Brown-Forman Corp. (NYSE:BF.B) is a collection of wonderful alcoholic brands, including the iconic labels such as Jack Daniel's, Woodford Reserve, Old Forester and El Jimador.

The company's brands are truly global as they are sold in more than 170 countries. Brown-Forman is regarded as one of the best managed spirits brands in the world. It is also one of the long-term holdings of value investing legend Tom Russo (Trades, Portfolio). During the past decade, however, the company has vastly underperformed the general market due to both industry and company-specific headwinds. In this analysis, we will take a closer look at these challenges.

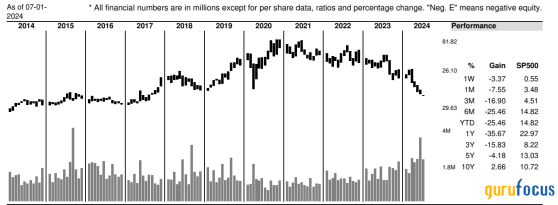

Brown-Forman's long stretch of underperformanceAccording to GuruFocus' stock manual for Brown-Forman, the stock has significantly underperformed the S&P 500 Index over the past one, three, five and 10 years.

The stock price reflects weak fundamental growth over the past decade.

The disappointing growth rate for Brown-Forman is not something long-term shareholders are familiar with and is a reflection of the challenging operating environment the company has faced over the past decade.

Now let's take a closer look at the challenges the wine and spirits company has encountered.

Declining gross marginOf all the challenges Brown-Forman has faced in the past decade, the declining gross margin is the most significant.

As can be seen from the above chart, Brown-Forman's gross margin peaked in 2015 at almost 70%. Since then, it has continued to decline and bottomed out at 58.99% for 2023. The gross margin has improved to 60.46% for 2024, but this is still very low compared to the average gross margin over the past two decades.

There are a few factors contributing to the declining gross margin. First of all, starting in 2018, Brown-Forman has experienced significant foreign exchange headwinds as well as cost increases for raw materials such as agave and wood. Second, the European Union and United Kingdom imposed tariffs on American whiskey in 2018. The tariff was lifted in 2022. Third, Brown Forman (NYSE:BFb) faces severe supply chain constraints, particularly after Covid-19. For instance, as Brown-Forman disclosed in its latest 10-K filing, during the recent global supply chain challenges, its primary glass provider could not produce sufficient quantities to meet its needs, which increased the cost of production. Finally, transportation and logistics costs also soared as a result of the supply chain disruption caused by the pandemic.

Fortunately, after years of contraction, it looks like the period of decline has finally come to an end as Brown-Forman's gross margin expanded in 2024.

Distributor inventory disruptionCovid-19 not only disrupted Brown-Forman's supply chain, but also disrupted its channel inventory system. This was an industry-wide issue for spirits producers.

During the pandemic, spirits distributors across the U.S loaded up on inventory in order to cope with the supply chain disruption. As Brown-Forman records revenue when they ship the products to its distributors, any net increase in distributor inventories will positively impact reported net sales. Here I applaud the company for great disclosure of distributor inventory changes. Below are supplement disclosures accompanying its earnings release, which detailed the change in distributor inventory for fiscal years 2022 and 2024.

Brown-Forman's 2022 distributor inventory change schedule

Brown-Forman's 2024 distributor inventory change schedule

Clearly, the company's 2022 results benefited greatly from the distributor inventory buildup. However, when the trend reversed, Brown-Forman's financial results for 2024 were negatively impacted by the decrease of distributor inventories.

Weak consumer demandBefore the pandemic, the long-term trend had spirits taking market share from beer and wine for many years. Within the spirits market, another long-term trend has been premiumization. Brown-Forman took decades to reshape its portfolio to ride the premiumization wave. During the pandemic, consumers in developed markets kept trading up and consumed more premium spirits. This is evident in the company's supplemental depletions (depletions volume is an approximate measure for consumer demand) schedule for 2022.

Brown-Forman's 2022 depletions schedule

For the year, Brown-Forman experienced strong consumer demand as depletions volume increased 10% across the portfolio, which was largely due to the reopening of the on-premise channel. However, the trend quickly reversed as inflation eroded consumers' purchasing power in developed markets. The schedule for 2024 reflected this change of direction as depletions volume declined 8% across the portfolio.

Brown-Forman's 2024 depletions schedule

On top of volume decline, consumers in developed markets are also trading down to lower-priced spirits as they are struggling with higher inflation. This has negatively impacted Brown-Forman's financial performance.

Summing it upI have followed the global spirits industry for many years. Without a doubt, the past decade has been quite abnormal for Brown-Forman as the company faced unprecedented challenges, particularly during and after Covid. Of all the major challenges, it looks like the gross margin issue and distributor inventory issue have passed. However, consumer sentiment for premium spirits will likely remain challenging for a while. While it looks like the market has priced in some of the headwinds the company is facing, it will take some patience for Brown-Forman's investors to wait for the complete turnaround of the business fundamentals.

This content was originally published on Gurufocus.com