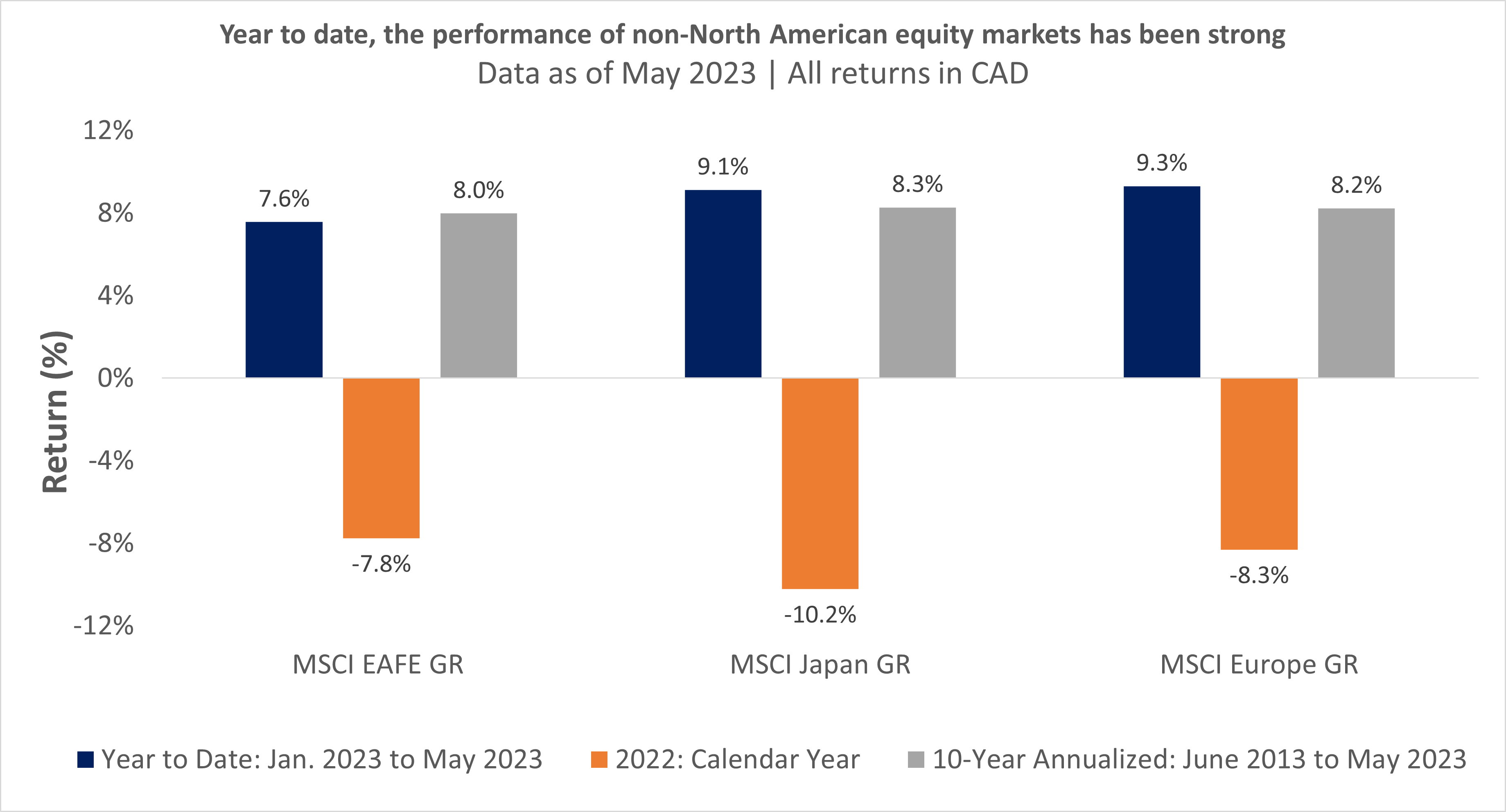

While much of this year’s equity resurgence has been centered on the performance of US equities, the performance of foreign capital markets, namely, Europe, Japan, Australasia, and Far East equities, has also been an exemplary year to date. In 2022, the global economy was plagued with many issues, ranging from supply chain disruptions, elevated inflation, and increasing commodity prices, all of which affected capital markets. While challenges remain, these international equity markets have markedly improved coming off of last year’s lows.

For investors looking to reduce their North American equity exposure, there are pure-play solutions that provide fulsome exposure to the above-mentioned equity markets. Provided below is a profile of three Canadian ETFs that capture the European, Japan, Australasia, and Far East (EAFE) equities respectively.

Investing in European Equities

Investors looking for concentrated exposure to the largest European companies that are sector leaders should consider Horizons Europe 50 Index ETF (HXX), which passively tracks the Solactive Europe 50 Rolling Futures Index (Total Return). As of May 2023, the firm’s sector exposure is broadly distributed between Consumer Goods (19.75%), Financials (18.28%), Information Technology (15.31%), and Industrial Services (14.41%). From a geographic perspective, France (41.55%), Germany (26.43%), and the Netherlands (15.40%) have the strongest presence.

Given the fund’s broad sector exposure, its holdings are equally diverse, with names such as LVMH Moet Hennessy Louis Vuitton SE, Siemens AG (ETR:SIEGn), L'Oreal SA, and Allianz (ETR:ALVG) SE being among the top ten holdings. The expense ratio is fairly low at 0.19%.

Investing in Japanese Equities

The BMO (TSX:BMO) Japan Index ETF (ZJPN) replicates the Solactive GBS Japan Large & Mid Cap Index, providing investors with fulsome access to the Japanese equities market. Regarding the fund’s sector exposure, as of May 2023, Industrials (23.47%) has the leading allocation, followed by Consumer Discretionary (19.71%), and Information Technology (14.62%).

The fund’s holdings are reflective of some established industry leaders, namely, Toyota Motor Corp, Sony Group Corp, and Hitachi Ltd. The expense ratio is fairly low at 0.40%.

Investing in Europe, Australasia & Far East (EAFE) Equities

The BMO MSCI EAFE Index ETF (ZEA) replicates the MSCI EAFE Index, providing investors with fulsome access to a broad sampling of companies that are industry leaders within the stated regional areas. Given the international focus of the mandate, its sector allocation is fairly broad, with Financial (18.13%), Industrials (15.94%), Health Care (13.60%), Consumer Discretionary (12.20%), and Consumer Staples (10.26%) being of prominent focus as of May 2023.

From a portfolio holdings standpoint, many of the previous names referenced in the earlier two funds are also present in this mandate. Thus investors can utilize these solutions as a means of gaining comprehensive international equity exposure within their portfolio. The expense ratio is fairly low at 0.22%.

This content was originally published by our partners at the Canadian ETF Marketplace.