- TSMC, the world's top chipmaker, fuels tech giants like Apple but boasts even faster sales growth.

- AI demand has skyrocketed TSMC sales by 40%, and analysts are bullish with soaring target prices.

- Strategic US partnership and robust financials position TSMC for continued growth.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Taiwan Semiconductor Manufacturing (NYSE:TSM), the world's largest chipmaker, is quietly powering the success of Wall Street giants like Apple (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA). Despite a lower market valuation compared to its customers, TSMC boasts skyrocketing sales and ambitious growth plans.

Early this year, legendary investor Warren Buffett's Berkshire Hathaway (NYSE:BRKb) sold his $5 billion stake in the company, claiming geopolitical risks would make it a difficult bet going forward. However, as time goes by and the Taiwan-based giant keeps sailing unfazed, market participants are beginning to wonder if the Oracle of Omaha missed the mark on this one.

Let's take a look at the company's current situation with InvestingPro for more clues.

Sales Surge Fueled by AI Demand

TSMC recently crossed the coveted trillion-dollar market cap, and its latest sales figures confirm this wasn't a blip. The company's sales surged a staggering 40% year-over-year in the first half of 2024, exceeding analyst expectations of a 35.5% increase. This growth is fueled by the booming Artificial Intelligence (AI) sector, where major companies are fiercely competing for market share.

Analysts Bullish on TSMC

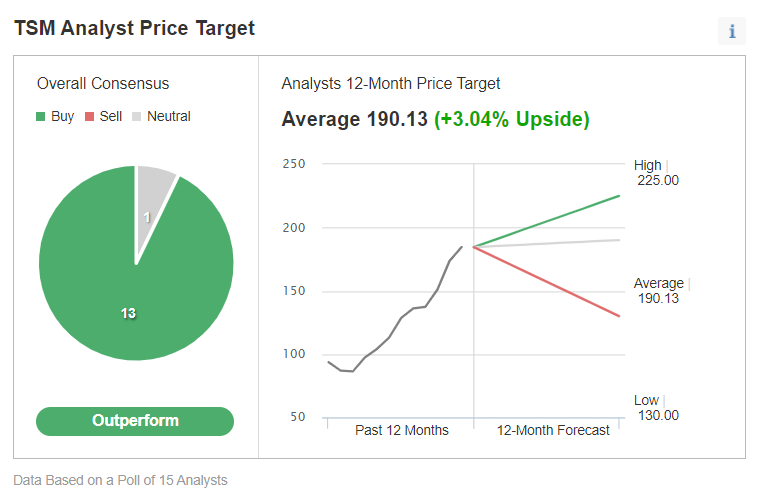

Savvy analysts anticipated this surge, revising their ratings upwards in recent days. Since late June, TSMC has received a flurry of "buy" recommendations and price target increases. Goldman Sachs (NYSE:GS) initiated coverage with a "conviction buy".

However, the current analyst consensus remains even more optimistic, with an average target price of $190.13, implying significant upside potential from TSMC's current trading price.

Source: InvestingPro

Technically, the stock has been rallying since breaking out above the $100 resistance.

TSMC's Strategic Alliance with the U.S. Government Strengthens Financial Health

TSMC's primary ally is the U.S. government, which has strategically partnered with the Taiwanese semiconductor giant amid the trade struggle with China. This central role has enabled TSMC to receive preferential treatment in the United States.

In April, President Joe Biden announced that TSMC would be eligible for up to $6.6 billion in direct funding from the U.S. Department of Commerce under the Chips and Science Act, a law designed to promote domestic research and semiconductor manufacturing. With these funds, TSMC will build a third factory at its U.S. site in Phoenix, Arizona, bringing its total investment in the industrial complex to over $65 billion.

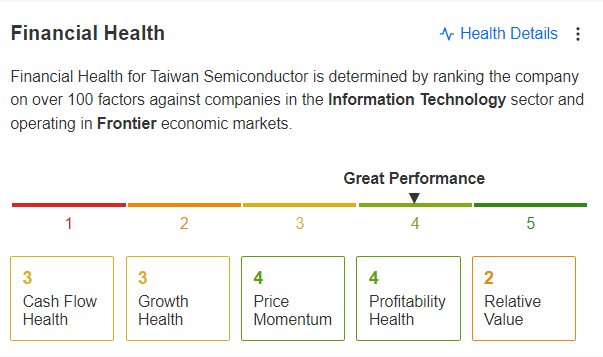

Between new facilities, strategic investments, and soaring demand for AI technology, TSMC is solidifying its financial health. According to InvestingPro, TSMC boasts a very robust financial performance, earning a score of 4 out of 5.

Source: InvestingPro

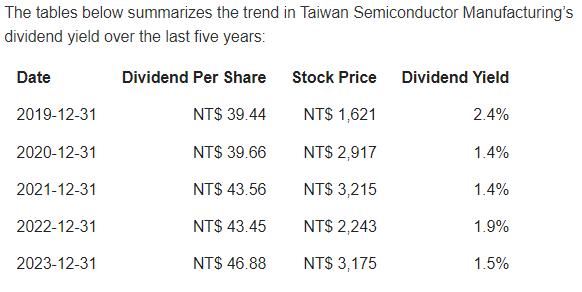

Thanks to its strong financial standing, TSMC has consistently rewarded its shareholders by repurchasing shares. This reliable dividend policy underscores the company’s financial stability.

Source: InvestingPro

Future Growth Plans

Looking ahead, TSMC shows no signs of slowing down. The company aims to achieve an annual revenue growth rate (CAGR) of 15-20%, a gross margin of 53% or higher, and a return on equity (ROE) of 25% or higher.

TSMC will release its overall first-half financial statements on July 18. In the meantime, a 40% increase in sales is a positive indicator, suggesting that TSMC has effectively countered the decline in smartphone sales. As the smartphone sector shows signs of recovery, TSMC gains additional momentum to potentially join the ranks of trillion-dollar companies.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips.

Don't miss this limited-time offer!

Subscribe to InvestingPro today and take your investing game to the next level

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.