- Bonds have been selling off for quite a while now

- Once considered the safest investment, the sell-off has proven how risky long-duration bonds can be

- This is a great opportunity for investors to reevaluate their investment philosophy about bond investments being 'risk-free'

"Bonds are safe!"

How often do we hear this phrase?

Many believed that stuffing their portfolios with government bonds was the route to safety. The common wisdom was that even if the stock market took a nosedive, bonds would come to the rescue and stabilize the portfolio.

However, as we've come to see, this belief hasn't held up. It's important to remember the words of the wise Howard Marks: markets are like a pendulum, swinging between extremes, seldom resting around the mean.

After over a decade of basking in the low-yield, rising-price environment, bonds have had their rude awakening. Yields dipped into the negative, and prices soared, but the tide has turned for bonds as well.

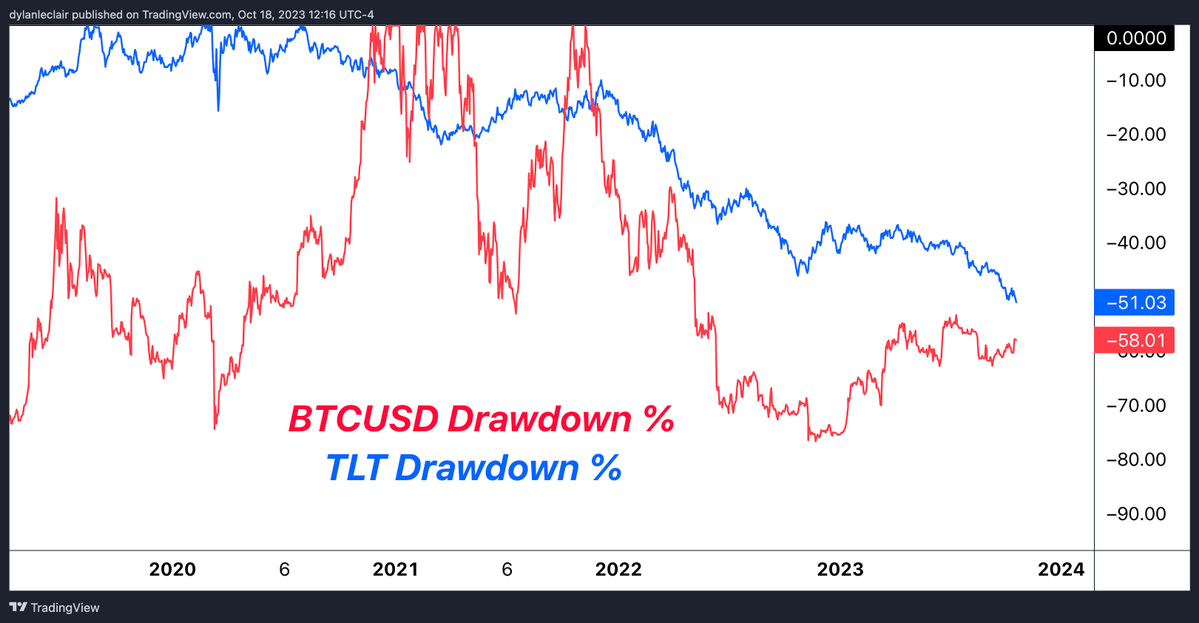

Here's an intriguing chart, depicting the drawdown (that's a decline) of iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT), compared with... Bitcoin.

A close look reveals that the scale of the decline has been strikingly similar in recent years: All this in practically 2 years. It serves as a powerful reminder that the traditional concept of risk, as understood by 99% of investors, requires a profound reevaluation.

All this in practically 2 years. It serves as a powerful reminder that the traditional concept of risk, as understood by 99% of investors, requires a profound reevaluation.

