The current market speculation surrounding artificial intelligence (A.I.) has garnered everyone’s attention. You can’t turn on a television or pick up a newspaper without a mention of “artificial intelligence.” The “F.O.M.O.” (Fear Of Missing Out) in stocks associated with developing and implementing artificial intelligence is evident.

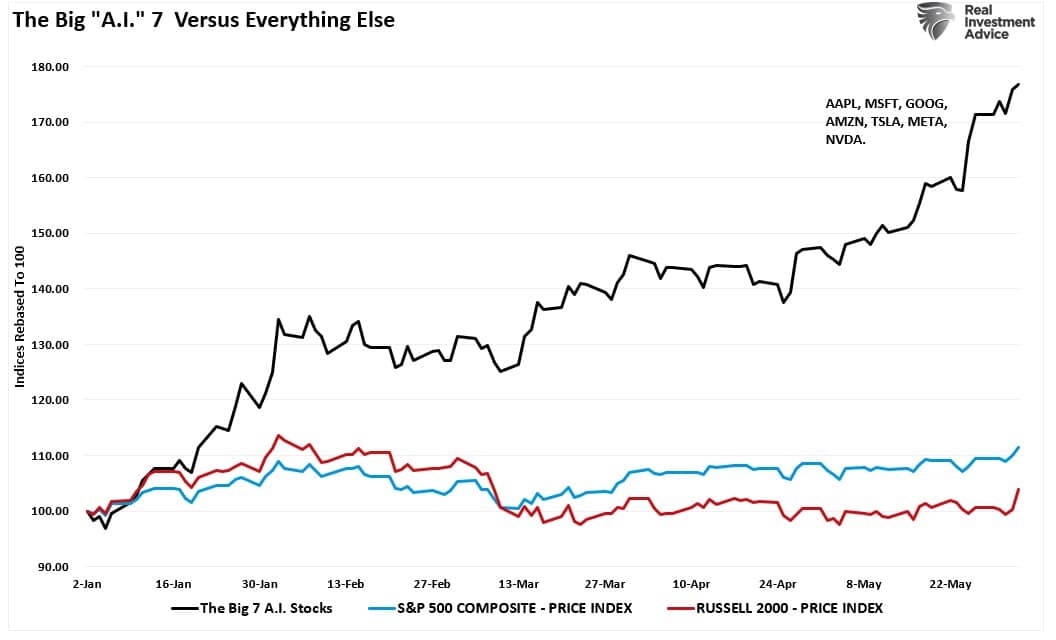

The chart below shows the performance differential between the basket of the big “7” stocks associated with A.I. versus the S&P 500 and the Small/Midcapitalization Russell 2000 indexes.

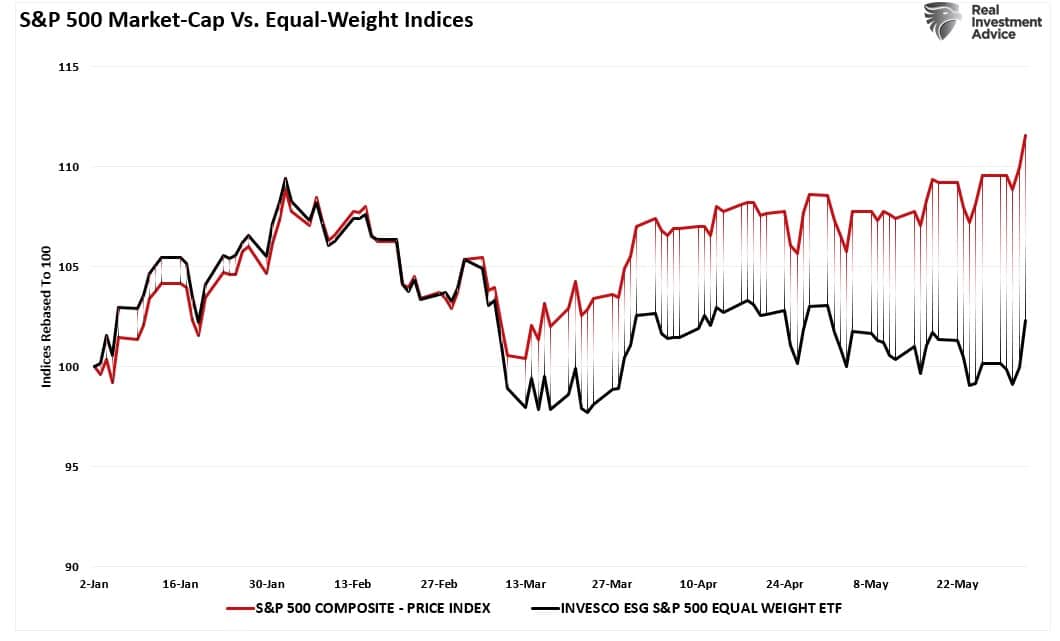

Given that the big “7” are a large part of the S&P 500, the entire returns year-to-date in the broad index have come from just those seven stocks. As noted by Doug Kass recently:

