Company Description and Qualitative Analysis

Hut 8 Mining Corp (TSX:HUT). operates as a cryptocurrency mining company in Canada. Hut 8 is involved in industrial scale bitcoin mining operations as well as creating a hybrid data center model that serves both web 2.0, nascent digital asset computing sectors, and web 3.0. Hut 8 has established a Tier 0 to Tier 4 computing platform and allocated digital asset mining and open-source distributed ledger technology to underutilized areas in conventional high performance computer data centers. Hut 8 currently operates only in Canada and is the largest mining company in North America (in terms of fleet size).

Quantitative Analysis

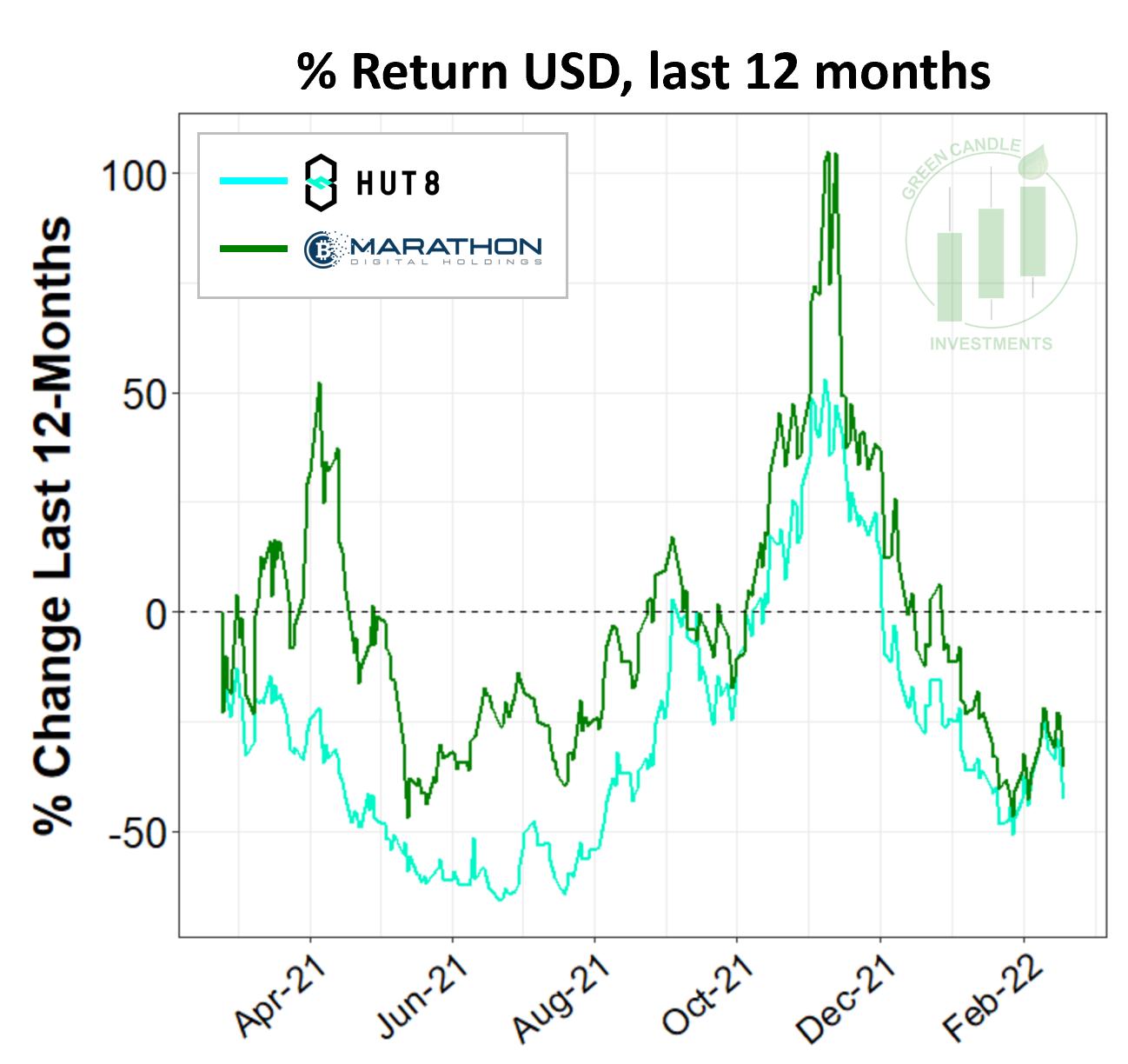

At the time of this writing (2/20/2022), HUT is trading at $5.94 with a 52 week range of $3.15 - $16.57 and a market cap of $994.5M USD. In Q3 of 2021, they posted $47.9 million in revenue. and produced 905 self-mined bitcoin, 100% of which was added to their balance sheet; HUT has the largest self-mined bitcoin holding of any publicly traded company in the world. Return of equity (ROE: Net Income / Total Equity *100) of HUT is 18.67% and net margin (net income / revenue) is 50.85%. The debt to equities ratio (total liabilities / total equity) is 0.03. This financial analysis was done using financialstockdata.com (sign up using our promo code GCI here). You can view HUT’s last quarterly earnings here and latest 10K here. Below we have percent returns for Hut 8 versus returns for Marathon Digital Holdings Inc. (ticker: MARA), another large, North American Bitcoin mining company.

Bullish Thesis

Here are three points to support the bullish thesis:

-

Abundance of Natural Resources in Canada: Although we both do not feel the ESG narrative is warranted and the energy usage should not be a major factor, it is appealing that Canada has large amounts of natural resources. Also miners produce a ton of heat and can be a nuisance for anyone in a warm climate and Canada’s tough winters can actually be seen as a benefit for the large amounts of miners. The cheap energy and ability to hone in on some natural resources can increase profits and allow Hut 8 to continue to grow with outstanding margins.

-

Largest Mining Footprint: In a rapidly growing space with more and more competition coming into the market, Hut 8 has a head start on all the competition. It currently has the largest footprint of any bitcoin mining company in North America and has 91% of its miners online. It will continue to grow if profits keep increasing and it seems that Hut 8 is in a prime position to continue to bring on more miners.

