Author's Note: In our Brief Breakdowns, we pick a stock and take opposite sides – one of us presents the bullish argument and the other presents the bearish argument.

Company Description and Qualitative Analysis

Marathon Digital Holdings Inc (NASDAQ:MARA). is a bitcoin mining company with operations located in the United States. Marathon Digital started by collecting patents related to encryption and shifted its business in 2020 to focus on bitcoin mining. It currently has the largest market cap of any publicly traded bitcoin mining company. As we detail below, the company and industry are both growing rapidly. Because Marathon is currently the largest market cap of any company in the space, it is primed for massive movement in a very large and rapidly growing space.

Quantitative Analysis

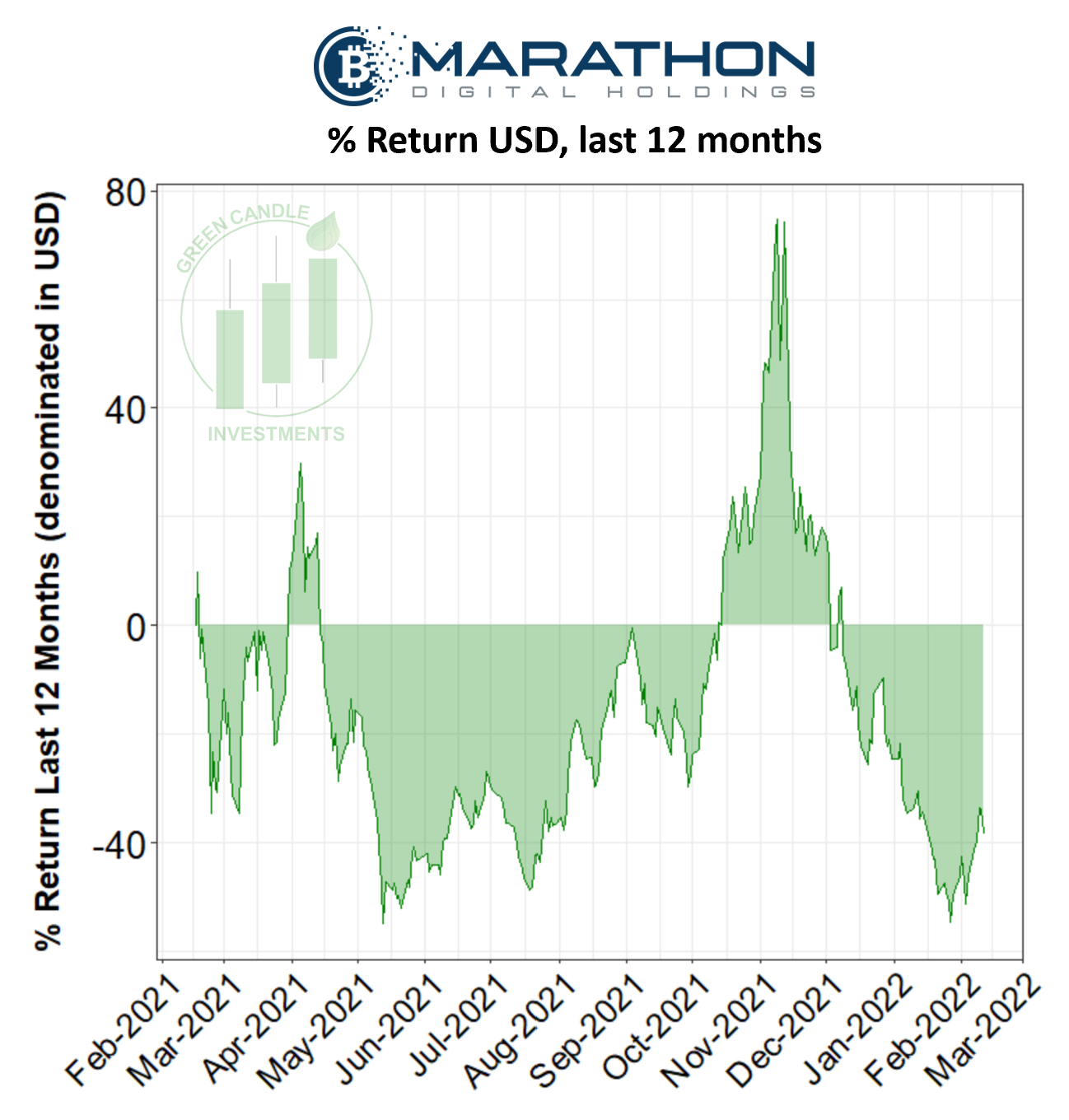

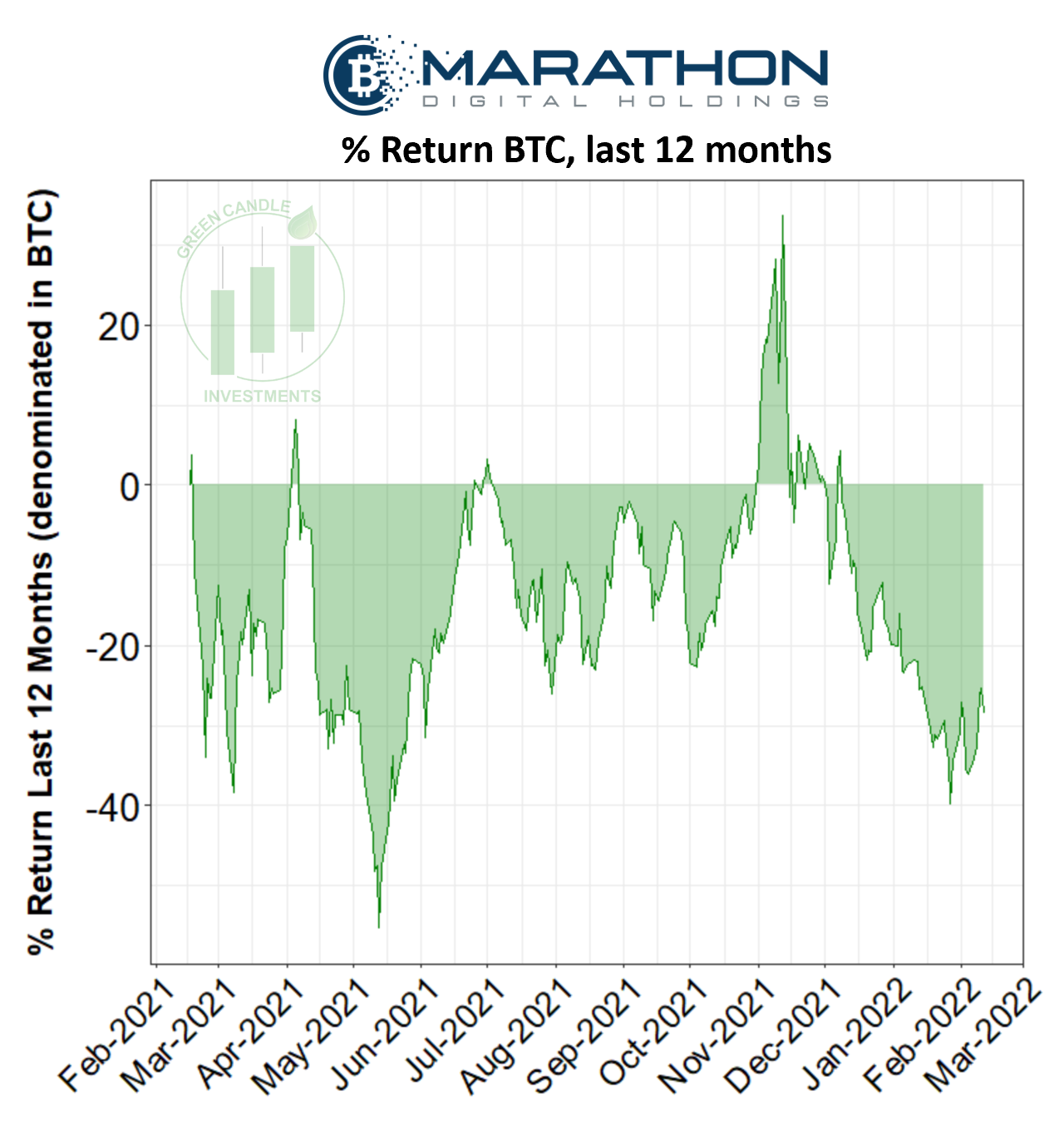

At the time of this writing (2/13/2022), MARA is trading at $26.93 with a 52 week range of $18.32 - $83.45 and a market cap of $2.76B USD. In Q3 of 2021 revenues increased 76% compared to Q2 and 6,091% year-over-year to $51.7 million. MARA produced 1,252 self-mined bitcoin which was a 91% increase from 654 bitcoin from the previous quarter. Non-GAAP income from operations was $43.5 million. Return of equity (ROE: Net Income / Total Equity *100) of MARA is -9.47% and net margin (net income / revenue) is -57.03%. The debt to equities ratio (total liabilities / total equity) is 0.01. You can view MARA’s last quarterly earnings here and latest 10K here. Below we have percent returns denominated in both USD and in Bitcoin.