“Taken in a broader context, over 100% of all the gains this year in the S&P Index have been driven by seven stocks. Three of those seven stocks account for 68% of the S&P’s entire yearly gains. Year-to-date, the unweighted S&P Index, has climbed by +9.1%, thanks to a +30% rise in technology, while the Russell Index is -1.0%, and the equal-weighted S&P 500 Index is -1.1% lower.”

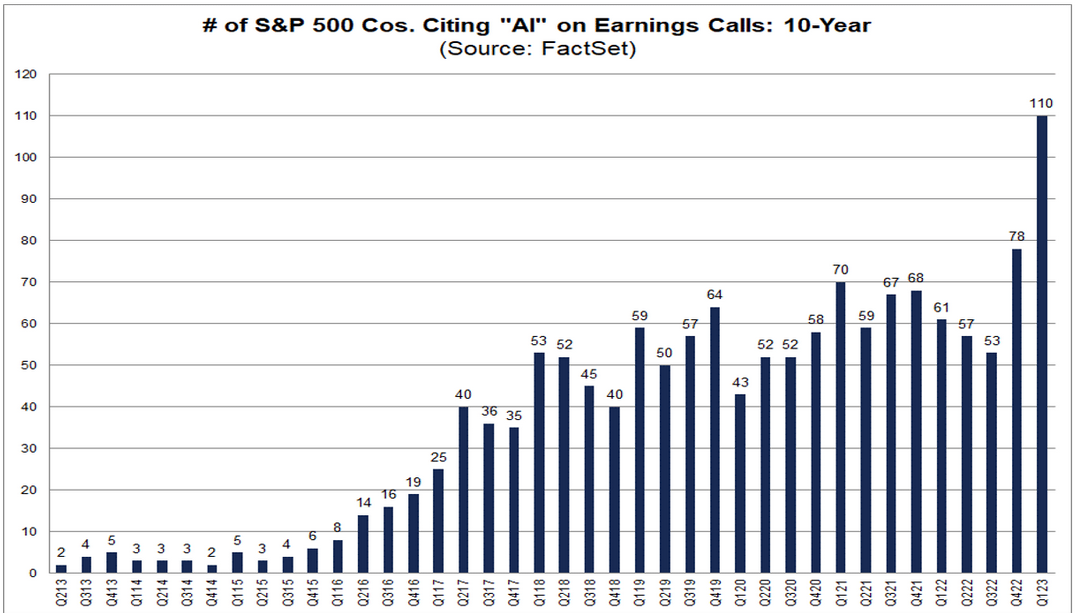

Of course, companies are not oblivious to the investor flows into their corporate stock and are jumping on the bandwagon as well to hype the speculation by mentioning “artificial intelligence” in earnings reports and press releases. As shown below, the number of mentions of artificial intelligence has soared in recent months.

“Of these companies, 110 cited the term “AI” during their earnings call for the first quarter. This number is well above the 5-year average of 57 and the 10-year average of 34.

In fact, this is the highest number of S&P 500 companies citing “AI” on earnings calls going back to at least 2010 (using current index constituents going back in time). The previous record was 78, which occurred in the prior quarter (Q4 2022).

At the sector level, the Information Technology (38), Industrials (17), and Communication Services (15) sectors have the highest number of S&P 500 companies citing “AI” on Q1 earnings calls, while the Communication Services (75%) and Information Technology (66%) sectors have the highest percentages of companies citing “AI” on Q1 earnings calls.” – FactSet

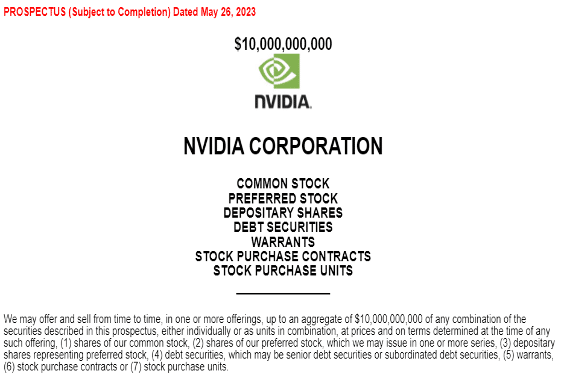

Of course, companies are also willing to take as much money as possible from the speculation.

