | 0.25 |

| Kurtosis | 13.52 |

| Skewness | -1.76 |

| Upside Capture Ratio | 95.17% |

| Downside Capture Ratio | 115.62% |

The company's historical risk-return data reflects the past and is not guaranteed to reoccur. Nevertheless, the dataset provides a solid guidepost to investors who want to understand how Blackstone Mortgage REIT would contribute to a diversified investment portfolio's risk-return dimensions.

Limitations of the analysisA comprehensive research report concedes its limitations.

The primary limitation of this analysis relates to subjectivity. Although the study is based on solid theoretical underpinnings, the bond market is highly unpredictable. Therefore, predicting the trajectory of a mortgage REIT such as Blackstone Mortgage Trust involves a degree of subjectivity.

Another consideration is the mREIT's distinctive traits. Blackstone Mortgage's constituency has unique characteristics that must be assessed before consolidating an interlinkage between the systematic environment and its outlook.

Finally, the valuation section emphasized Blackstone Mortgage Trust's price-book ratio. However, alternative valuation techniques may yield different results. Thus, opposing metrics should be considered to avoid biases.

Concluding thoughtsBlackstone Mortgage Trust is on a knife's edge as lower mortgage rates and rising credit risk premiums have exposed fundamental faultlines. Although the fund has a compelling dividend yield, a rise in credit provisions, lower net interest income and systematic challenges might thwart its total return prospects.

Some may see value in Blackstone Mortgage Trust's price-book discount and alluring dividend yield. However, a rounded view of the REIT's influencing variables shows that a drawdown is likely.

This content was originally published on Gurufocus.com