Bullish Thesis

Here are three points to support the bullish thesis:

-

Opportunity to be a “first mover” in an emerging industry: At $2.8B, Marathon is one of the largest bitcoin mining companies in North America by market cap. Their January 2022 hashrate of 3.6 exahash per second (EH/s) puts them ahead of competitors like Riot Blockchain (3.4 EH/s), Hut 8 (2.4 EH/s), BitFarms (2.3 EH/s), and HIVE Blockchain (1.87 EH/s). Not only are they a dominant player in the industry now, but their continued effort toward expansion will very likely increase their market share going forward. By early 2023, they expect to have 199,000 miners online and a hashrate of 23.3 EH/s - this would leave many of their competitors in the rearview mirror. Having this much momentum in a relatively young market gives Marathon a first mover advantage over younger companies entering the industry.

-

Commitment to growth: In Q2 of 2020, Marathon purchased 10,500 S19 Pro miners from Bitmain. They followed this with the purchase of an additional 90,000 miners in Q4 of the same year. In Q2 of 2021, they announced a partnership with Compute North to build a new mining facility that would host 73,000 machines and be 100% carbon neutral. In December, Marathon announced that they had struck a deal to purchase an additional 78,000 S19 miners from Bitmain for approximately $879 million. These new miners are expected to be delivered and brought online throughout 2022 and they expect to have 199,000 miners fully operationally by early 2023. This would increase Marathon’s hashrate by nearly 600% to ~23.3 EH/s. These expansions demonstrate the company’s commitment to spending money on growth - at this early stage in the mining industry, I think their commitment to growth will put them well ahead of their current competitors and future companies looking to break into the market.

-

Positive news on regulatory stability: Over the last several months we’ve seen more and more regulatory bodies take a positive stance toward bitcoin mining operations. This year alone, in both India and Russia, central banks suggested blanket bans on cryptocurrency miners before legislative bodies stepped in and opted instead for regulatory responses. In the U.S., where Marathon operates, the regulatory landscape remains uncertain, however there appear to be a growing number of legislators who hold positive views toward Bitcoin and bitcoin mining. Of particular note, senators Ted Cruz (Texas) and Cynthia Lumis (Wyoming) have given vocal support to members of the bitcoin mining community. Texas Gubernatorial candidate Don Huffines claimed that he wants to make his state the “citadel for Bitcoin” and Senate candidate Josh Mandel tweeted that Ohio must be a “pro-bitcoin state.” So, although the regulatory landscape remains uncertain, there is no doubt that the U.S. is seeing a rise in the number of pro-bitcoin politicians. In my opinion, this is bullish for the bitcoin mining sector.

Bearish Thesis

Here are three points to support the bearish thesis:

-

Regulatory uncertainty: Currently Marathon has locations in Montana and is building one in Texas, which are both very bitcoin mining friendly states. Although the United States has historically been one of the more stable governments globally, the US could clamp down on regulations surrounding bitcoin mining for some reason. Whether it's the ESG narrative or something else, bitcoin mining has been extremely polarizing in the US political realm. I would like to see Marathon potentially venture out to another country so the business is not reliant on one specific regulatory body.

-

Over Reliance on Mining Rig Manufacturers: Marathon does not develop any of their bitcoin miners therefore is reliant on companies developing bitcoin miners for their business. As mentioned above on the regulatory uncertainty, I do not like the fact that a company relies heavily on third-parties to dictate their business. This is a large enough industry that they should be able to manage this risk, but if you decide to invest in Marathon this should be on your radar.

-

Bitcoin Failing: As a bitcoin guy this is difficult for me to see, but it is a risk that investors should be aware of. As long as bitcoin is in circulation, btc needs miners in order for the network to survive. If bitcoin fails, so will bitcoin miners. So investors are taking bets that both these scenarios will not happen. With the industry being as large as it is, I find it hard to believe that bitcoin fails.

Visit Green Candle Investments for more stock, sector, and cryptocurrency analysis.