“Watch what they do, not what they say. If NVDA knew with certainty this was going to keep going to infiniti for a while, they would not likely be selling all this stock now. They don’t even need the money. This is a cash rich company. But they are smart to do so. Why not build a war chest when the getting is good?” – Doug Kass

Dot.com Redux

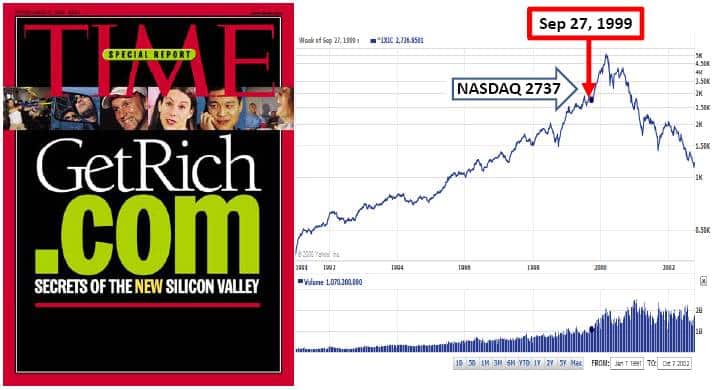

All of this is interesting because we saw much the same in 1999 as companies rushed to jump into the “internet boom” that would change the world.

The difference versus today was that companies would advance regardless of actual revenue, earnings, or valuations. It only mattered if they were on the cutting edge of the internet revolution.

Today, the companies racing higher on artificial intelligence have actual revenues and income. However, I am sure there will be an explosion of new companies coming to market to jump on the “A.I.” train, ultimately diluting those earnings and revenues.

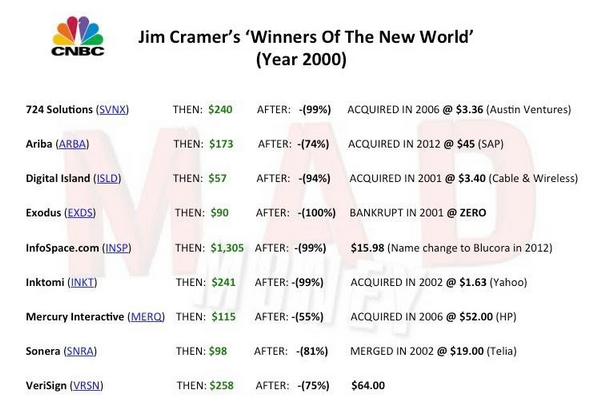

What remains the same is that analysts, and investors, once again believe that “trees can grow to the sky.” The internet craze in 1999 sucked in retail and professionals alike. Then, Jim Cramer published his famous list of “winners” for the decade in March 2000.

Such is unsurprising, as endless possibilities existed of how the internet would change our lives, the workplace, and futures. While the internet did indeed change our world, the reality of valuations and earnings growth eventually collided with the fantasy.

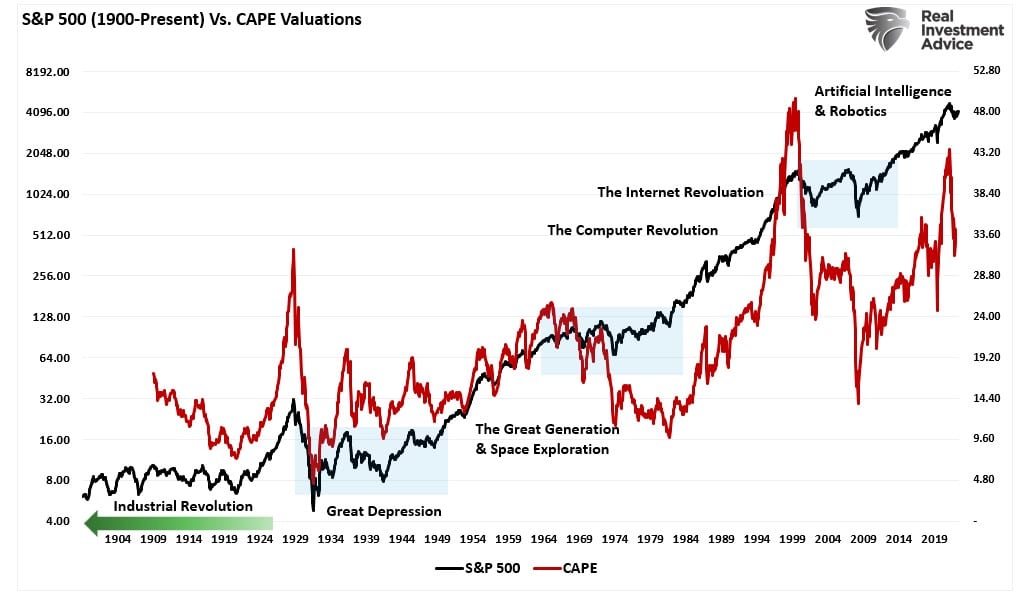

As we showed previously, the “revolutions” are not new and can last for quite a while, but ultimately, valuations always became problematic when earnings growth failed to meet lofty expectations.