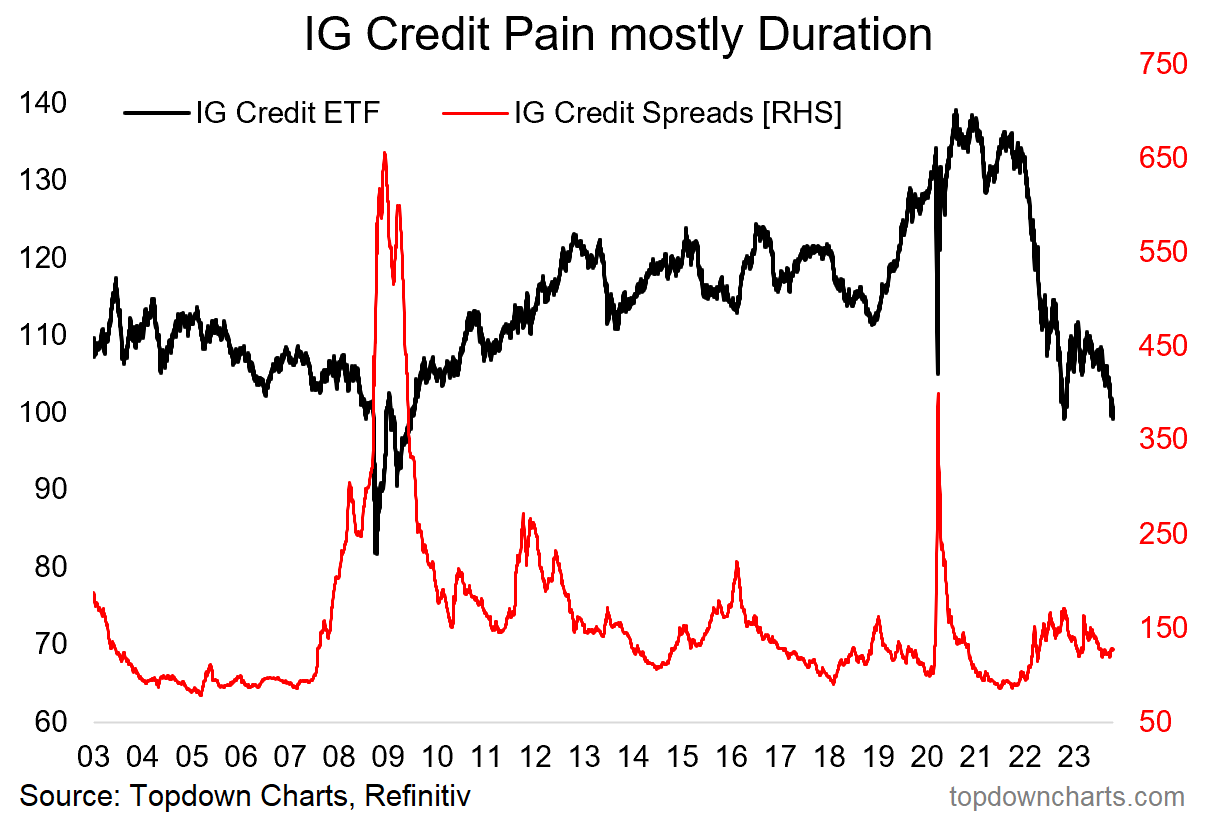

What makes this bear market particularly intriguing is that the price plummet, unlike the subprime crisis, was not triggered by risk spread, but by duration risk, as illustrated in the image below:

Let's simplify this for those not well-versed in financial jargon: The recent crash in bond prices is entirely due to the extended duration of the bonds one selected.

If an investor bought bonds with longer maturities, they experienced a more severe hit.

The key question is, why would one make that choice?

Some might argue:

"In 2021, if I bought a government bond with a maturity of under five years, the yield was close to zero or slightly above. I had to opt for longer maturities out of necessity."

However, did you carefully consider this risk? Did it not seem suspicious that bond prices (which move inversely to yields) kept rising year after year despite those yields?

Greed appears to have taken precedence once again.

Now there are different scenarios of suffering: there are those who were aware of the risks and might pass their bonds onto their children as an inheritance.

Some may hold these bonds until maturity to recoup their initial investment, while others may be forced to sell at a loss in desperation.

What Could Have Been Done Differently?

One could have diversified portfolios by issuer type, varied the durations (aiming for a lower average portfolio duration), maintained a good stock of specific liquidity to buy in during market crashes (knowing the associated risks), and adopted common-sense strategies.

Instead, many investors chose to chase high coupon payments. But maybe the more pertinent question is not when this bear market will end, but whether it's time to reconsider your investment philosophy as well.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.