- Borussia Dortmund's remarkable Champions League run has propelled its stock price up by 14% year-to-date.

- Despite a disappointing Bundesliga season, fans are thrilled as the team prepares to face Real Madrid in the final.

- A victory on Saturday could further boost BVB's stock, which has already gained 13% in May alone.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Borussia Dortmund's (ETR:BVB) disappointing Bundesliga season has been overshadowed by their remarkable Champions League run, propelling them to their third final in history and sending the stock higher.

Despite finishing a lackluster fifth in the Bundesliga, Borussia Dortmund fans are ecstatic as their team prepares to face Real Madrid in the Champions League final on Saturday.

The success of this season, coupled with the team's previous triumphs in 1997 and 2013, has translated into a 14% year-to-date surge for the club's shares (BVB) on the Frankfurt Stock Exchange.

In May alone, the stock has gained 12% in anticipation of the final. A victory against the Spanish giants could further boost the stock's upward trajectory.

Dortmund Faces Uphill Battle

Overcoming Real Madrid will be no easy feat for the Dortmund team, as the Spanish club is the all-time leader in the competition with 14 trophies. Borussia has only won the Champions League once, in 1996/97, defeating Juventus of Italy 3-1 in the final.

They then went on to beat Dida and Bebeto's Cruzeiro 2-0 in the Intercontinental Cup final. In 2012/13, they faced fellow German side Bayern Munich in the final but lost 2-1 to finish as runners-up.

Champions League Money to Boost Revenue

The team's impressive Champions League run, eliminating giants along the way, has raised expectations not only for a title but also for revenue and profit growth.

Dortmund has left behind established clubs in the competition, including Milan (Italy), Newcastle (England), PSV (Netherlands), Atlético de Madrid (Spain), and Paris Saint-Germain (France).

In the last balance sheet, released on May 10th, the club reported total revenue of €104 million in the first quarter of 2024, up 1.7% from the previous quarter, but a net loss of €21 million.

For the previous season, 2022/23, reported in the middle of last year, total revenue was €490 million (18% higher than 2021/22) and net profit was €9.6 million (after a loss of €32 million in 2021/22).

In the current season, the club has already achieved a net profit of €49 million on revenue of €443 million. For this Champions League, Borussia projects to earn over €100 million in total – if they win the title, the UEFA prize money is an additional €20 million.

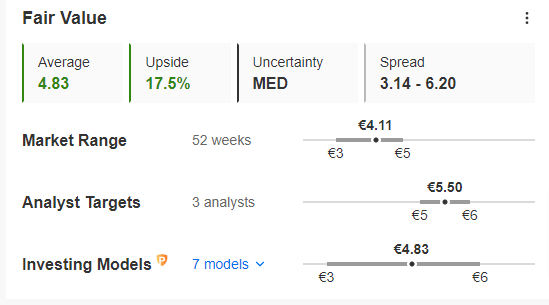

Source: InvestingPro

Borussia Dortmund: Strong Financials and Growth Prospects

Bullish sentiment surrounding Borussia Dortmund (BVB) stock extends beyond the possibility of winning the European title.

The club was profitable in the previous season and is expected to remain so in the near future, with projected earnings growth in 2024. Additionally, Dortmund maintains a moderate debt level (Net Debt/Total Capital of 10.9%).

On the other hand, current liquidity is low (0.6x), with short-term liabilities exceeding liquid assets. The Relative Strength Index (RSI) indicates the stock is overbought (meaning there is a risk of a price decline).

Overall Financial Health

BVB's overall financial health score is 2.69, close to the average (2.75), indicating no cause for concern. The most notable strengths lie in the Price Trend category (score of 3.35), with an excellent return over the past three months (23.3%), and Profitability (score of 2.94), characterized by a Gross Margin of 94.8% and an average ROE of 96.2% over the past two years.

Borussia Dortmund is not the only football club with publicly traded shares. Two other traditional European teams and former Champions League winners also have shares listed on stock exchanges: Manchester United (NYSE:MANU) on the NYSE and Juventus Football Club (BIT:JUVE) on the Borsa Italiana.

Manchester United won the FA Cup last Saturday against rivals Manchester City, but their underwhelming Premier League season resulted in an 18% drop in their stock price in 2024. Juventus also underperformed in Serie A, and their stock has declined by 27% this year.

***

Introducing ProPicks: Our cutting-edge AI analyzes mountains of data to pinpoint high-potential stocks before the market reacts.

Stop missing out! Subscribe to ProPicks today and:

- Unearth hidden opportunities: Leverage AI to identify undervalued stocks with explosive growth potential.

- Stay ahead of the curve: Get a monthly list of AI-picked buys and sells before the market reacts.

- Gain an edge: Make informed investment decisions with powerful data and insights.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.