Throughout history, low valuations preceded the best investment return periods. Such is because low valuations allowed for multiple expansions as investors could “pay up” for expected earnings growth.

For example, in 1994, investors could buy Microsoft (NASDAQ:MSFT) shares at a Price-to-Sales ratio of roughly three. As the internet boomed and more computers were needed to attach to the internet, sales for Microsoft accelerated.

Today, shares of Microsoft are trading at more than 11 times Price-to-Sales. The expectations are that AI will fuel another massive boom in revenue.

However, therein lies the problem with valuations. There is little margin for error for NVDA or MSFT with price-to-sales ratios of 38x and 12x, respectively.

Challenges Lay Ahead

While the current speculation can last much longer than logic, or valuations, would dictate, reality will eventually matter. For now, the speculation is supported by the dreams of a new A.I. world with endless possibilities.

The belief is that EVERY company will eventually buy products from the likes of NVDA and MSFT, which will provide a massive surge in earnings. However, there are some significant challenges to that thesis.

“The barriers to entry are massive in terms of IP, capital, and established industry relationships. The investment that companies will need to make to be successful in AI is enormous, and only a handful of companies can afford that investment.

I think it’s reasonably similar to the cloud, where GOOG, MSFT, and AMZN have become the dominant players because they have the capital in what is also a capital-intensive game. Similar idea for NVDA et al. here for AI.” – Jim Covello via Goldman Sachs (NYSE:GS)

As with the data cloud services, there are two headwinds to eventual earnings and revenue growth. The first, as noted, is that only a handful of companies have the capital to compete successfully in that business. Secondly, and most crucial, is that as cloud services become more prevalent, profit margins decline as competition increases.

While NVDA recently stated they expect revenue to surge by 50%, leading to a massive jump in its stock price, NVDA will be unable to sustain that growth rate for long. The problem for many companies currently hyping A.I. as part of their business model, the cost will ultimately be the barrier to entry. As my colleague Doug Kass recently noted:

“Are you paying anything for ChatGPT? But MSFT and GOOGL are spending enormous amounts of money producing ChatGPT (and Bard). These NVDA H100 products sell for $270K per pop. Not kidding, I have never seen anything like it. This is another impediment to growth, as only a few companies can spend at scale on this stuff. The 8 GPU baseboard alone is $195K. They make about $190K of gross profit per H100 sold.”

As I noted previously with respect to Nvidia (NASDAQ:NVDA), the ability for them to sell enough GPUs to justify current valuations is going to be a challenge. More importantly, once the few companies that can afford these products have bought them, the sales rate will slow considerably. Such makes the current valuations for NVDA hard to justify.

But that is just my opinion.

An Expert Opinion

If you want an expert opinion on the A.I. speculation, I suggest there is no better one than Roger McNamee, a Silicon Valley investing legend, who, in a recent CNBC interview said,

Today’s things they’re calling A.I., particularly the generative A.I.s – these are just B.S. generators, they have no verified content in them, and the results totally unreliable. The notion we will apply these to things like searches will result in one lousy outcome after another.

The guys at OpenAI [the company behind ChatGPT] are trying to create the illusion that their actions are inevitable. Yet there is no way to monetize this other than surveillance capitalism – [monetizing user data] – and we know from social media how much harm that causes.

What you’re looking at is a battle between the OpenAI guys trying to create this sense of inevitability and the market saying, “Wait, interest rates are now 5%, it costs half a billion dollars in parts [the cost of Nvidia’s A.I. Chips] to do each training session. That’s too high in a 5% interest rate environment when you have a business with no obvious business model.”

[Using chatbots] You have to do fact-checking on a search engine that defeats the purpose of a search engine. That isn’t progress.

While A.I. has enormous potential, the trick is you need to change the incentives. Executives who lead these projects are incentivized to protect those who use them and ensure that the content produces accurate results. Until you see those things driving the industry, the products will suck.

His bottom line, however, is the best…

“There are corporations and journalists that have completely bought into this. Before investors buy into this we should just ask: How are you going to get paid? How are you going to get a return on something that is effectively a half million dollars each time you do a training set… in a 5% environment.”

See the problem.

There is nothing wrong with speculating in these names while speculation runs rampant. However, just remember that eventually, reality will prevail. So, from an investor’s view, don’t get too greedy and forget to sell.