-

Bitcoin on the Balance Sheet: According to their most recent investors presentation, Hut8 owns more self-mined Bitcoin than any other publicly traded company in the world. With their holdings of bitcoin and continual mining, this number looks to increase and will continue to increase. As a believer in bitcoin, I believe this move will pay off significantly for Hut in the future.

Bearish Thesis

Here are three points to support the bearish thesis:

-

Increased non-Bitcoin focus: Based on several recent announcements, it’s becoming clear that Hut 8 is increasing their focus on non-Bitcoin related operations. Specifically, they’re expanding into more traditional data centers to provide more of a “platform-based” service for other industries and organizations, including gaming, media/entertainment, Web 3.0, and government. In my opinion, this signals a loss of focus for Hut 8 - while there’s certainly benefits to product/service diversification, I’d like to see HUT maintain more of a focus on bitcoin mining and related technologies (e.g., in-house chip development, cooling technologies, etc.).

-

More Bitcoin-focused Competition: While Hut 8 expands into non-Bitcoin related products and services, many of their competitors are maintaining their focus on bitcoin mining. Marathon, who we covered last week, is expanding their mining fleet rapidly, with an expected 199,000 mining rigs to be fully online by early 2023. They’re also developing cooling technologies - like immersion cooling - in-house. Others, like Bitfarms, are expanding their mining footprint globally, which provides some protection against potential geopolitical uncertainty. Currently, Hut 8 operates only in Canada. With the recent political posture against bitcoin donations to the Freedom Convoy, it’s possible that the Canadian government will take a generally unfriendly stance on cryptocurrencies moving forward.

-

ESG Buy-In: In their most recent investors presentation (February 2022), Hut 8 lays out their ESG-related goals, including their goal to be carbon neutral by 2025. In my opinion, this effort is misguided. Bitcoin mining companies should find the cheapest, most reliable sources of energy, regardless of whether they are “renewable.” In fact, a massive amount of energy is wasted in the form of non-renewable sources such as natural gas flaring. I would much rather see a bitcoin mining company find creative ways to capture and use wasted and/or stranded sources of energy (e.g., natural gas) than increase their usage of wind/solar energy.

Visit Green Candle Investments for more stock, sector, and cryptocurrency analysis.